Answered step by step

Verified Expert Solution

Question

1 Approved Answer

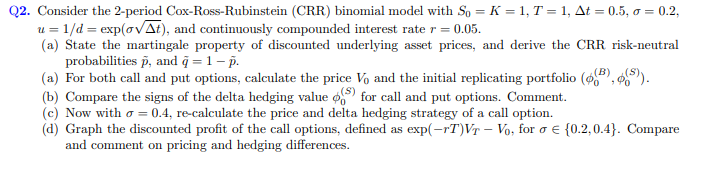

Q2. Consider the 2-period Cox-Ross-Rubinstein (CRR) binomial model with So = K = 1,T= 1, At = 0.5, = 0.2, u = 1/d =

Q2. Consider the 2-period Cox-Ross-Rubinstein (CRR) binomial model with So = K = 1,T= 1, At = 0.5, = 0.2, u = 1/d = exp(oAt), and continuously compounded interest rate r = 0.05. (a) State the martingale property of discounted underlying asset prices, and derive the CRR risk-neutral probabilities p, and q = 1 - p. (a) For both call and put options, calculate the price Vo and the initial replicating portfolio ((B), (5)). (b) Compare the signs of the delta hedging value (5) for call and put options. Comment. (c) Now with = 0.4, re-calculate the price and delta hedging strategy of a call option. (d) Graph the discounted profit of the call options, defined as exp(-rT)VT - Vo, for = {0.2,0.4}. Compare and comment on pricing and hedging differences.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The martingale property of discounted underlying asset prices states that under the riskneutral probability measure the expected discounted price of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started