Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q2: Yield curve, forward rate, bond pricing There are three parts in this question, you are expected to answer all of them. You observe the

Q2: Yield curve, forward rate, bond pricing

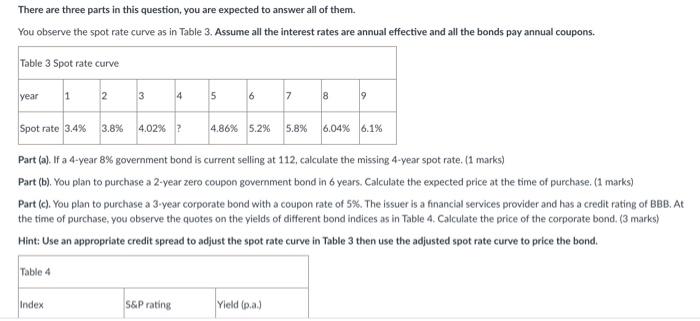

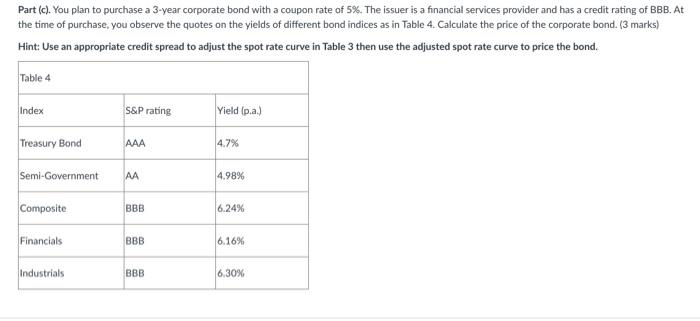

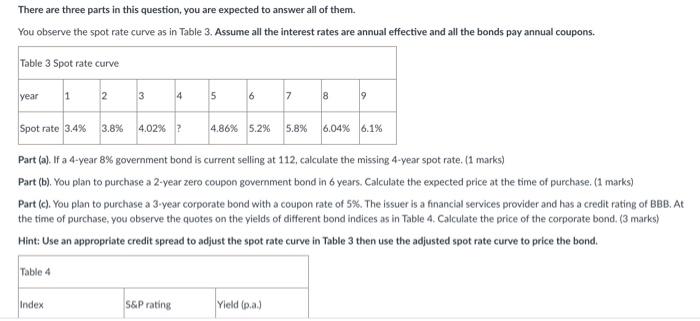

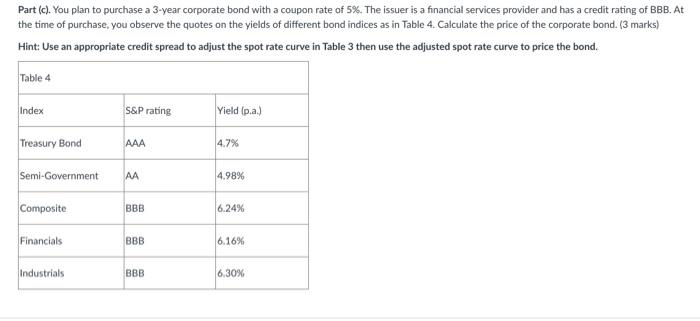

There are three parts in this question, you are expected to answer all of them. You observe the spot rate curve as in Table 3. Assume all the interest rates are annual effective and all the bonds pay annual coupons. Table 3 Spot rate curve year 1 2 3 4 5 6 7 8 9 Spot rate 3.4% 3.8% 4.02% 4.86% 5.2% 5.8% 6.04% 6.1% Part (a). If a 4-year 8% government bond is current selling at 112, calculate the missing 4-year spot rate. (1 marks) Part (b). You plan to purchase a 2-year zero coupon government bond in 6 years. Calculate the expected price at the time of purchase. (1 marks) Part (c). You plan to purchase a 3-year corporate bond with a coupon rate of 5%. The issuer is a financial services provider and has a credit rating of BBB. At the time of purchase, you observe the quotes on the yields of different bond indices as in Table 4. Calculate the price of the corporate bond. (3 marks) Hint: Use an appropriate credit spread to adjust the spot rate curve in Table 3 then use the adjusted spot rate curve to price the bond. Table 4 Index S&P rating Yield (p.a.) Part (c). You plan to purchase a 3-year corporate bond with a coupon rate of 5%. The issuer is a financial services provider and has a credit rating of BBB. At the time of purchase, you observe the quotes on the yields of different bond indices as in Table 4. Calculate the price of the corporate bond. (3 marks) Hint: Use an appropriate credit spread to adjust the spot rate curve in Table 3 then use the adjusted spot rate curve to price the bond. Table 4 Index S&P rating Yield (p.a.) Treasury Bond AAA 4.7% Semi-Government AA 4.98% Composite BBB 6.24% Financials BBB 6.16% Industrials BBB 6.30%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started