Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q2 Patricia is the wife of John. John has asked your firm to provide advice to his wife, as a favour to him, and

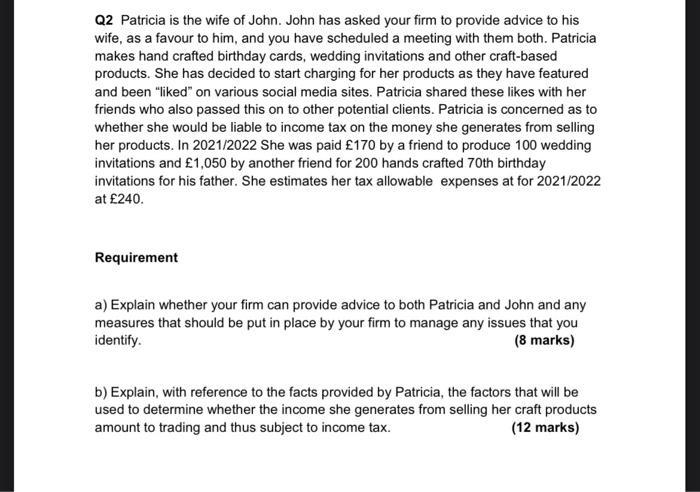

Q2 Patricia is the wife of John. John has asked your firm to provide advice to his wife, as a favour to him, and you have scheduled a meeting with them both. Patricia makes hand crafted birthday cards, wedding invitations and other craft-based products. She has decided to start charging for her products as they have featured and been "liked" on various social media sites. Patricia shared these likes with her friends who also passed this on to other potential clients. Patricia is concerned as to whether she would be liable to income tax on the money she generates from selling her products. In 2021/2022 She was paid 170 by a friend to produce 100 wedding invitations and 1,050 by another friend for 200 hands crafted 70th birthday invitations for his father. She estimates her tax allowable expenses at for 2021/2022 at 240. Requirement a) Explain whether your firm can provide advice to both Patricia and John and any measures that should be put in place by your firm to manage any issues that you identify. (8 marks) b) Explain, with reference to the facts provided by Patricia, the factors that will be used to determine whether the income she generates from selling her craft products amount to trading and thus subject to income tax. (12 marks)

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The ability to pay principle in taxation is based on a persons ability to pay taxes It is the amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started