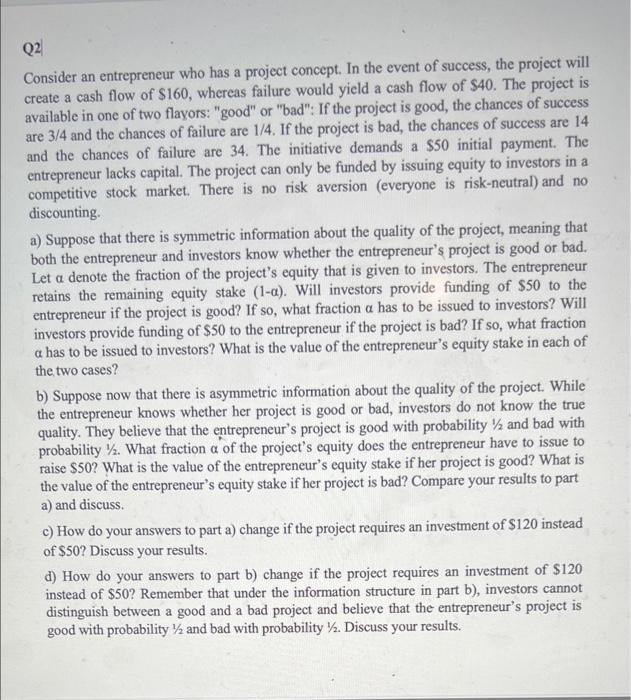

Q2 Consider an entrepreneur who has a project concept. In the event of success, the project will create a cash flow of $160, whereas failure would yield a cash flow of $40. The project is available in one of two flayors: "good" or "bad": If the project is good, the chances of success are 3/4 and the chances of failure are 1/4. If the project is bad, the chances of success are 14 and the chances of failure are 34. The initiative demands a $50 initial payment. The entrepreneur lacks capital. The project can only be funded by issuing equity to investors in a competitive stock market. There is no risk aversion (everyone is risk-neutral) and no discounting. a) Suppose that there is symmetric information about the quality of the project, meaning that both the entrepreneur and investors know whether the entrepreneur's project is good or bad. Let a denote the fraction of the project's equity that is given to investors. The entrepreneur retains the remaining equity stake (1-a). Will investors provide funding of $50 to the entrepreneur if the project is good? If so, what fraction a has to be issued to investors? Will investors provide funding of $50 to the entrepreneur if the project is bad? If so, what fraction a has to be issued to investors? What is the value of the entrepreneur's equity stake in each of the two cases? b) Suppose now that there is asymmetric information about the quality of the project. While the entrepreneur knows whether her project is good or bad, investors do not know the true quality. They believe that the entrepreneur's project is good with probability and bad with probability . What fraction a of the project's equity does the entrepreneur have to issue to raise $50? What is the value of the entrepreneur's equity stake if her project is good? What is the value of the entrepreneur's equity stake if her project is bad? Compare your results to part a) and discuss. c) How do your answers to part a) change if the project requires an investment of $120 instead of $50? Discuss your results. d) How do your answers to part b) change if the project requires an investment of $120 instead of $50? Remember that under the information structure in part b), investors cannot distinguish between a good and a bad project and believe that the entrepreneur's project is good with probability and bad with probability 2. Discuss your results. Q2 Consider an entrepreneur who has a project concept. In the event of success, the project will create a cash flow of $160, whereas failure would yield a cash flow of $40. The project is available in one of two flayors: "good" or "bad": If the project is good, the chances of success are 3/4 and the chances of failure are 1/4. If the project is bad, the chances of success are 14 and the chances of failure are 34. The initiative demands a $50 initial payment. The entrepreneur lacks capital. The project can only be funded by issuing equity to investors in a competitive stock market. There is no risk aversion (everyone is risk-neutral) and no discounting. a) Suppose that there is symmetric information about the quality of the project, meaning that both the entrepreneur and investors know whether the entrepreneur's project is good or bad. Let a denote the fraction of the project's equity that is given to investors. The entrepreneur retains the remaining equity stake (1-a). Will investors provide funding of $50 to the entrepreneur if the project is good? If so, what fraction a has to be issued to investors? Will investors provide funding of $50 to the entrepreneur if the project is bad? If so, what fraction a has to be issued to investors? What is the value of the entrepreneur's equity stake in each of the two cases? b) Suppose now that there is asymmetric information about the quality of the project. While the entrepreneur knows whether her project is good or bad, investors do not know the true quality. They believe that the entrepreneur's project is good with probability and bad with probability . What fraction a of the project's equity does the entrepreneur have to issue to raise $50? What is the value of the entrepreneur's equity stake if her project is good? What is the value of the entrepreneur's equity stake if her project is bad? Compare your results to part a) and discuss. c) How do your answers to part a) change if the project requires an investment of $120 instead of $50? Discuss your results. d) How do your answers to part b) change if the project requires an investment of $120 instead of $50? Remember that under the information structure in part b), investors cannot distinguish between a good and a bad project and believe that the entrepreneur's project is good with probability and bad with probability 2. Discuss your results