Answered step by step

Verified Expert Solution

Question

1 Approved Answer

About the model of loanable funds market, a) We learned that a model is a simplied representation of the world (i.e., of the economy,

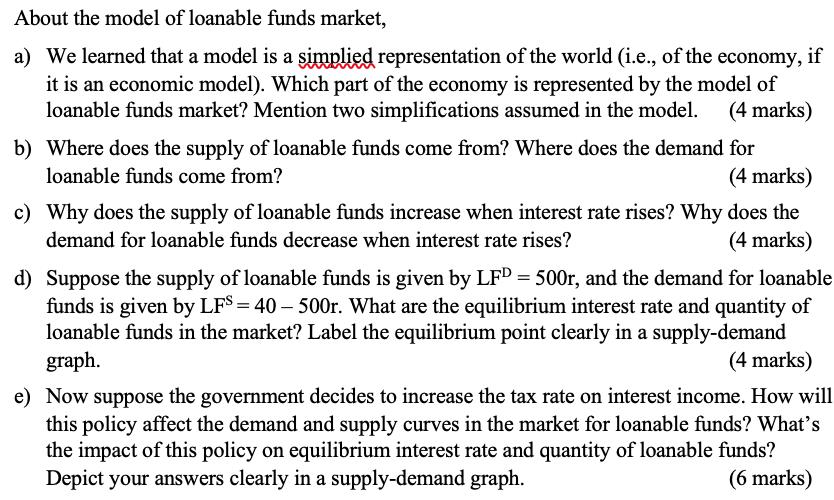

About the model of loanable funds market, a) We learned that a model is a simplied representation of the world (i.e., of the economy, if it is an economic model). Which part of the economy is represented by the model of loanable funds market? Mention two simplifications assumed in the model. (4 marks) b) Where does the supply of loanable funds come from? Where does the demand for loanable funds come from? (4 marks) c) Why does the supply of loanable funds increase when interest rate rises? Why does the demand for loanable funds decrease when interest rate rises? (4 marks) d) Suppose the supply of loanable funds is given by LFD = 500r, and the demand for loanable funds is given by LFS = 40-500r. What are the equilibrium interest rate and quantity of loanable funds in the market? Label the equilibrium point clearly in a supply-demand graph. (4 marks) e) Now suppose the government decides to increase the tax rate on interest income. How will this policy affect the demand and supply curves in the market for loanable funds? What's the impact of this policy on equilibrium interest rate and quantity of loanable funds? Depict your answers clearly in a supply-demand graph. (6 marks)

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution Choose o 1 Epro so that p XH X To and Pi XH H for i 01 Since ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started