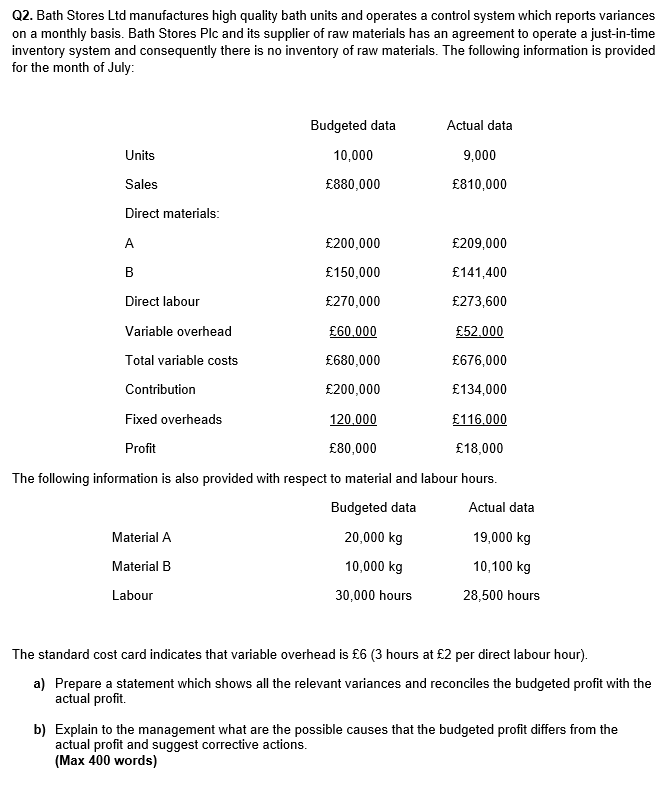

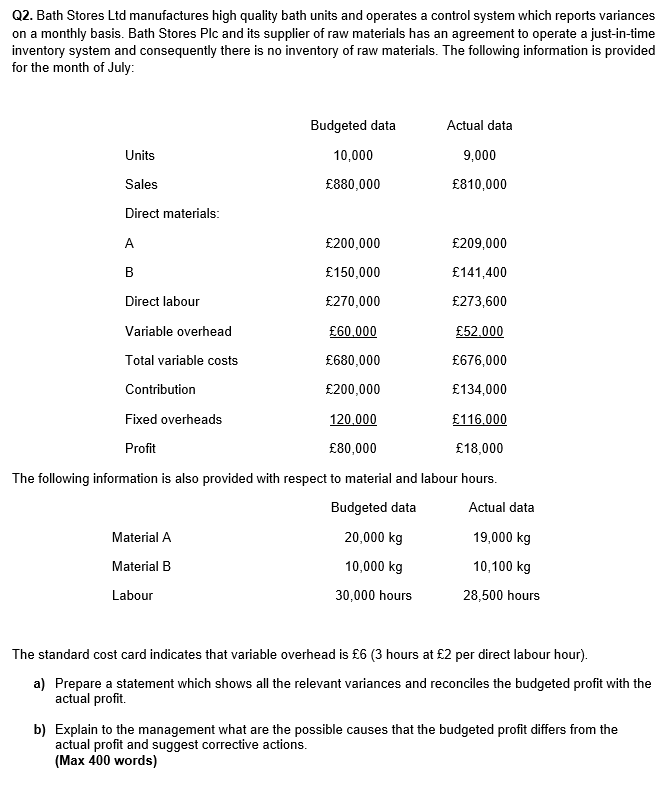

Q2. Bath Stores Ltd manufactures high quality bath units and operates a control system which reports variances on a monthly basis. Bath Stores Plc and its supplier of raw materials has an agreement to operate a just-in-time inventory system and consequently there is no inventory of raw materials. The following information is provided for the month of July: Actual data Budgeted data 10,000 Units 9,000 Sales 880,000 810,000 Direct materials: A 200,000 209,000 B 150,000 141,400 Direct labour 270,000 273,600 Variable overhead 60,000 52.000 Total variable costs 680,000 676,000 Contribution 200,000 134,000 Fixed overheads 116.000 120,000 80,000 Profit 18,000 The following information is also provided with respect to material and labour hours. Budgeted data Actual data Material A 20,000 kg 19,000 kg Material B 10,000 kg 10,100 kg Labour 30,000 hours 28,500 hours The standard cost card indicates that variable overhead is 6 (3 hours at 2 per direct labour hour). a) Prepare a statement which shows all the relevant variances and reconciles the budgeted profit with the actual profit b) Explain to the management what are the possible causes that the budgeted profit differs from the actual profit and suggest corrective actions. (Max 400 words) Q2. Bath Stores Ltd manufactures high quality bath units and operates a control system which reports variances on a monthly basis. Bath Stores Plc and its supplier of raw materials has an agreement to operate a just-in-time inventory system and consequently there is no inventory of raw materials. The following information is provided for the month of July: Actual data Budgeted data 10,000 Units 9,000 Sales 880,000 810,000 Direct materials: A 200,000 209,000 B 150,000 141,400 Direct labour 270,000 273,600 Variable overhead 60,000 52.000 Total variable costs 680,000 676,000 Contribution 200,000 134,000 Fixed overheads 116.000 120,000 80,000 Profit 18,000 The following information is also provided with respect to material and labour hours. Budgeted data Actual data Material A 20,000 kg 19,000 kg Material B 10,000 kg 10,100 kg Labour 30,000 hours 28,500 hours The standard cost card indicates that variable overhead is 6 (3 hours at 2 per direct labour hour). a) Prepare a statement which shows all the relevant variances and reconciles the budgeted profit with the actual profit b) Explain to the management what are the possible causes that the budgeted profit differs from the actual profit and suggest corrective actions. (Max 400 words)