Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q2. Piti Bank Corporation (PBMC), a premier investment bank offers full-brokerage services to its current and prospecting clients. One of the services offered by PBMC

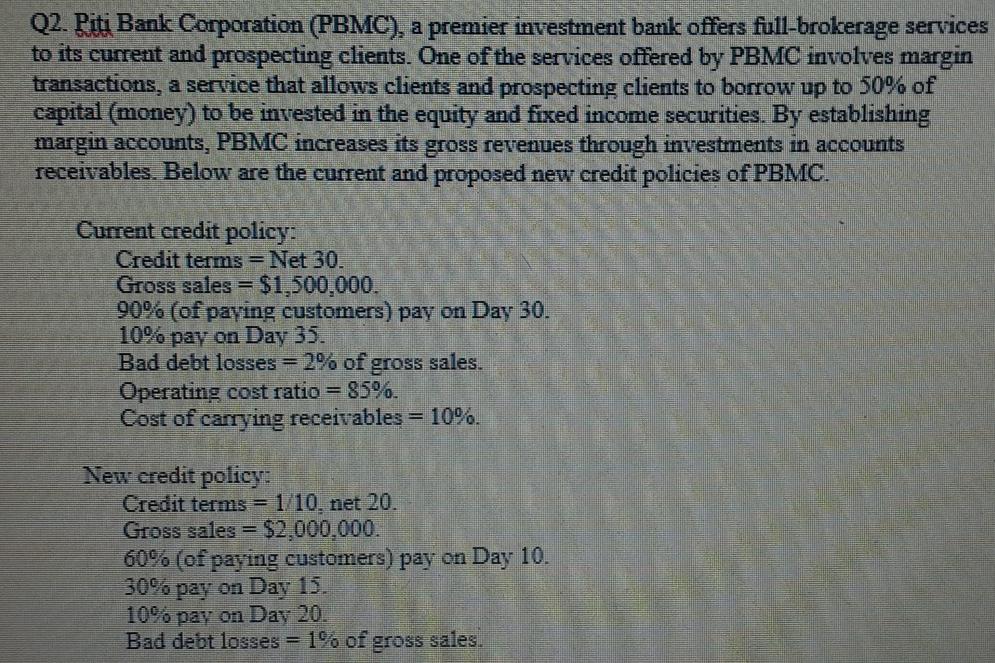

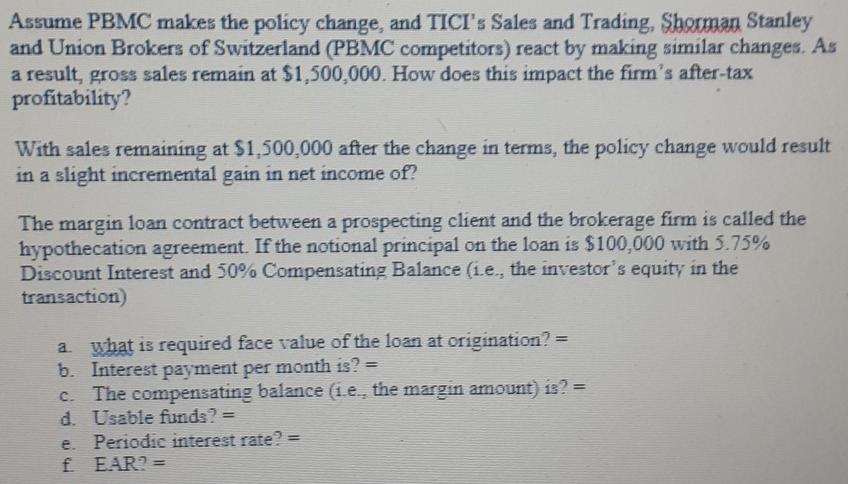

Q2. Piti Bank Corporation (PBMC), a premier investment bank offers full-brokerage services to its current and prospecting clients. One of the services offered by PBMC involves margin transactions, a service that allows clients and prospecting clients to borrow up to 50% of capital (money) to be invested in the equity and fixed income securities. By establishing margin accounts, PBMC increases its gross revenues through investments in accounts receivables. Below are the current and proposed new credit policies of PBMC. Current credit policy: Credit terms = Net 30. Gross sales = $1,500,000. 90% (of paying customers) pay on Day 30. 10% pay on Day 35. Bad debt losses = 2% of gross sales. Operating cost ratio = 85%. Cost of carrying receivables = 10%. New credit policy: Credit terms = 1/10. net 20. Gross sales = $2.000.000. 60% (of paying customers) pay on Day 10. 30% pay on Day 15. 10% pay on Day 20. Bad debt losses = 1% of gross sales. Assume PBMC makes the policy change, and TICI's Sales and Trading, Sherman Stanley and Union Brokers of Switzerland (PBMC competitors) react by making similar changes. As a result, gross sales remain at $1,500,000. How does this impact the firm's after-tax profitability? With sales remaining at $1,500,000 after the change in terms, the policy change would result in a slight incremental gain in net income of? The margin loan contract between a prospecting client and the brokerage firm is called the hypothecation agreement. If the notional principal on the loan is $100,000 with 5.75% Discount Interest and 50% Compensating Balance (i.e., the investor's equity in the transaction) a. what is required face value of the loan at origination? = b. Interest payment per month is? = The compensating balance (1.e. the margin amount) is? = d. Usable funds? = e Periodic interest rate? f EAR? = Q2. Piti Bank Corporation (PBMC), a premier investment bank offers full-brokerage services to its current and prospecting clients. One of the services offered by PBMC involves margin transactions, a service that allows clients and prospecting clients to borrow up to 50% of capital (money) to be invested in the equity and fixed income securities. By establishing margin accounts, PBMC increases its gross revenues through investments in accounts receivables. Below are the current and proposed new credit policies of PBMC. Current credit policy: Credit terms = Net 30. Gross sales = $1,500,000. 90% (of paying customers) pay on Day 30. 10% pay on Day 35. Bad debt losses = 2% of gross sales. Operating cost ratio = 85%. Cost of carrying receivables = 10%. New credit policy: Credit terms = 1/10. net 20. Gross sales = $2.000.000. 60% (of paying customers) pay on Day 10. 30% pay on Day 15. 10% pay on Day 20. Bad debt losses = 1% of gross sales. Assume PBMC makes the policy change, and TICI's Sales and Trading, Sherman Stanley and Union Brokers of Switzerland (PBMC competitors) react by making similar changes. As a result, gross sales remain at $1,500,000. How does this impact the firm's after-tax profitability? With sales remaining at $1,500,000 after the change in terms, the policy change would result in a slight incremental gain in net income of? The margin loan contract between a prospecting client and the brokerage firm is called the hypothecation agreement. If the notional principal on the loan is $100,000 with 5.75% Discount Interest and 50% Compensating Balance (i.e., the investor's equity in the transaction) a. what is required face value of the loan at origination? = b. Interest payment per month is? = The compensating balance (1.e. the margin amount) is? = d. Usable funds? = e Periodic interest rate? f EAR? =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started