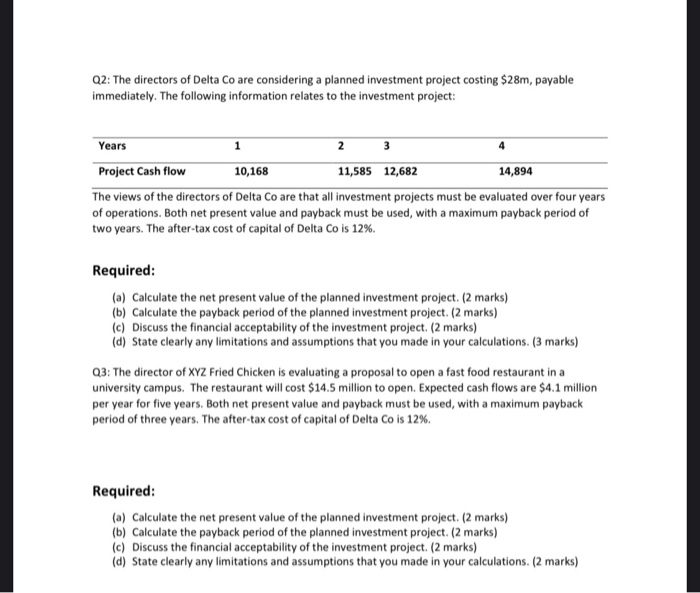

Q2: The directors of Delta Co are considering a planned investment project costing $28m, payable immediately. The following information relates to the investment project: Years 2 3 Project Cash flow 10,168 11,585 12,682 14,894 The views of the directors of Delta Co are that all investment projects must be evaluated over four years of operations. Both net present value and payback must be used, with a maximum payback period of two years. The after-tax cost of capital of Delta Co is 12%. Required: (a) Calculate the net present value of the planned investment project. (2 marks) (b) Calculate the payback period of the planned investment project. (2 marks) (c) Discuss the financial acceptability of the investment project. (2 marks) (d) State clearly any limitations and assumptions that you made in your calculations. (3 marks) Q3: The director of XYZ Fried Chicken is evaluating a proposal to open a fast food restaurant in a university campus. The restaurant will cost $14.5 million to open. Expected cash flows are $4.1 million per year for five years. Both net present value and payback must be used, with a maximum payback period of three years. The after-tax cost of capital of Delta Co is 12%. Required: (a) Calculate the net present value of the planned investment project. (2 marks) (b) Calculate the payback period of the planned investment project. (2 marks) (c) Discuss the financial acceptability of the investment project. (2 marks) (d) State clearly any limitations and assumptions that you made in your calculations. (2 marks) Q2: The directors of Delta Co are considering a planned investment project costing $28m, payable immediately. The following information relates to the investment project: Years 2 3 Project Cash flow 10,168 11,585 12,682 14,894 The views of the directors of Delta Co are that all investment projects must be evaluated over four years of operations. Both net present value and payback must be used, with a maximum payback period of two years. The after-tax cost of capital of Delta Co is 12%. Required: (a) Calculate the net present value of the planned investment project. (2 marks) (b) Calculate the payback period of the planned investment project. (2 marks) (c) Discuss the financial acceptability of the investment project. (2 marks) (d) State clearly any limitations and assumptions that you made in your calculations. (3 marks) Q3: The director of XYZ Fried Chicken is evaluating a proposal to open a fast food restaurant in a university campus. The restaurant will cost $14.5 million to open. Expected cash flows are $4.1 million per year for five years. Both net present value and payback must be used, with a maximum payback period of three years. The after-tax cost of capital of Delta Co is 12%. Required: (a) Calculate the net present value of the planned investment project. (2 marks) (b) Calculate the payback period of the planned investment project. (2 marks) (c) Discuss the financial acceptability of the investment project. (2 marks) (d) State clearly any limitations and assumptions that you made in your calculations. (2 marks)