Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q2: Stocks and Bonds Jane Smith bought a $1000 bond from Nike for $920 four years ago. The bond bears an interest rate of 8%

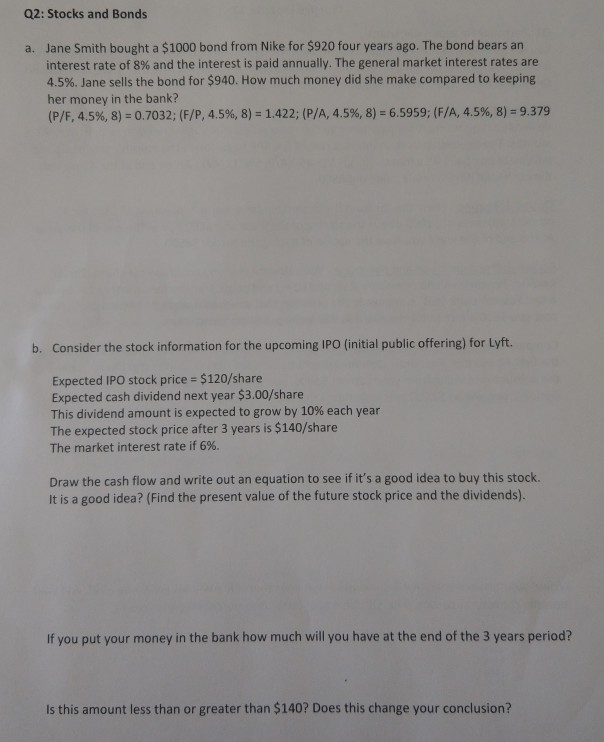

Q2: Stocks and Bonds Jane Smith bought a $1000 bond from Nike for $920 four years ago. The bond bears an interest rate of 8% and the interest is paid annually. The general market interest rates are 4.5%. Jane sells the bond for $940. How much money did she make compared to keeping a. her money in the bank? (P/F, 4.5%, 8) 0.7032; (F/P, 4.5% , 8) 1.422; (P /A, 4.5 %, 8 ) 6.5959; (F/A, 4.5 %, 8 ) 9.379 b. Consider the stock information for the upcoming IPO (initial public offering) for Lyft. Expected IPO stock price Expected cash dividend next year $3.00/share This dividend amount is expected to grow by 10 % each year The expected stock price after 3 years is $140/share The market interest rate if 6% $120/share equation to see if it's a good idea to buy this stock. Draw the cash flow and write out an It is a good idea? (Find the present value of the future stock price and the dividends). If you put your money in the bank how much will you have at the end of the 3 years period? Is this amount less than or greater than $140? Does this change your conclusion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started