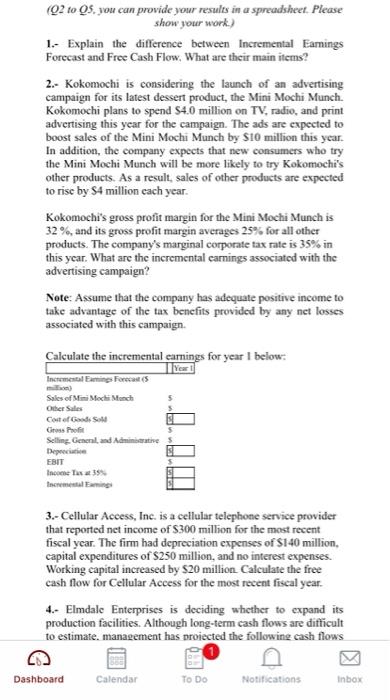

(Q2 to 5, you can provide your results in a spreadsheet. Please show your work) 1. Explain the difference between Incremental Earnings Forecast and Free Cash Flow, What are their main items? 2.- Kokomochi is considering the launch of an advertising campaign for its latest dessert product, the Mini Mochi Munch. Kokomochi plans to spend 54.0 million on TV, radio, and print advertising this year for the campaign. The ads are expected to boost sales of the Mini Mochi Munch by $10 million this year. In addition, the company expects that new consumers who try the Mini Mochi Munch will be more likely to try Kokomochi's other products. As a result, sales of other products are expected to rise by S4 million each year. Kokomochi's gross profit margin for the Mini Mochi Munch is 32%, and its gross profit margin averages 25% for all other products. The company's marginal corporate tax rate is 35% in this year. What are the incremental earnings associated with the advertising campaign? Note: Assume that the company has adequate positive income to take advantage of the tax benefits provided by any net losses associated with this campaign. Calculate the incremental earnings for year I below: Year! Incremental Exmin Forecast Sales of Mis Mechi Monch Other Sales Cost of Good Sole Gross Profit Selling Geneland Adminise Depreciate EBIT Income Tas femming 3.- Cellular Access, Inc. is a cellular telephone service provider that reported net income of S300 million for the most recent fiscal year. The firm had depreciation expenses of $140 million, capital expenditures of $250 million, and no interest expenses. Working capital increased by S20 million Calculate the free cash flow for Cellular Access for the most recent fiscal year. 4. Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows Dashboard Calendar To Do Notifications Inbox (Q2 to 5, you can provide your results in a spreadsheet. Please show your work) 1. Explain the difference between Incremental Earnings Forecast and Free Cash Flow, What are their main items? 2.- Kokomochi is considering the launch of an advertising campaign for its latest dessert product, the Mini Mochi Munch. Kokomochi plans to spend 54.0 million on TV, radio, and print advertising this year for the campaign. The ads are expected to boost sales of the Mini Mochi Munch by $10 million this year. In addition, the company expects that new consumers who try the Mini Mochi Munch will be more likely to try Kokomochi's other products. As a result, sales of other products are expected to rise by S4 million each year. Kokomochi's gross profit margin for the Mini Mochi Munch is 32%, and its gross profit margin averages 25% for all other products. The company's marginal corporate tax rate is 35% in this year. What are the incremental earnings associated with the advertising campaign? Note: Assume that the company has adequate positive income to take advantage of the tax benefits provided by any net losses associated with this campaign. Calculate the incremental earnings for year I below: Year! Incremental Exmin Forecast Sales of Mis Mechi Monch Other Sales Cost of Good Sole Gross Profit Selling Geneland Adminise Depreciate EBIT Income Tas femming 3.- Cellular Access, Inc. is a cellular telephone service provider that reported net income of S300 million for the most recent fiscal year. The firm had depreciation expenses of $140 million, capital expenditures of $250 million, and no interest expenses. Working capital increased by S20 million Calculate the free cash flow for Cellular Access for the most recent fiscal year. 4. Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows Dashboard Calendar To Do Notifications Inbox