Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q2: What would be the price of a 4% annual coupon bond with 4 years to maturity that is callable at its $100 par value

Q2: What would be the price of a 4% annual coupon bond with 4 years to maturity that is callable at its $100 par value at any time starting 1 year from today? What is the value to the issuer of the option to call the bond?

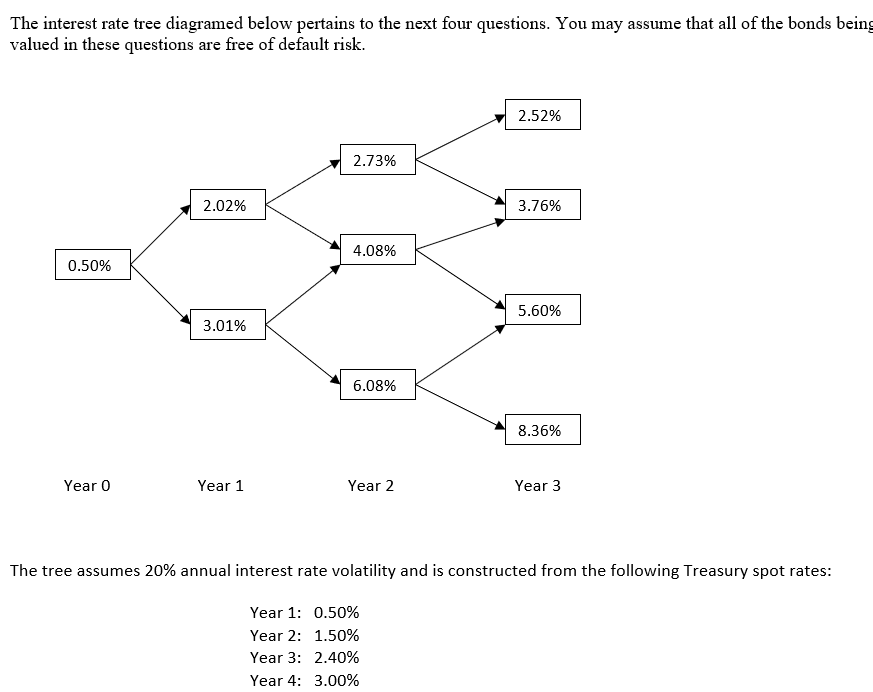

The interest rate tree diagramed below pertains to the next four questions. You may assume that all of the bonds being valued in these questions are free of default risk. 2.52% 2.73% 2.02% 3.76% 4.08% 0.50% 5.60% 3.01% 6.08% 8.36% Year o Year 1 Year 2 Year 3 The tree assumes 20% annual interest rate volatility and is constructed from the following Treasury spot rates: Year 1: 0.50% Year 2: 1.50% Year 3: 2.40% Year 4: 3.00% The interest rate tree diagramed below pertains to the next four questions. You may assume that all of the bonds being valued in these questions are free of default risk. 2.52% 2.73% 2.02% 3.76% 4.08% 0.50% 5.60% 3.01% 6.08% 8.36% Year o Year 1 Year 2 Year 3 The tree assumes 20% annual interest rate volatility and is constructed from the following Treasury spot rates: Year 1: 0.50% Year 2: 1.50% Year 3: 2.40% Year 4: 3.00%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started