q2

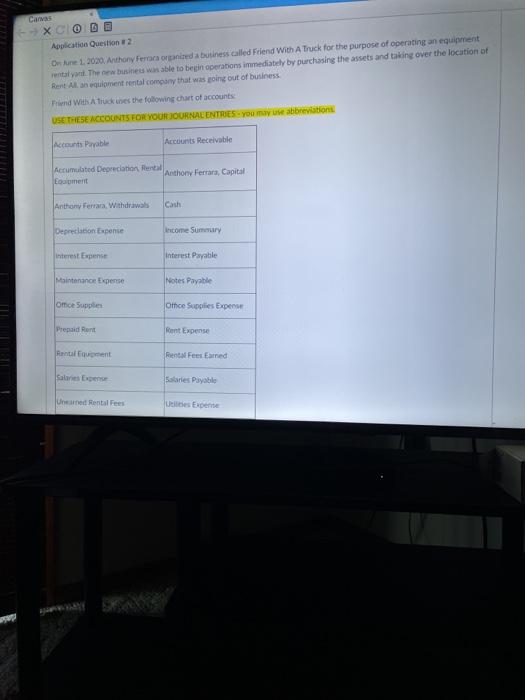

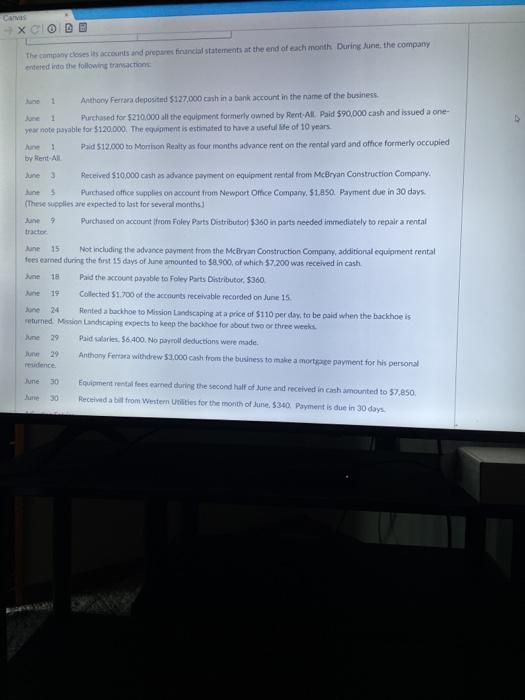

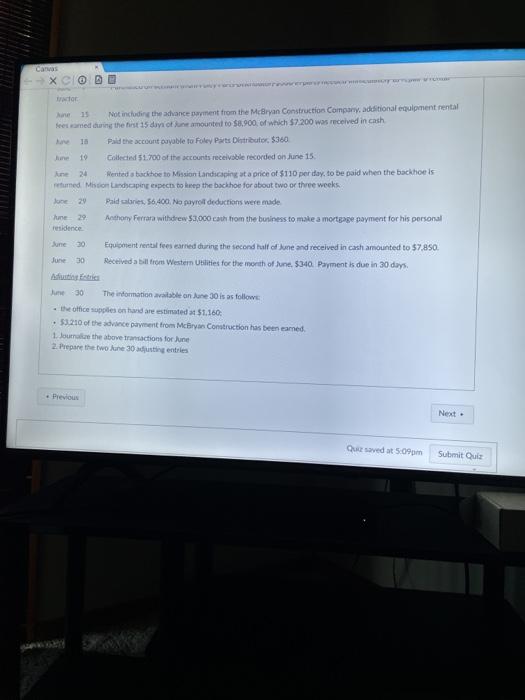

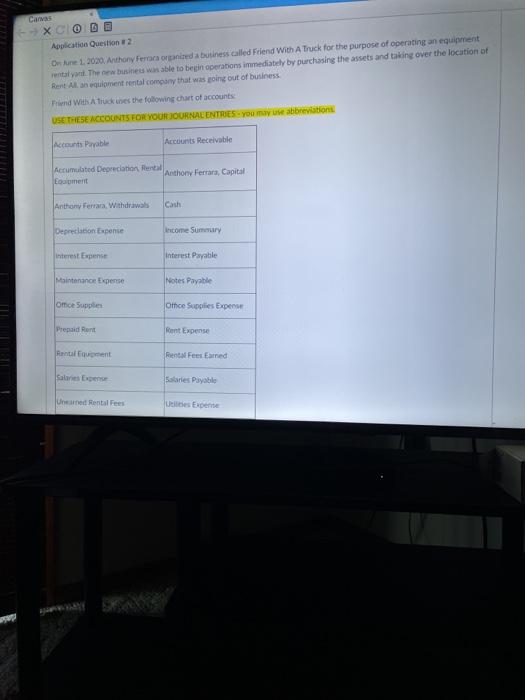

Canvas X DE Aplication Question 2 Ore 1.2020. Anthony Ferrara organized a business called Friend With A Truck for the purpose of operating an equipment bly. The new business was able to begin operations immediately by purchasing the assets and taking over the location of Rent Alan qument rental company that was going out of business Pred With A trudes the following chart of accounts USE THESE ACCOUNTS FOR YOUR JOURNAE ENTRIES you may abbreviation Accounts Payable Accounts Receivable Accumulated Depreciation Renta Anthony Ferrara, Capital Eocument Anthony Ferrara, Withdrawas Cash Depreciation Experte Income Summary Interest Expense Interest Payable Maintenance Expense Notes Payable Omce Supplies Othce Supplies Expert Prepaid Rent Rent Expense Antal runt Rent Fees Earned salaries Expense Salaries Payable Unanet Rentals Ulices Expen Car X CODE The company does its accounts and prepared financial statements at the end of each month During Aune, the company entered indo the following transactions une 1 Le 1 Anthony Ferrara deposited $127,000 cash in a bank account in the name of the business Purchased for $210.000 all the equipment formerly owned by Rent All Paid $90,000 cash and issued a one- year note payable for $120.000. The equipment is estimated to have a useful life of 10 years Paid 512.000 to Morrison Realty as four months advance rent on the mental yard and office formerly occupied by Rent-All lunes Received $10,000 cash as advance payment on equipment rental from McBryan Construction Company, 5 Purchased office supplies on account from Newport Office Company, $1850. Payment due in 30 days (These supplies are expected to last for several months June Purchased on account from Foley Parts Distributori 5260 in parts needed immediately to repair a rental Line tractor line ne 15 Not including the advance payment from the McBryan Construction Company, additional equipment rental fees earned during the first 15 days of June amounted to $8.900, of which 57.200 was received in cash Paid the count payable to Foley Parts Distributor, $360 Collected 51.700 of the accounts receivable recorded on June 15 fone 24 Hented a backhoe to Mission Landscaping at a price of $110 per day to be paid when the backhoe is returned Mission Landscaping expects to keep the backhoe for sbout two or three weeks une 29 Paidalaries. 56.400. No payroll deductions were made. June Anthony Ferrara withdrew $9.000 cash from the business to make a morte payment for his personal sidence 29 June 30 Equipment rental fees earned during the second half of une and received in cash amounted to 57.850 Received a bit from Western Unities for the month of June $340. Payment is due in 30 days 30 X tractor Not including the advance Dayment from the McBryan Construction Company additional equipment rental frescamed during the first day of a mounted to $8.900, of which $7.200 was received in cash Paid the accountable to Foley Parts Distributor $360 10 Collected 51.700 of the accounts receivable recorded on June 15 24 Wented backhoe to Mission Landscaping at a price of $110 per day to be paid when the backhoe is returned Mission Landscaping expects to keep the backhoe for about two or three weeks Jone 20 Paid bares, 56,400. No payroll deductions were made une 29 Anthony Ferrata withdrew $3,000 coth from the business to make a mortgage payment for his personal residence June 30 Equipment rental fees earned during the second half of June and received in cash amounted to 57,850 Received a bit from Western Unities for the month of June. $340. Payments due in 30 days. June 30 June 30 The information able on June 30 is as follows: the office spoles on and are estimated at $1.160. 53.210 of the advance payment from McBryan Construction has been eamed. 1. Joure the above transactions for une 2. Prepare the two fune 30 usting entries . Previous Next Qusaved at 5:09 pm Submit Out Canvas X DE Aplication Question 2 Ore 1.2020. Anthony Ferrara organized a business called Friend With A Truck for the purpose of operating an equipment bly. The new business was able to begin operations immediately by purchasing the assets and taking over the location of Rent Alan qument rental company that was going out of business Pred With A trudes the following chart of accounts USE THESE ACCOUNTS FOR YOUR JOURNAE ENTRIES you may abbreviation Accounts Payable Accounts Receivable Accumulated Depreciation Renta Anthony Ferrara, Capital Eocument Anthony Ferrara, Withdrawas Cash Depreciation Experte Income Summary Interest Expense Interest Payable Maintenance Expense Notes Payable Omce Supplies Othce Supplies Expert Prepaid Rent Rent Expense Antal runt Rent Fees Earned salaries Expense Salaries Payable Unanet Rentals Ulices Expen Car X CODE The company does its accounts and prepared financial statements at the end of each month During Aune, the company entered indo the following transactions une 1 Le 1 Anthony Ferrara deposited $127,000 cash in a bank account in the name of the business Purchased for $210.000 all the equipment formerly owned by Rent All Paid $90,000 cash and issued a one- year note payable for $120.000. The equipment is estimated to have a useful life of 10 years Paid 512.000 to Morrison Realty as four months advance rent on the mental yard and office formerly occupied by Rent-All lunes Received $10,000 cash as advance payment on equipment rental from McBryan Construction Company, 5 Purchased office supplies on account from Newport Office Company, $1850. Payment due in 30 days (These supplies are expected to last for several months June Purchased on account from Foley Parts Distributori 5260 in parts needed immediately to repair a rental Line tractor line ne 15 Not including the advance payment from the McBryan Construction Company, additional equipment rental fees earned during the first 15 days of June amounted to $8.900, of which 57.200 was received in cash Paid the count payable to Foley Parts Distributor, $360 Collected 51.700 of the accounts receivable recorded on June 15 fone 24 Hented a backhoe to Mission Landscaping at a price of $110 per day to be paid when the backhoe is returned Mission Landscaping expects to keep the backhoe for sbout two or three weeks une 29 Paidalaries. 56.400. No payroll deductions were made. June Anthony Ferrara withdrew $9.000 cash from the business to make a morte payment for his personal sidence 29 June 30 Equipment rental fees earned during the second half of une and received in cash amounted to 57.850 Received a bit from Western Unities for the month of June $340. Payment is due in 30 days 30 X tractor Not including the advance Dayment from the McBryan Construction Company additional equipment rental frescamed during the first day of a mounted to $8.900, of which $7.200 was received in cash Paid the accountable to Foley Parts Distributor $360 10 Collected 51.700 of the accounts receivable recorded on June 15 24 Wented backhoe to Mission Landscaping at a price of $110 per day to be paid when the backhoe is returned Mission Landscaping expects to keep the backhoe for about two or three weeks Jone 20 Paid bares, 56,400. No payroll deductions were made une 29 Anthony Ferrata withdrew $3,000 coth from the business to make a mortgage payment for his personal residence June 30 Equipment rental fees earned during the second half of June and received in cash amounted to 57,850 Received a bit from Western Unities for the month of June. $340. Payments due in 30 days. June 30 June 30 The information able on June 30 is as follows: the office spoles on and are estimated at $1.160. 53.210 of the advance payment from McBryan Construction has been eamed. 1. Joure the above transactions for une 2. Prepare the two fune 30 usting entries . Previous Next Qusaved at 5:09 pm Submit Out