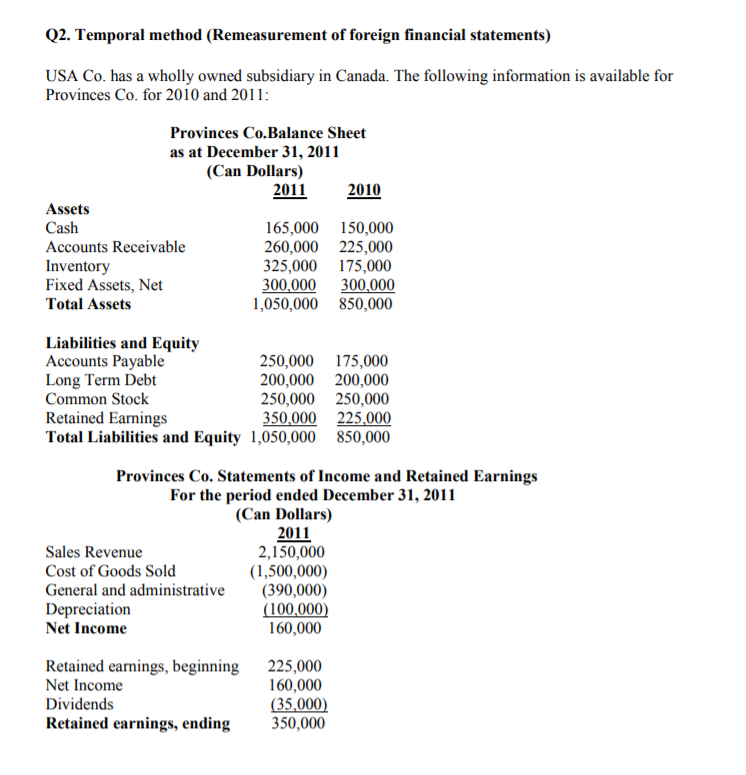

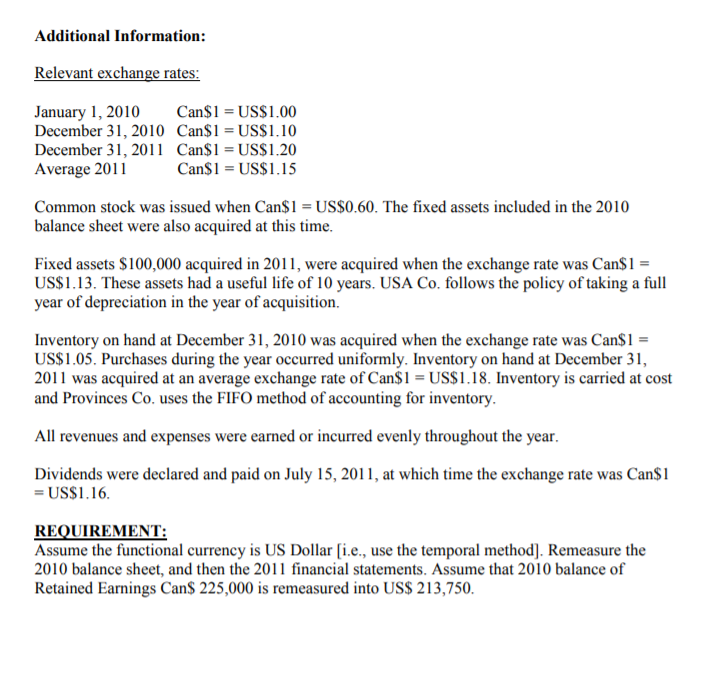

Q2. Temporal method (Remeasurement of foreign financial statements) USA Co. has a wholly owned subsidiary in Canada. The following information is available for Provinces Co. for 2010 and 2011: Provinces Co.Balance Sheet as at December 31, 2011 (Can Dollars) 2011 2010 Assets Cash 165,000 150,000 Accounts Receivable 260,000 225,000 Inventory 325,000 175,000 Fixed Assets, Net 300,000 300,000 Total Assets 1,050,000 850,000 Liabilities and Equity Accounts Payable 250,000 Long Term Debt 200,000 Common Stock 250,000 Retained Earnings 350,000 Total Liabilities and Equity 1,050,000 175,000 200,000 250,000 225,000 850,000 Provinces Co. Statements of Income and Retained Earnings For the period ended December 31, 2011 (Can Dollars) 2011 Sales Revenue 2,150,000 Cost of Goods Sold (1,500,000) General and administrative (390,000) Depreciation (100,000) Net Income 160,000 Retained earnings, beginning Net Income Dividends Retained earnings, ending 225,000 160,000 (35,000) 350,000 Additional Information: Relevant exchange rates: January 1, 2010 Can$1 = US$1.00 December 31, 2010 Can$1 = US$1.10 December 31, 2011 Can$1 = US$1.20 Average 2011 Can$1 = US$1.15 Common stock was issued when Can$1 = US$0.60. The fixed assets included in the 2010 balance sheet were also acquired at this time. Fixed assets $100,000 acquired in 2011, were acquired when the exchange rate was Can$1 = US$1.13. These assets had a useful life of 10 years. USA Co. follows the policy of taking a full year of depreciation in the year of acquisition Inventory on hand at December 31, 2010 was acquired when the exchange rate was Can$1 = US$1.05. Purchases during the year occurred uniformly. Inventory on hand at December 31, 2011 was acquired at an average exchange rate of Can$1 = US$1.18. Inventory is carried at cost and Provinces Co. uses the FIFO method of accounting for inventory. All revenues and expenses were earned or incurred evenly throughout the year, Dividends were declared and paid on July 15, 2011, at which time the exchange rate was Can$1 = US$1.16. REQUIREMENT: Assume the functional currency is US Dollar (i.e., use the temporal method). Remeasure the 2010 balance sheet, and then the 2011 financial statements. Assume that 2010 balance of Retained Earnings Can$ 225,000 is remeasured into US$ 213,750. Q2. Temporal method (Remeasurement of foreign financial statements) USA Co. has a wholly owned subsidiary in Canada. The following information is available for Provinces Co. for 2010 and 2011: Provinces Co.Balance Sheet as at December 31, 2011 (Can Dollars) 2011 2010 Assets Cash 165,000 150,000 Accounts Receivable 260,000 225,000 Inventory 325,000 175,000 Fixed Assets, Net 300,000 300,000 Total Assets 1,050,000 850,000 Liabilities and Equity Accounts Payable 250,000 Long Term Debt 200,000 Common Stock 250,000 Retained Earnings 350,000 Total Liabilities and Equity 1,050,000 175,000 200,000 250,000 225,000 850,000 Provinces Co. Statements of Income and Retained Earnings For the period ended December 31, 2011 (Can Dollars) 2011 Sales Revenue 2,150,000 Cost of Goods Sold (1,500,000) General and administrative (390,000) Depreciation (100,000) Net Income 160,000 Retained earnings, beginning Net Income Dividends Retained earnings, ending 225,000 160,000 (35,000) 350,000 Additional Information: Relevant exchange rates: January 1, 2010 Can$1 = US$1.00 December 31, 2010 Can$1 = US$1.10 December 31, 2011 Can$1 = US$1.20 Average 2011 Can$1 = US$1.15 Common stock was issued when Can$1 = US$0.60. The fixed assets included in the 2010 balance sheet were also acquired at this time. Fixed assets $100,000 acquired in 2011, were acquired when the exchange rate was Can$1 = US$1.13. These assets had a useful life of 10 years. USA Co. follows the policy of taking a full year of depreciation in the year of acquisition Inventory on hand at December 31, 2010 was acquired when the exchange rate was Can$1 = US$1.05. Purchases during the year occurred uniformly. Inventory on hand at December 31, 2011 was acquired at an average exchange rate of Can$1 = US$1.18. Inventory is carried at cost and Provinces Co. uses the FIFO method of accounting for inventory. All revenues and expenses were earned or incurred evenly throughout the year, Dividends were declared and paid on July 15, 2011, at which time the exchange rate was Can$1 = US$1.16. REQUIREMENT: Assume the functional currency is US Dollar (i.e., use the temporal method). Remeasure the 2010 balance sheet, and then the 2011 financial statements. Assume that 2010 balance of Retained Earnings Can$ 225,000 is remeasured into US$ 213,750