Question

Q2. Law Office: You are trying to automate the records for your uncle's law firm. Multiple attorneys work for the firm, and for each of

-

Q2. Law Office: You are trying to automate the records for your uncle's law firm. Multiple attorneys work for the firm, and for each of them you want to store their first name, last name, date hired, hourly billing rate, and date promoted to partner (blank if the attorney is not a partner). Each attorney has multiple cases, which is identified by a unique "docket number". Each case has a name and description, is worked on by only one attorney, and involves a single client. For each client, you want to store a first name, last name, middle name, phone number, address, city, state, and zip code (assume you do

Q2. Law Office: You are trying to automate the records for your uncle's law firm. Multiple attorneys work for the firm, and for each of them you want to store their first name, last name, date hired, hourly billing rate, and date promoted to partner (blank if the attorney is not a partner). Each attorney has multiple cases, which is identified by a unique "docket number". Each case has a name and description, is worked on by only one attorney, and involves a single client. For each client, you want to store a first name, last name, middle name, phone number, address, city, state, and zip code (assume you do

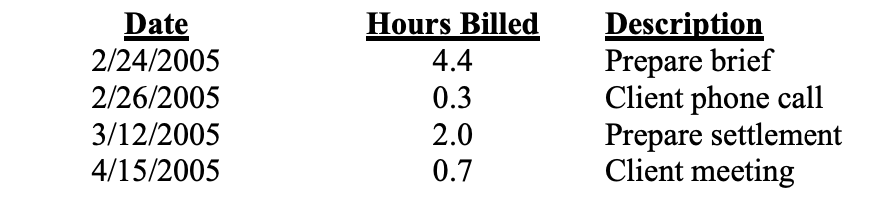

not have a zip-code table). Finally, you want to keep track of the billable hours spent on each case. For a single case, this comprises information that looks like

Date and Hours Billed are in the picture.

Description

Prepare brief Client phone call Prepare settlement Client meeting

Draw an entity-relationship diagram and write a database design outline.

Date 2/24/2005 2/26/2005 3/12/2005 4/15/2005 Hours Billed 4.4 0.3 2.0 0.7 Description Prepare brief Client phone call Prepare settlement Client meetingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started