Answered step by step

Verified Expert Solution

Question

1 Approved Answer

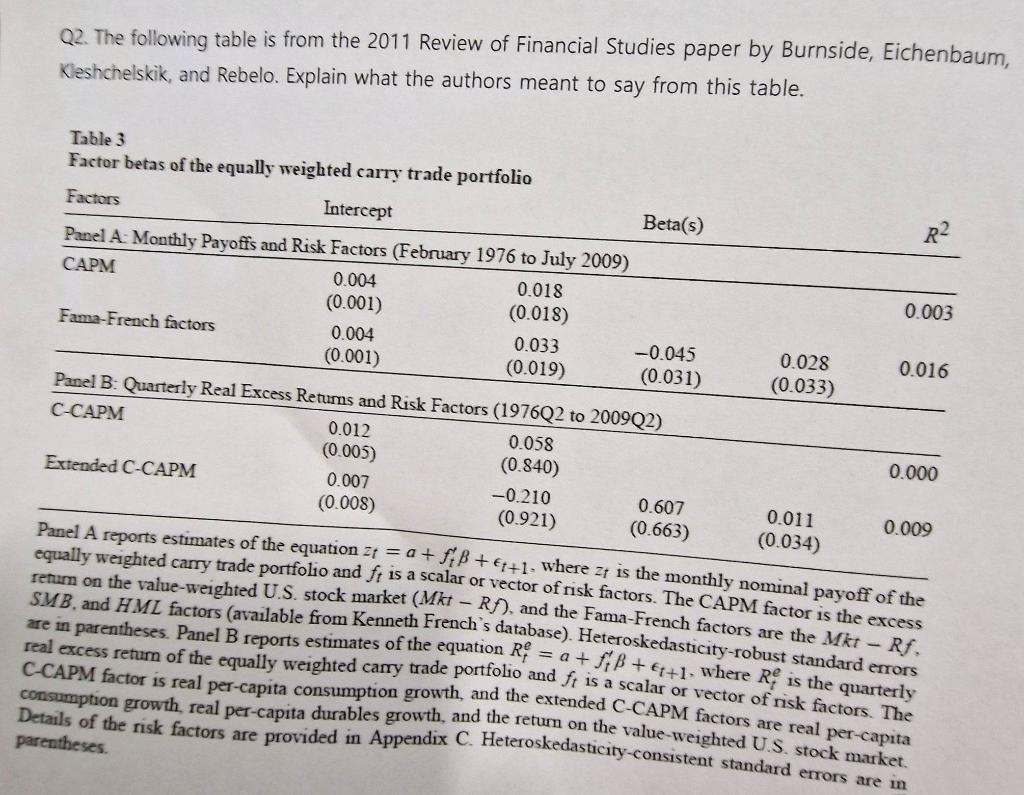

Q2. The following table is from the 2011 Review of Financial Studies paper by Burnside, Eichenbaum, Kleshchelskik, and Rebelo. Explain what the authors meant

Q2. The following table is from the 2011 Review of Financial Studies paper by Burnside, Eichenbaum, Kleshchelskik, and Rebelo. Explain what the authors meant to say from this table. Table 3 Factor betas of the equally weighted carry trade portfolio Factors Intercept Panel A: Monthly Payoffs and Risk Factors (February 1976 to July 2009) CAPM Fama-French factors 0.004 (0.001) Extended C-CAPM 0.004 (0.001) 0.012 (0.005) 0.018 (0.018) 0.007 (0.008) 0.033 (0.019) Panel B: Quarterly Real Excess Returns and Risk Factors (1976Q2 to 2009Q2) C-CAPM 0.058 (0.840) -0.210 Beta(s) (0.921) -0.045 (0.031) 0.607 (0.663) 0.028 (0.033) 0.011 (0.034) 0.003 0.016 0.000 Panel A reports estimates of the equation z = a + equally weighted carry trade portfolio and ft is a scalar or vector of risk factors. The CAPM factor is the excess fi++1. where zi is the monthly nominal payoff of the return on the value-weighted U.S. stock market (Mkt - Rf), and the Fama-French factors are the Mkt - Rf. SMB, and HML factors (available from Kenneth French's database). Heteroskedasticity-robust standard errors are in parentheses. Panel B reports estimates of the equation R = a + B +et+1. where Re is the quarterly real excess return of the equally weighted carry trade portfolio and ft is a scalar or vector of risk factors. The C-CAPM factor is real per-capita consumption growth, and the extended C-CAPM factors are real per-capita consumption growth, real per-capita durables growth, and the return on the value-weighted U.S. stock market. Details of the risk factors are provided in Appendix C. Heteroskedasticity-consistent standard errors are in parentheses. 0.009

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

The table provided is from the paper Review of Financial Studies by Burnside Eichenbaum Kleshchelski and Rebelo published in 2011 The authors present ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started