Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q2 You enter 20 short gold futures contracts at the end of day 1 (at the settlement price for that day). You close out

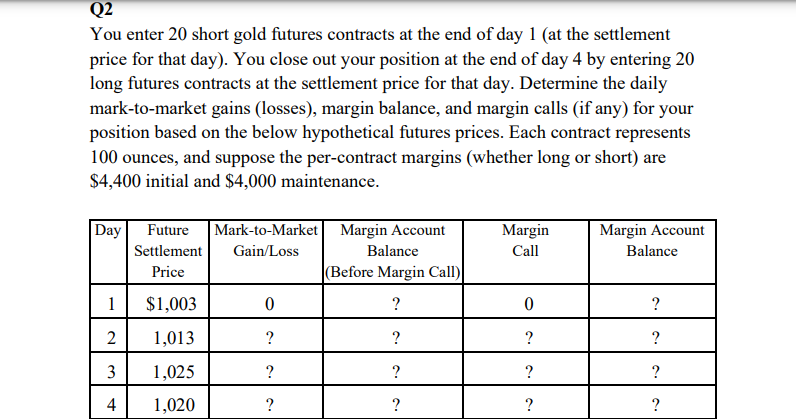

Q2 You enter 20 short gold futures contracts at the end of day 1 (at the settlement price for that day). You close out your position at the end of day 4 by entering 20 long futures contracts at the settlement price for that day. Determine the daily mark-to-market gains (losses), margin balance, and margin calls (if any) for your position based on the below hypothetical futures prices. Each contract represents 100 ounces, and suppose the per-contract margins (whether long or short) are $4,400 initial and $4,000 maintenance. Day Future Mark-to-Market Settlement Gain/Loss Margin Account Balance Margin Call Margin Account Balance Price (Before Margin Call) 1 $1,003 0 ? 0 ? 2 1,013 ? ? ? ? 3 1,025 ? ? ? ? 4 1,020 ? ? ? ?

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the daily marktomarket gains losses margin balance and margin calls if any for the posi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started