Question

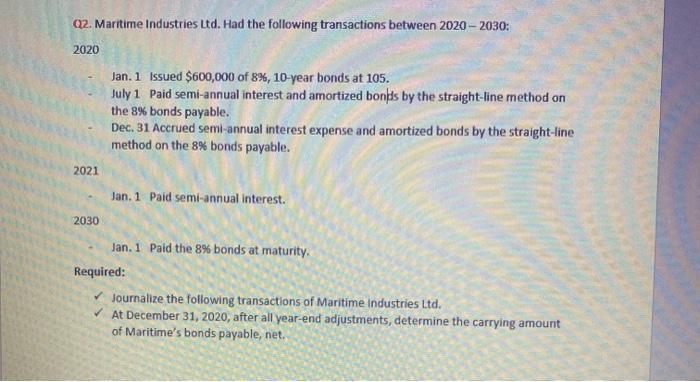

Q2. Maritime Industries Ltd. Had the following transactions between 2020 2030: 2020 Jan. 1 Issued $600,000 of 8%, 10-year bonds at 105. July 1

Q2. Maritime Industries Ltd. Had the following transactions between 2020 2030: 2020 Jan. 1 Issued $600,000 of 8%, 10-year bonds at 105. July 1 Paid semi-annual interest and amortized bonds by the straight-line method on the 8% bonds payable. Dec. 31 Accrued semi-annual interest expense and amortized bonds by the straight-line method on the 8% bonds payable. 2021 Jan. 1 Paid semi-annual interest. 2030 Jan. 1 Paid the 8% bonds at maturity. Required: Journalize the following transactions of Maritime Industries Ltd. V At December 31, 2020, after all year-end adjustments, determine the carrying amount of Maritime's bonds payable, net.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Working notes Bond face value Bond issue price Premium on issue of bonds 600000 630000 600000105 300...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Financial Accounting Concepts

Authors: Thomas Edmonds, Christopher Edmonds

9th edition

9781259296802, 9781259296758, 78025907, 1259296806, 9781259296765, 978-0078025907

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App