Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q2 Using the balance sheet and income statement in Q1 to: 1 Create a statement of cash flow for FreshGo Co. in 2020. 2

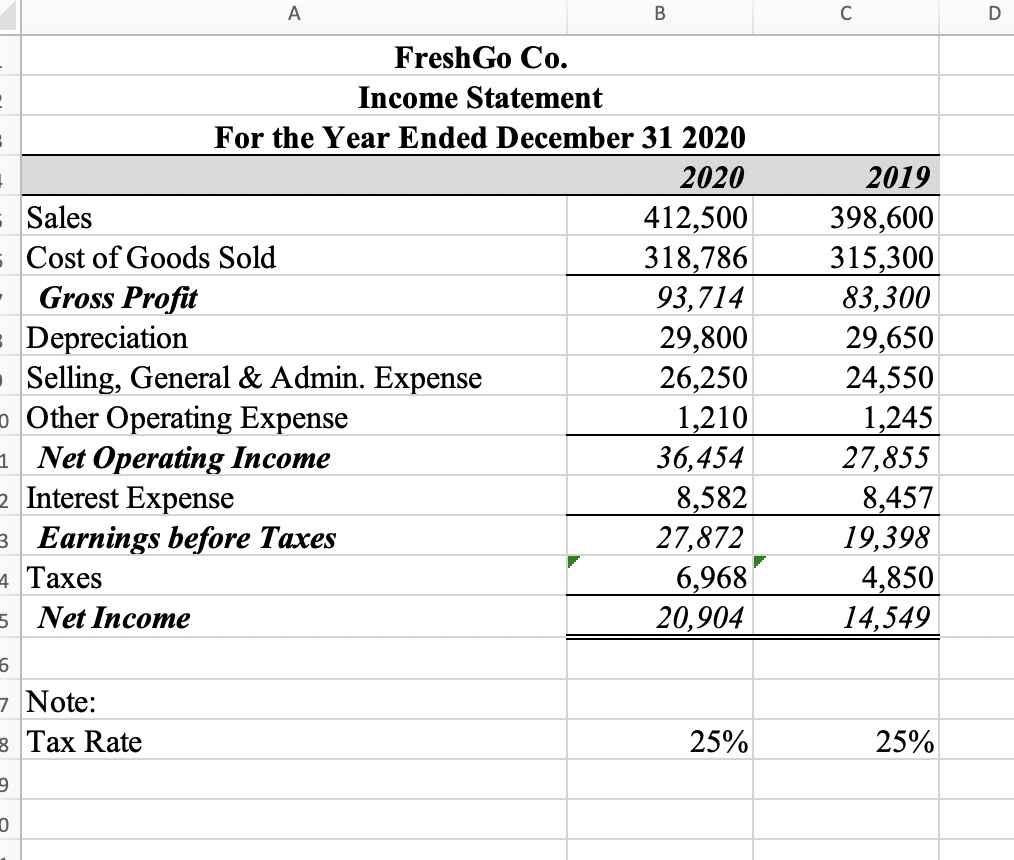

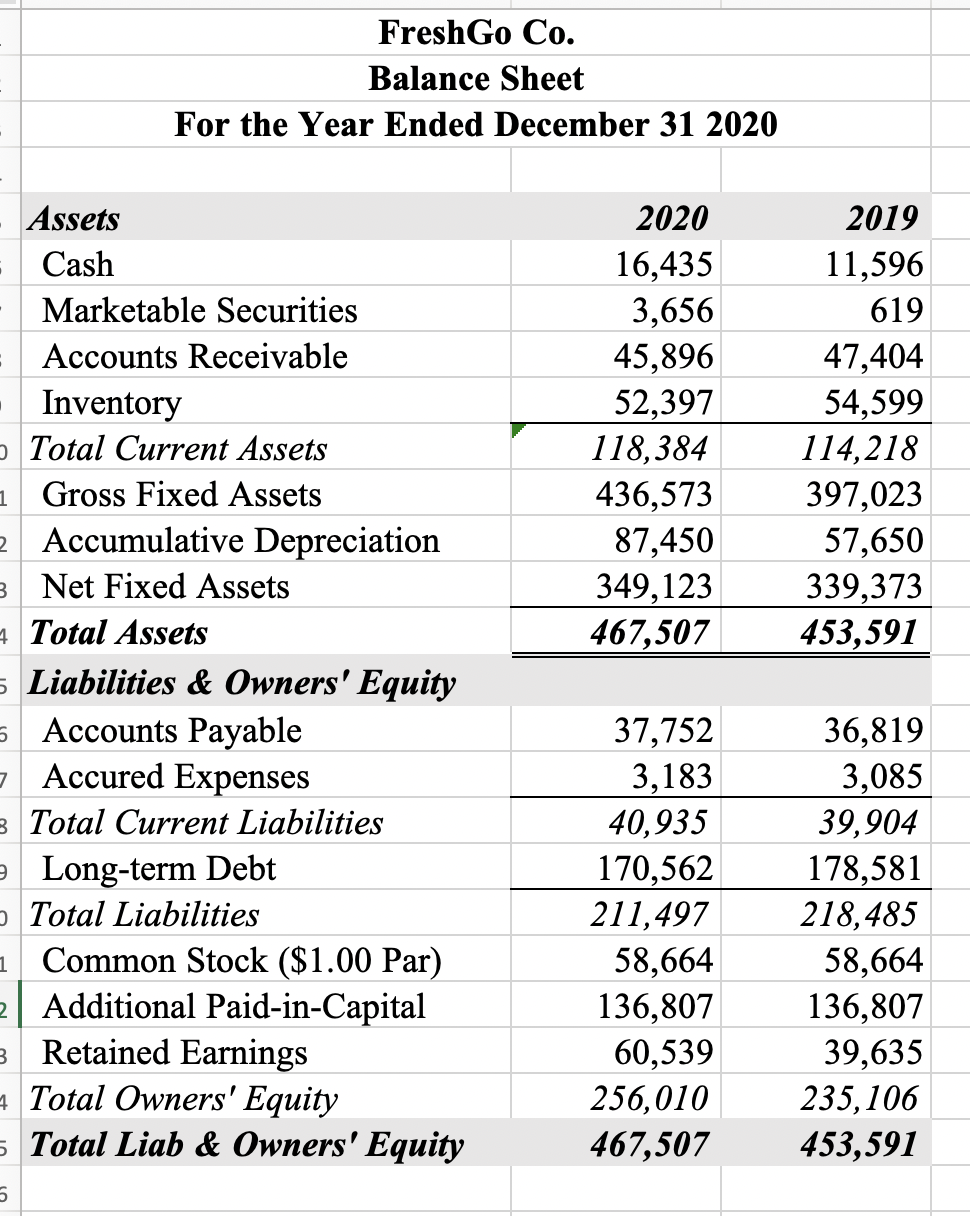

Q2 Using the balance sheet and income statement in Q1 to: 1 Create a statement of cash flow for FreshGo Co. in 2020. 2 Use formula to build this statement. Don't maually enter numbers here. Sales s Cost of Goods Sold Gross Profit A 1 2 Interest Expense For the Year Ended December 31 2020 2020 Depreciation Selling, General & Admin. Expense Other Operating Expense Net Operating Income 6 7 Note: 8 Tax Rate 9 0 FreshGo Co. Income Statement 3 Earnings before Taxes 4 Taxes 5 Net Income B 412,500 318,786 93,714 29,800 26,250 1,210 36,454 8,582 27,872 6,968 20,904 25% C 2019 398,600 315,300 83,300 29,650 24,550 1,245 27,855 8,457 19,398 4,850 14,549 25% D Assets Cash FreshGo Co. Balance Sheet For the Year Ended December 31 2020 Marketable Securities Accounts Receivable Inventory o Total Current Assets 1 Gross Fixed Assets 2 Accumulative Depreciation 3 Net Fixed Assets Total Assets 5 Liabilities & Owners' Equity 5 Accounts Payable 7 Accured Expenses 8 Total Current Liabilities Long-term Debt Total Liabilities 1 Common Stock ($1.00 Par) 2 Additional Paid-in-Capital 3 Retained Earnings Total Owners' Equity 5 Total Liab & Owners' Equity 5 2020 16,435 3,656 45,896 52,397 118,384 436,573 87,450 349,123 467,507 37,752 3,183 40,935 170,562 211,497 58,664 136,807 60,539 256,010 467,507 2019 11,596 619 47,404 54,599 114,218 397,023 57,650 339,373 453,591 36,819 3,085 39,904 178,581 218,485 58,664 136,807 39,635 235,106 453,591

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To create a statement of cash flow for FreshGo Co in 2020 we follow the standard method where cash flow is divided into three main activities operating activities investing activities and financing ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started