q2 accounting

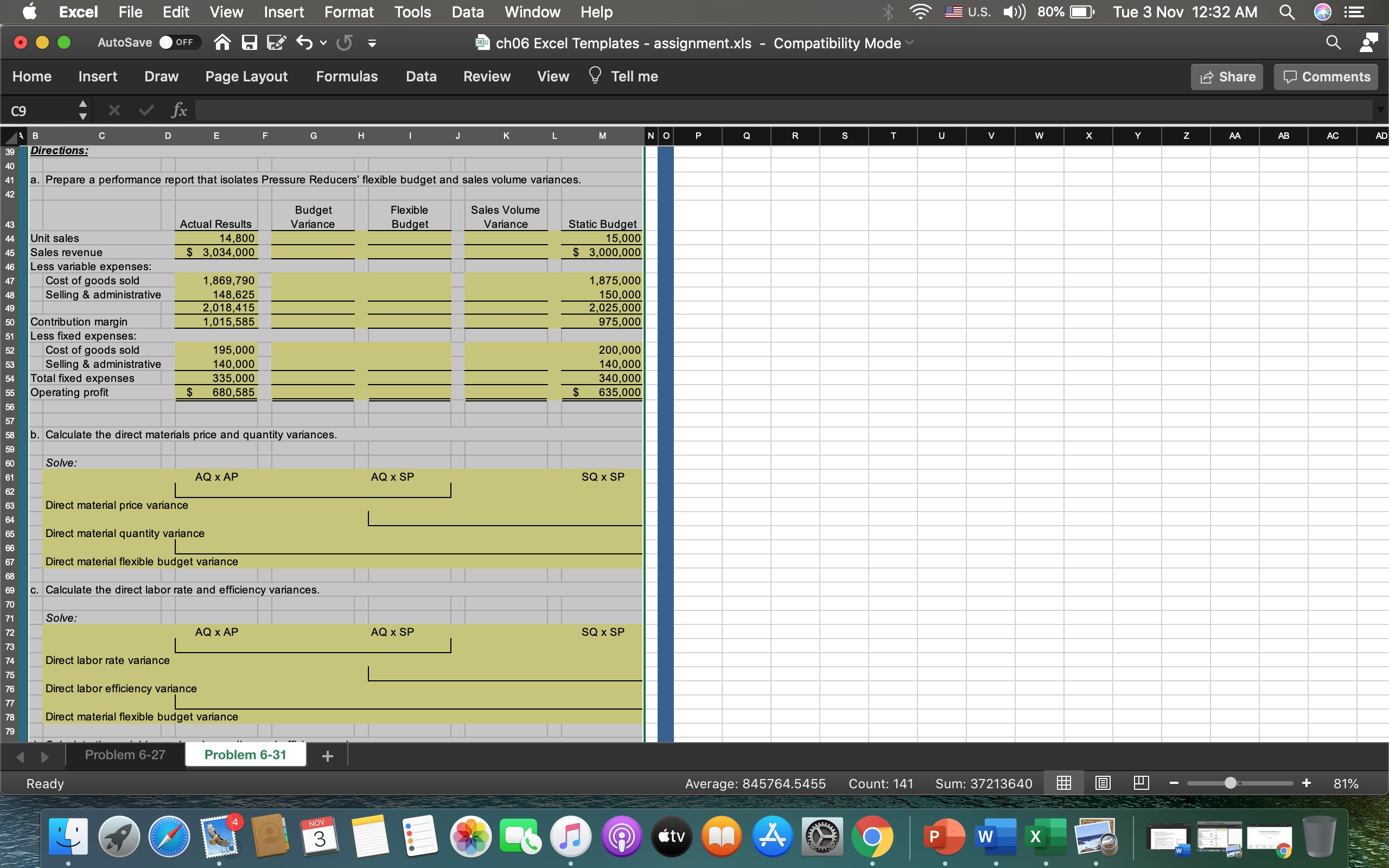

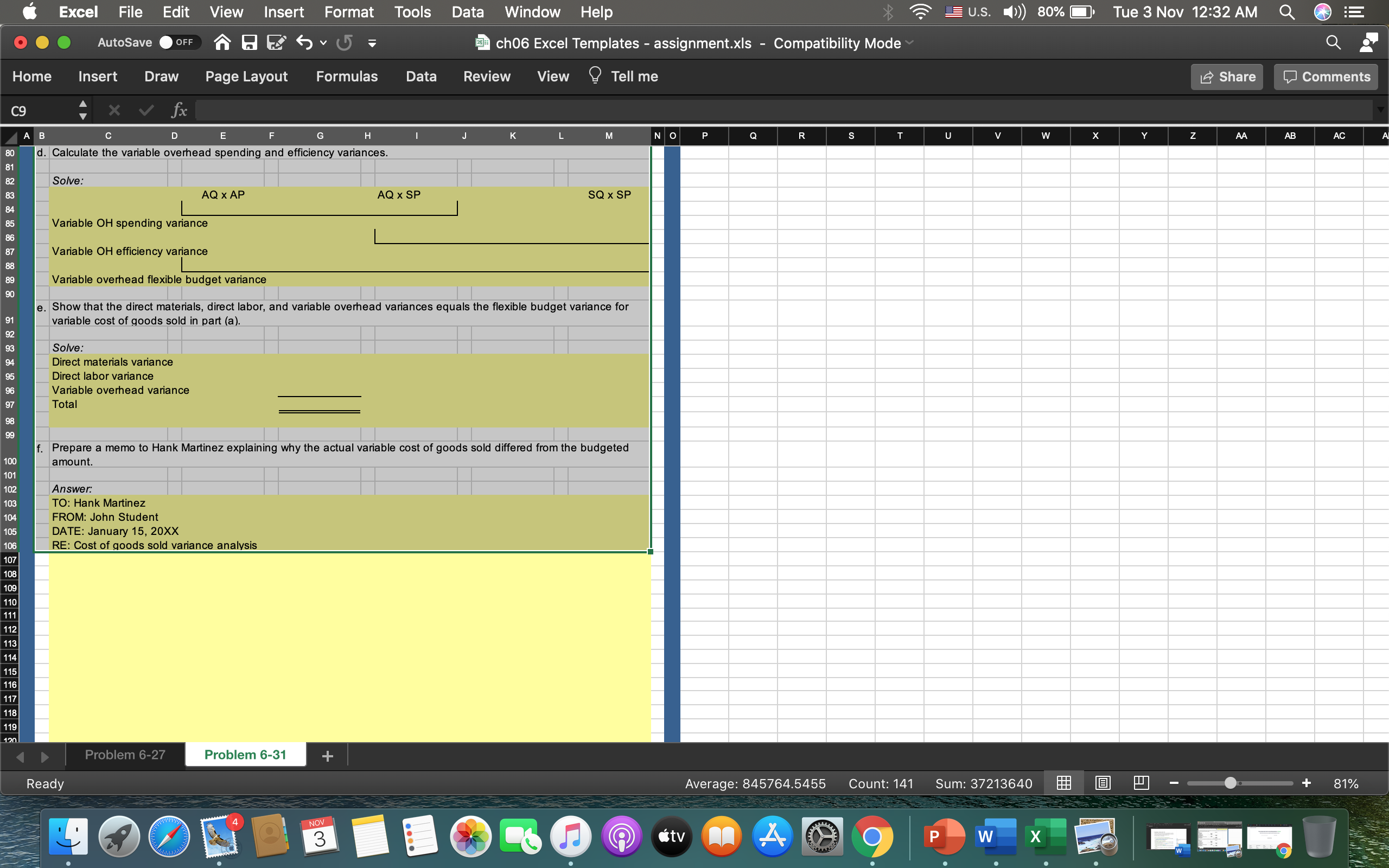

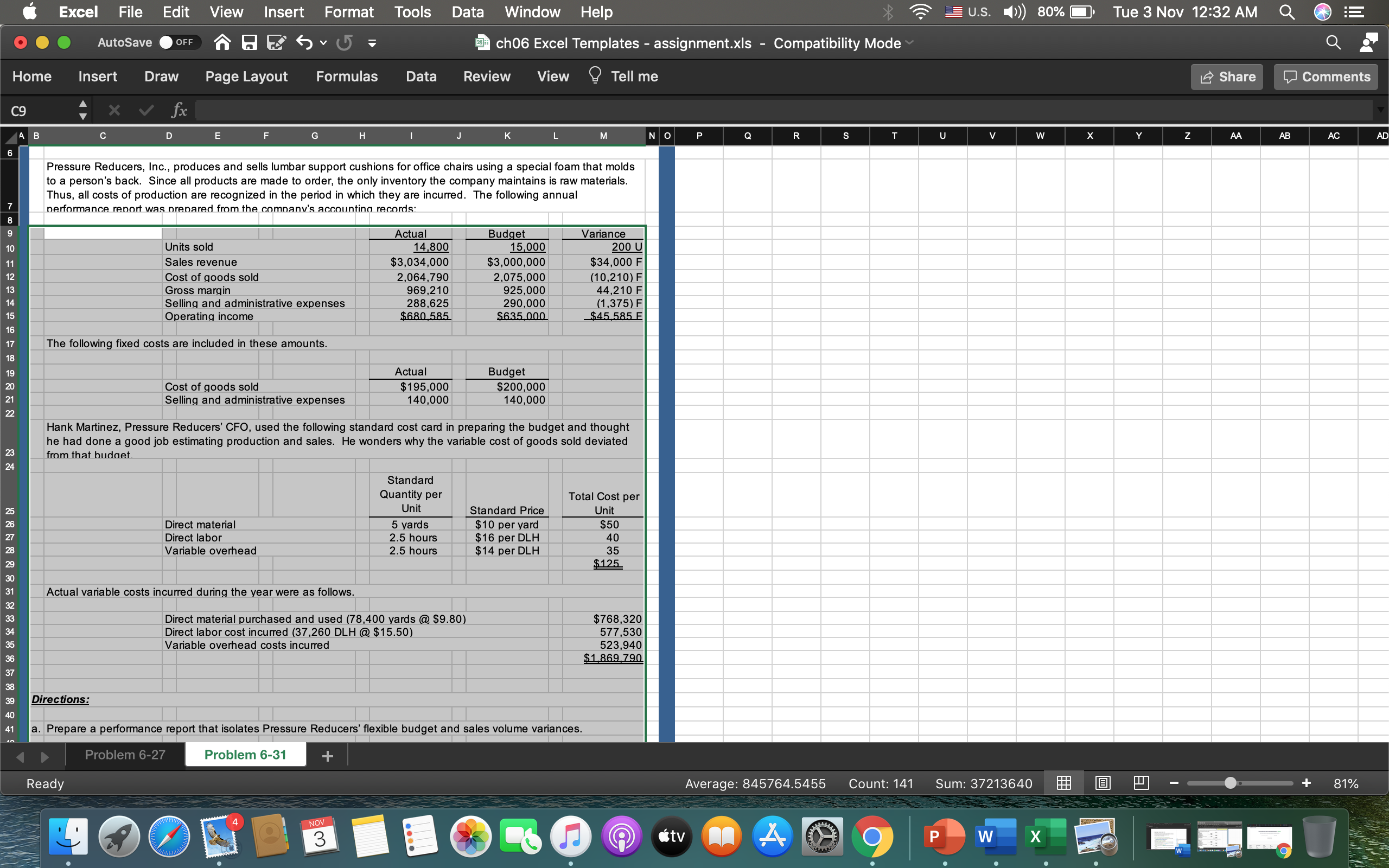

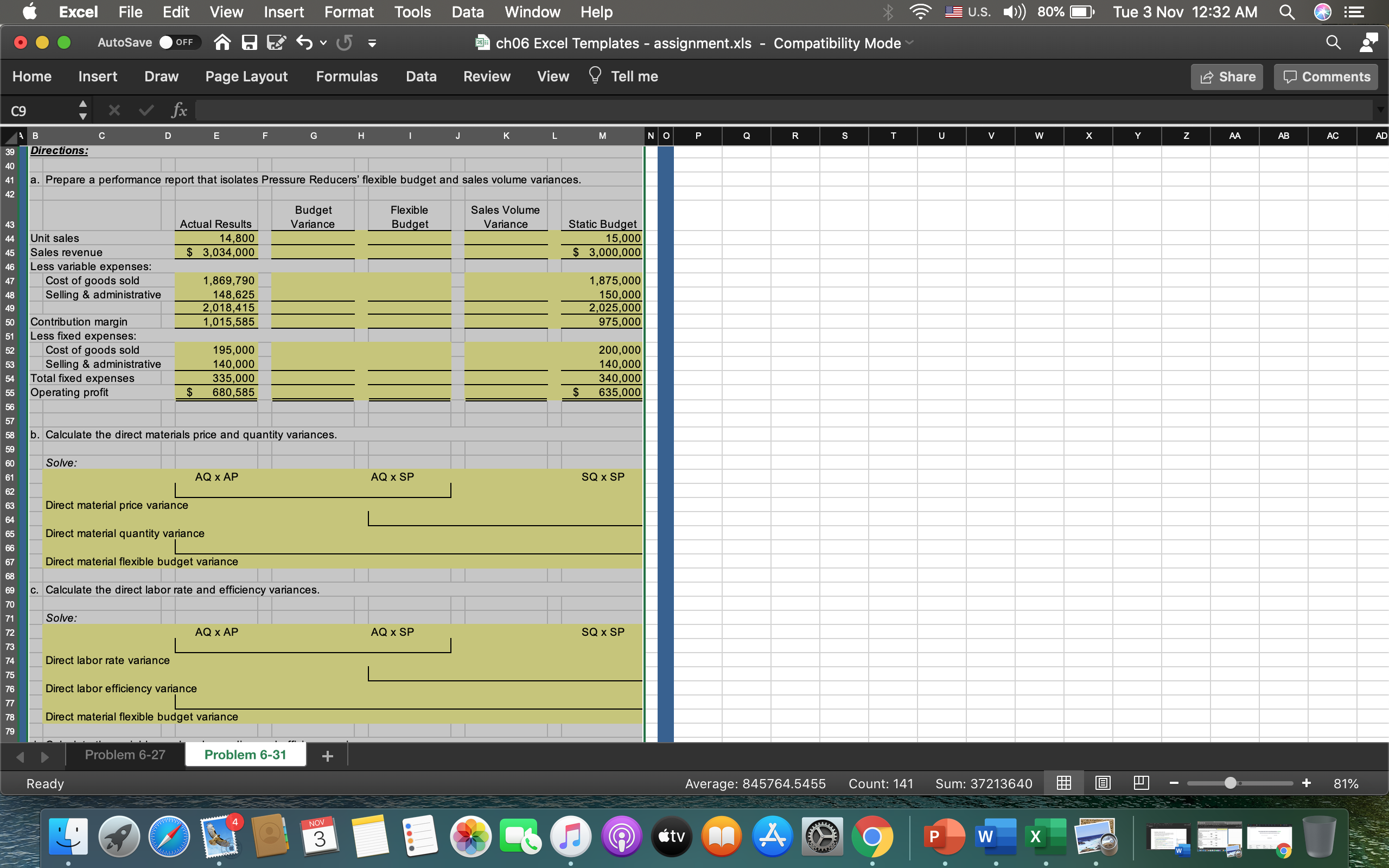

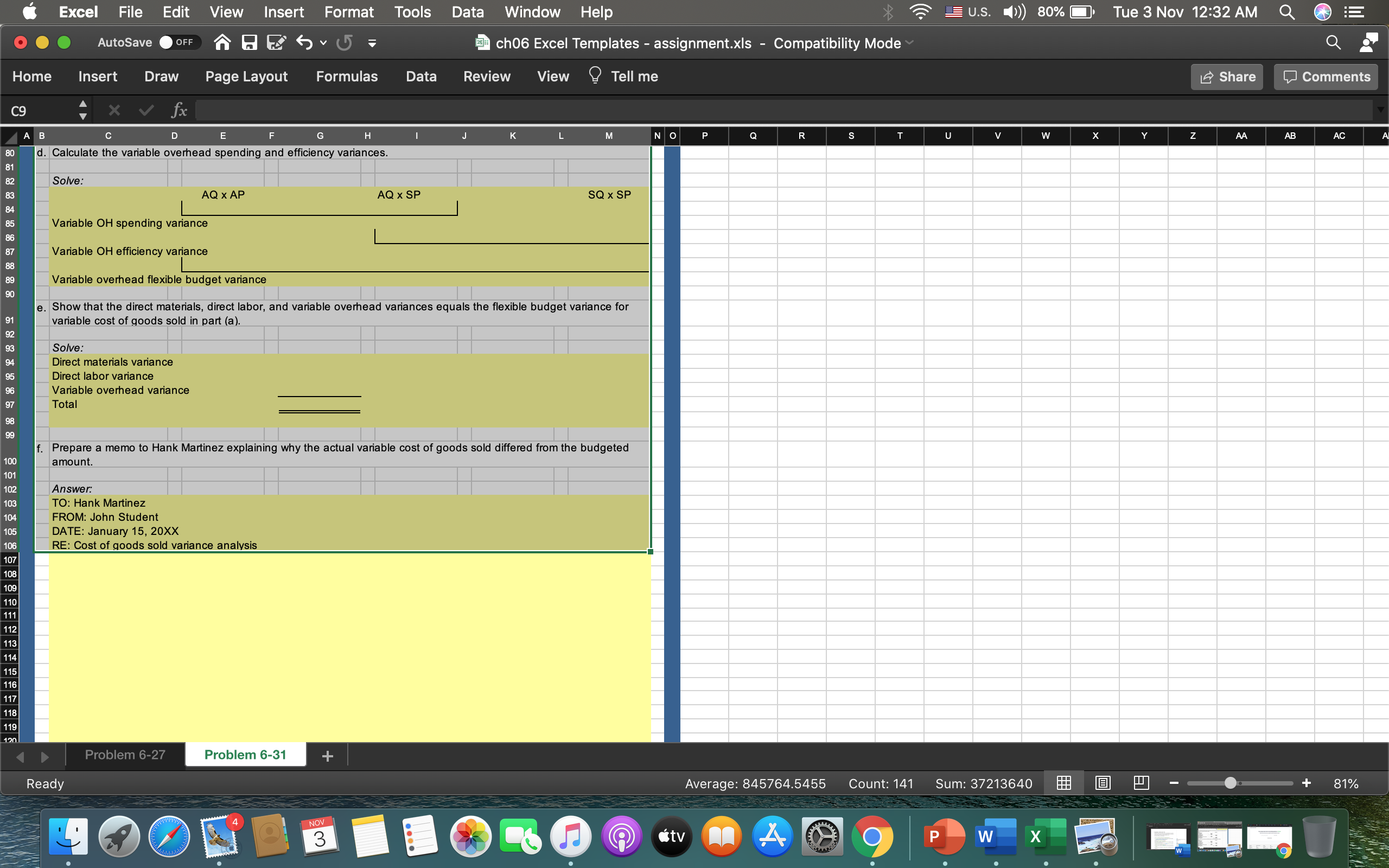

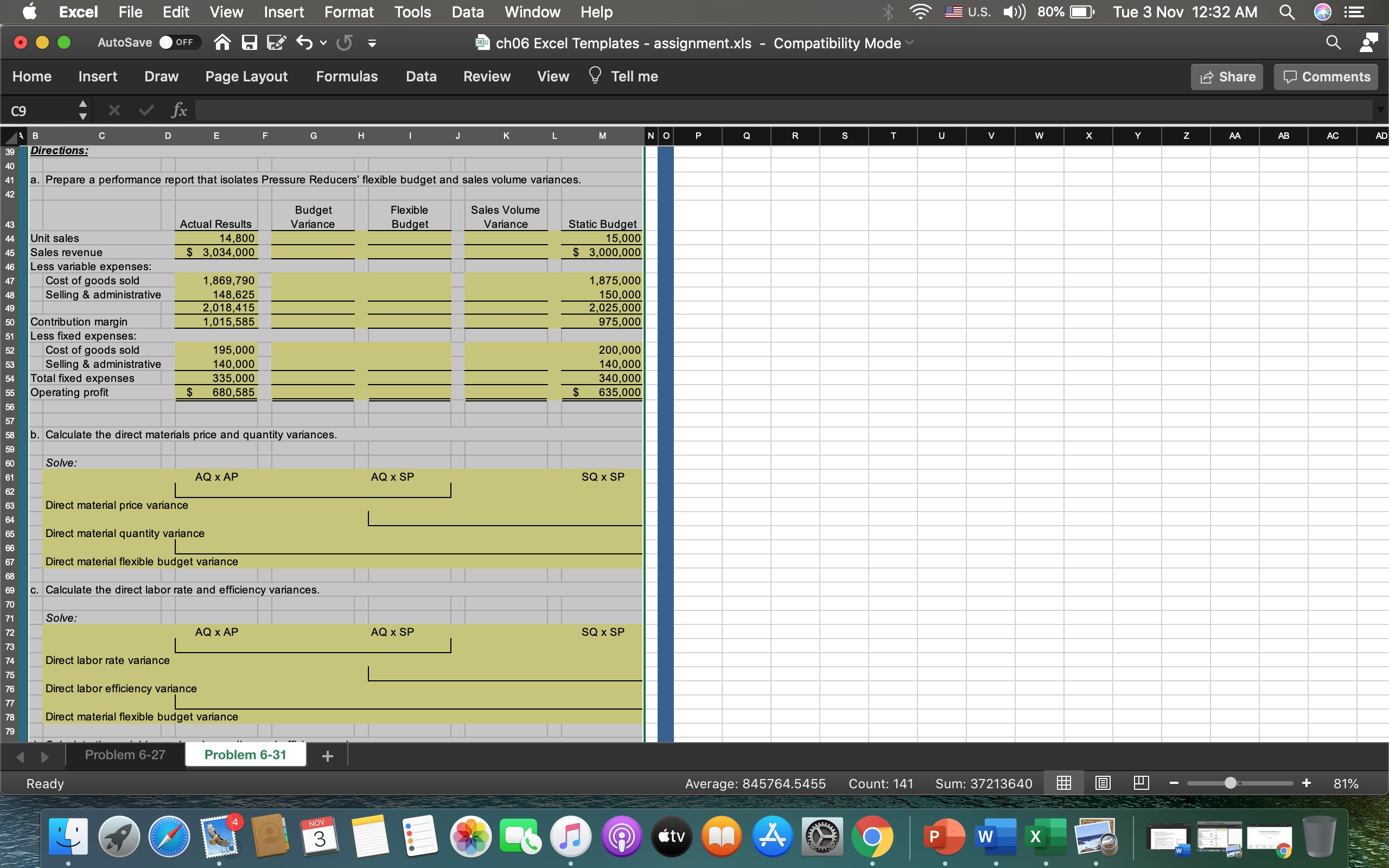

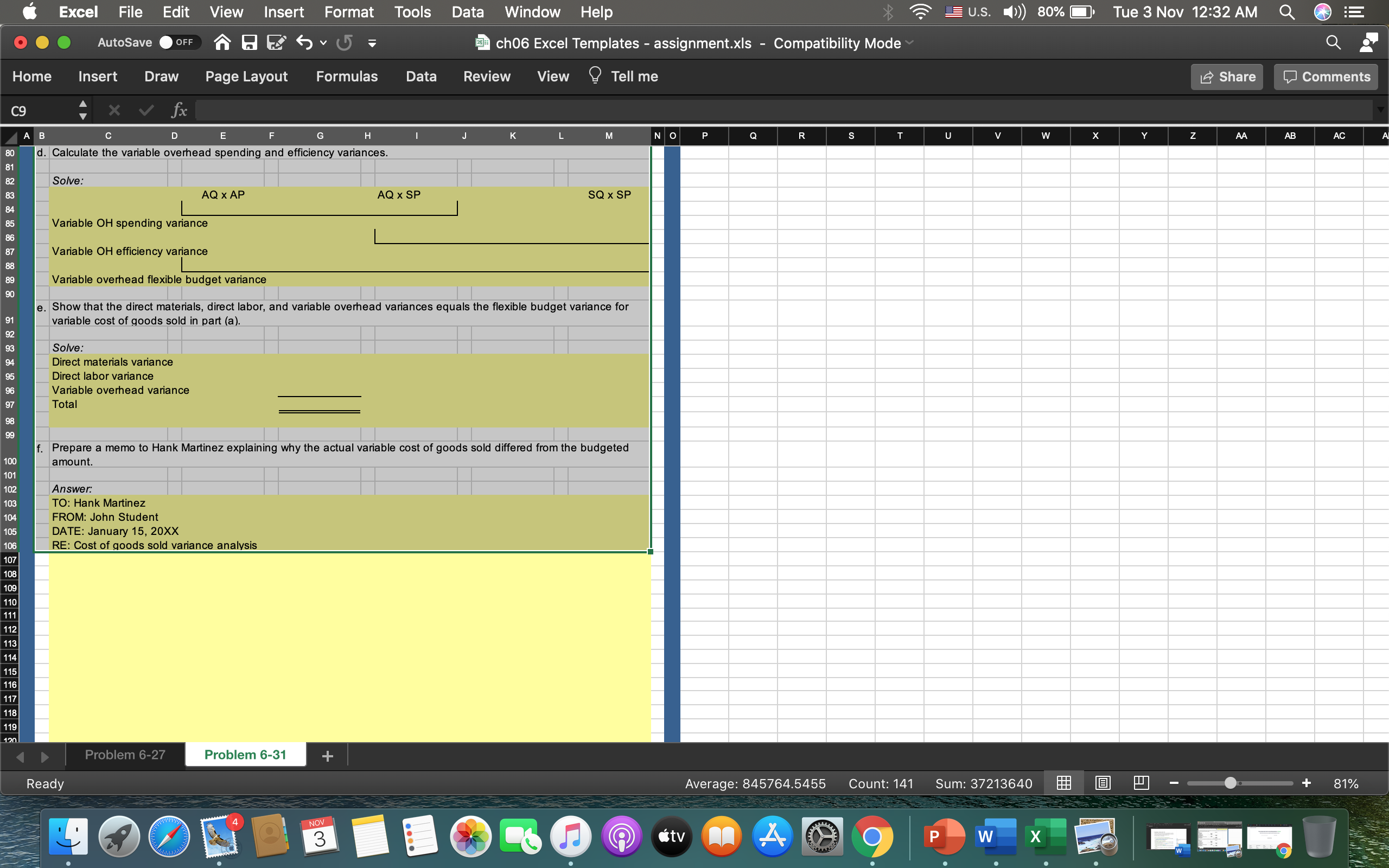

Excel File Edit View Insert Format Tools Data Window Help EUS. ) 80% Tue 3 Nov 12:32 AM Q E OO AutoSave . OFF ch06 Excel Templates - assignment.xIs - Compatibility Mode Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X V fx A B C D E G K M NO P Q R S T U V W X Y Z AA AB AC Pressure Reducers, Inc., produces and sells lumbar support cushions for office chairs using a special foam that molds to a person's back. Since all products are made to order, the only inventory the company maintains is raw materials. Thus, all costs of production are recognized in the period in which they are incurred. The following annual performance report was prepared from the company's accounting records: Actual Budget Variance Units sold 14,800 15,000 200 U Sales revenue $3,034,000 $3,000,000 $34,000 F Cost of goods sold 2,064,790 2,075,000 10,210) F Gross margin 969,210 925,000 44,210 F Selling and administrative expenses 288,625 290,000 Operating income $680 585 $635 000 (1,375) F $45 585 E The following fixed costs are included in these amounts. Actual Budge Cost of goods sold $ 195,000 $200,000 Selling and administrative expenses 140,000 140,000 Hank Martinez, Pressure Reducers' CFO, used the following standard cost card in preparing the budget and thought he had done a good job estimating production and sales. He wonders why the variable cost of goods sold deviated 23 24 from that budget Standard Quantity per Total Cost per Unit Standard Price Unit Direct material $10 per vard Direct labor 5 yards $50 2.5 hours $16 per DLH 40 Variable overhead 2.5 hours $14 per DLH 35 $125 Actual variable costs incurred during the year were as follows. Direct material purchased and used (78,400 yards @ $9.80) $768,320 Direct labor cost incurred (37,260 DLH @ $15.50) 577,530 Variable overhead costs incurred 523,940 $1 869 790 Directions: . Prepare a performance report that isolates Pressure Reducers' flexible budget and sales volume variances. Problem 6-27 Problem 6-31 Ready Average: 845764.5455 Count: 141 Sum: 37213640 + 81% NOV 3 "tv 4 W WExcel File Edit View Insert Format Tools Data Window Help EUS. () 80% Tue 3 Nov 12:32 AM Q E AutoSave . OFF ch06 Excel Templates - assignment.xIs - Compatibility Mode Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X V fx C D E F G H K M NO P Q R S T U V W X Y Z AA AB AC A B AD 39 Directions: 40 41 a. Prepare a performance report that isolates Pressure Reducers' flexible budget and sales volume variances 42 Budget Flexible Sales Volume 43 Actual Results Variance Budget Variance Static Budget 44 Unit sales 14,800 15,000 Sales revenue $ 3,034,000 $ 3,000,000 Less variable expenses: Cost of goods sold ,869,790 1,875,000 48 Selling & administrative 148,625 150,000 2,018,415 2,025,000 50 Contribution margin 1,015,585 975,000 Less fixed expenses Cost of goods sold 195,000 200,000 Selling & administrative 140,000 140,000 Total fixed expenses 335,000 340,000 Operating profit 680,585 635,000 b. Calculate the direct materials price and quantity variances. 59 3 2 8 Solve: AQ x AP AQ x SP SQ x SP 8 8 9 8 8 2 8 8 Direct material price variance Direct material quantity variance Direct material flexible budget variance c. Calculate the direct labor rate and efficiency variances. Solve: AQ X AP AQ X SP SQ x SP Direct labor rate variance Direct labor efficiency variance Direct material flexible budget variance Problem 6-27 Problem 6-31 + Ready Average: 845764.5455 Count: 141 Sum: 37213640 + 81% NOV 3 "tv 4 W WExcel File Edit View Insert Format Tools Data Window Help EUS. ) 80% Tue 3 Nov 12:32 AM Q E OO AutoSave . OFF ch06 Excel Templates - assignment.xIs - Compatibility Mode Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X v fx AB AC A B C D E G H J K M NO P Q R S U V w X Y Z AA d. Calculate the variable overhead spending and efficiency variances. Solve: AQ x AP AQ x SP SQ x SP Variable OH spending variance Variable OH efficiency variance 89 Variable overhead flexible budget variance 90 e. Show that the direct materials, direct labor, and variable overhead variances equals the flexible budget variance for 91 variable cost of goods sold in part (a). 92 Solve: Direct materials variance 95 Direct labor variance 96 Variable overhead variance 97 Total f. Prepare a memo to Hank Martinez explaining why the actual variable cost of goods sold differed from the budgeted 100 amount. 101 102 Answer: 103 TO: Hank Martinez 104 FROM: John Student 105 DATE: January 15, 20XX RE: Cost of goods sold variance analysis 119 420 Problem 6-27 Problem 6-31 + Ready Average: 845764.5455 Count: 141 Sum: 37213640 + 81% NOV 3 "tv 4 W W