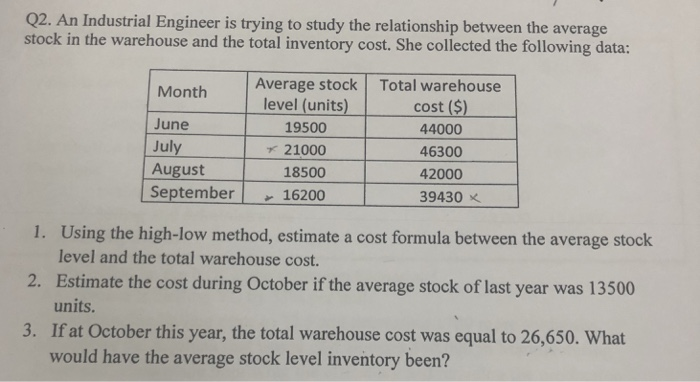

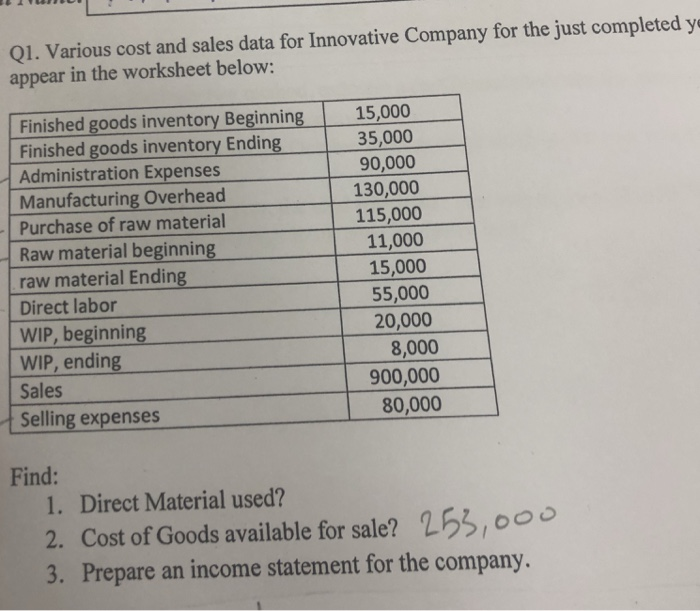

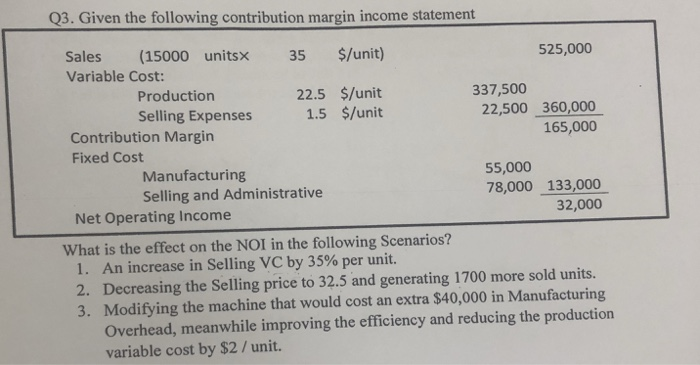

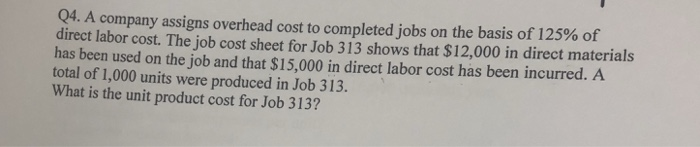

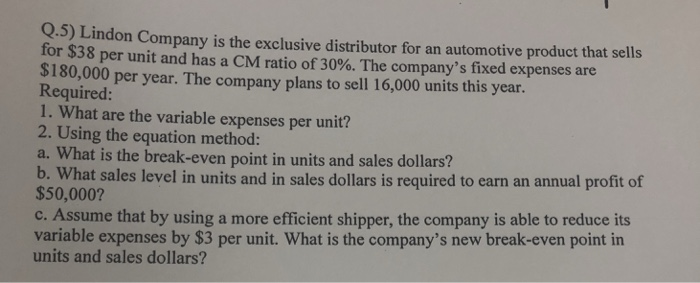

Q2. An Industrial Engineer is trying to study the relationship between the average stock in the warehouse and the total inventory cost. She collected the following data: Average stock Total warehouse Month June July level (units)cost (S) 44000 46300 1850042000 19500 21000 August September16200 39430x Using the high-low method, estimate a cost formula between the average stock level and the total warehouse cost. Estimate the cost during October if the average stock of last year was 13500 units. 1. 2. 3. If at October this year, the total warehouse cost was equal to 26,650. What would have the average stock level inventory been? Q1. Various cost and sales data for Innovative Company for the just completed y appear in the worksheet below: 15,000 Finished goods inventory Beginning Finished goods inventory Ending Administration Expenses Manufacturing Overhead Purchase of raw material Raw material beginning raw material Ending Direct labor WIP, beginning WIP, ending Sales Selling expenses 35,000 90,000 130,000 115,000 11,000 15,000 55,000 20,000 8,000 900,000 80,000 Find: 1. Direct Material used? 2. Cost of Goods available for sale? 263,000 3. Prepare an income statement for the company. 04. A company assigns overhead cost to completed jobs on the basis of 125% of direct labor cost. The job cost sheet for Job 313 shows that $12,000 in direct materials has been used on the job and that $15,000 in direct labor cost has been incurred. A total of 1,000 units were produced in Job 313. What is the unit product cost for Job 3132 Q.5) Lindon Company is the exclusive distributor for an automotive product that sells for $38 per unit and has a CM ratio of 30%. The company's fixed expenses are $180,000 per year. The company plans to sell 16,000 units this year. Required: 1. What are the variable expenses per unit? 2. Using the equation method: a. What is the break-even point in units and sales dollars? b. What sales level in units and in sales dollars is required to earn an annual profit of $50,000? c. Assume that by using a more efficient shipper, the company is able to reduce its variable expenses by $3 per unit. What is the company's new break-even point in units and sales dollars