Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q20: Company ABC enters a 50 million notional principal interest rate swap. The swap requires ABC to pay a fixed rate and receive a floating

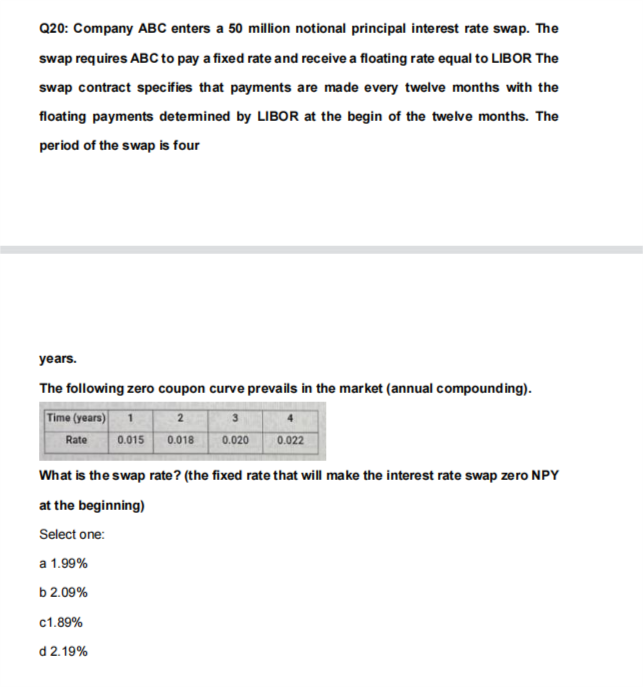

Q20: Company ABC enters a 50 million notional principal interest rate swap. The swap requires ABC to pay a fixed rate and receive a floating rate equal to LIBOR The swap contract specifies that payments are made every twelve months with the floating payments detemined by LIBOR at the begin of the twelve months. The period of the swap is four years. The following zero coupon curve prevails in the market (annual compounding). What is the swap rate? (the fixed rate that will make the interest rate swap zero NPY at the beginning) Select one: a 1.99% b 2.09% c1. 89% d 2.19%

Q20: Company ABC enters a 50 million notional principal interest rate swap. The swap requires ABC to pay a fixed rate and receive a floating rate equal to LIBOR The swap contract specifies that payments are made every twelve months with the floating payments detemined by LIBOR at the begin of the twelve months. The period of the swap is four years. The following zero coupon curve prevails in the market (annual compounding). What is the swap rate? (the fixed rate that will make the interest rate swap zero NPY at the beginning) Select one: a 1.99% b 2.09% c1. 89% d 2.19% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started