Question

Q2. Today McDonald's (MCD) stock is trading at $163.58 per share. The price of a put option on MCD expiring in 3 months with exercise

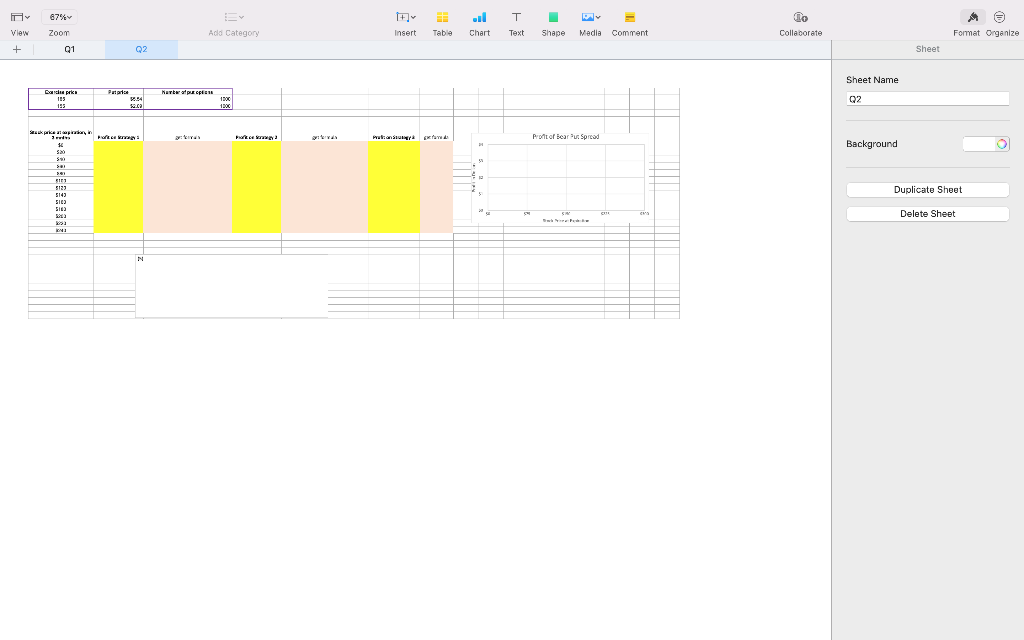

Q2. Today McDonald's (MCD) stock is trading at $163.58 per share. The price of a put option on MCD expiring in 3 months with exercise price K = $155 is $2.09 and with K =$165 is $5.54 Assume MCD stock price can take a value between $0 to $240, with increments of $20, in 3 months. Given the range of possible stock prices of MCD on expiration date, calculate the profits of the following investment strategies:

(1) Buying 1,000 put options on MCD with an exercise price of $165 (1 point)

(2) Selling 1,000 put options on MCD with an exercise price of $155 (1 point)

(3) Buying 1,000 put options on MCD with an exercise price of $165 and selling 1,000 put options on MCD with an exercise price of $155 (1 point).

(4) Plot your results from (3) with a scatter chart to display the Profit function of the strategy in (3) (1 point)

(5) What is the name of the strategy in (3)? Do you bet on a MCD price increase or decrease with this strategy? Write your answer in a textbox.

67% Hw Insert T Text lo Collaborate View Zoom Add Category Table Chart Shape Media Comment Format Organize + Q1 Q2 Sheet Sheet Name Pepe Natt E EEN Dari prika 185 195 la 130C 1200 Q2 a.ca POWER Pewa wunder g Protor Bears Sprcod Steekpresa * 320 Background sel BITI Duplicate Sheet 5143 SIL SIE Delete Sheet W KNI N 67% Hw Insert T Text lo Collaborate View Zoom Add Category Table Chart Shape Media Comment Format Organize + Q1 Q2 Sheet Sheet Name Pepe Natt E EEN Dari prika 185 195 la 130C 1200 Q2 a.ca POWER Pewa wunder g Protor Bears Sprcod Steekpresa * 320 Background sel BITI Duplicate Sheet 5143 SIL SIE Delete Sheet W KNI NStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started