Q.2.1 Calculate both the basic and the diluted earnings for the year ended 31 December 2020. Comparatives do not have to be provided.

Q.2.2 Rank the dilutive instruments and provide the antidilutive test for the year ended 31 December 2020. (Show all workings)

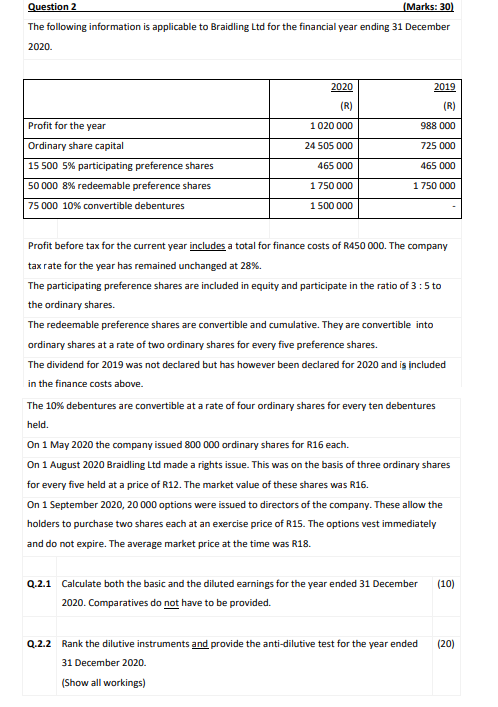

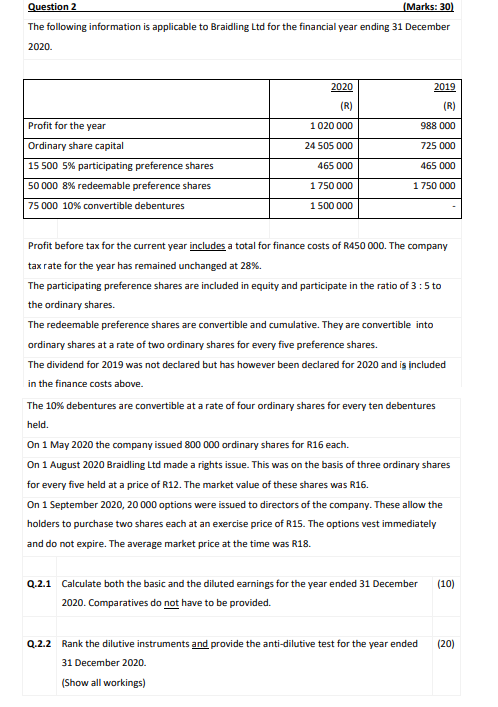

Question 2 (Marks: 30) The following information is applicable to Braidling Ltd for the financial year ending 31 December 2020. 2020 2019 (R) (R) Profit for the year 1 020 000 988 000 24 505 000 725 000 465 000 465 000 Ordinary share capital 15 500 5% participating preference shares 50 000 8% redeemable preference shares 75 000 10% convertible debentures 1 750 000 1 750 000 1 500 000 Profit before tax for the current year includes a total for finance costs of R450 000. The company tax rate for the year has remained unchanged at 28%. The participating preference shares are included in equity and participate in the ratio of 3 :5 to the ordinary shares. The redeemable preference shares are convertible and cumulative. They are convertible into ordinary shares at a rate of two ordinary shares for every five preference shares. The dividend for 2019 was not declared but has however been declared for 2020 and is included in the finance costs above. The 10% debentures are convertible at a rate of four ordinary shares for every ten debentures held. On 1 May 2020 the company issued 800 000 ordinary shares for R16 each. On 1 August 2020 Braidling Ltd made a rights issue. This was on the basis of three ordinary shares for every five held at a price of R12. The market value of these shares was R16. On 1 September 2020, 20 000 options were issued to directors of the company. These allow the holders to purchase two shares each at an exercise price of R15. The options vest immediately and do not expire. The average market price at the time was R18. (10) Q.2.1 Calculate both the basic and the diluted earnings for the year ended 31 December 2020. Comparatives do not have to be provided. (20) Q.2.2 Rank the dilutive instruments and provide the anti-dilutive test for the year ended 31 December 2020. (Show all workings) Question 2 (Marks: 30) The following information is applicable to Braidling Ltd for the financial year ending 31 December 2020. 2020 2019 (R) (R) Profit for the year 1 020 000 988 000 24 505 000 725 000 465 000 465 000 Ordinary share capital 15 500 5% participating preference shares 50 000 8% redeemable preference shares 75 000 10% convertible debentures 1 750 000 1 750 000 1 500 000 Profit before tax for the current year includes a total for finance costs of R450 000. The company tax rate for the year has remained unchanged at 28%. The participating preference shares are included in equity and participate in the ratio of 3 :5 to the ordinary shares. The redeemable preference shares are convertible and cumulative. They are convertible into ordinary shares at a rate of two ordinary shares for every five preference shares. The dividend for 2019 was not declared but has however been declared for 2020 and is included in the finance costs above. The 10% debentures are convertible at a rate of four ordinary shares for every ten debentures held. On 1 May 2020 the company issued 800 000 ordinary shares for R16 each. On 1 August 2020 Braidling Ltd made a rights issue. This was on the basis of three ordinary shares for every five held at a price of R12. The market value of these shares was R16. On 1 September 2020, 20 000 options were issued to directors of the company. These allow the holders to purchase two shares each at an exercise price of R15. The options vest immediately and do not expire. The average market price at the time was R18. (10) Q.2.1 Calculate both the basic and the diluted earnings for the year ended 31 December 2020. Comparatives do not have to be provided. (20) Q.2.2 Rank the dilutive instruments and provide the anti-dilutive test for the year ended 31 December 2020. (Show all workings)