Answered step by step

Verified Expert Solution

Question

1 Approved Answer

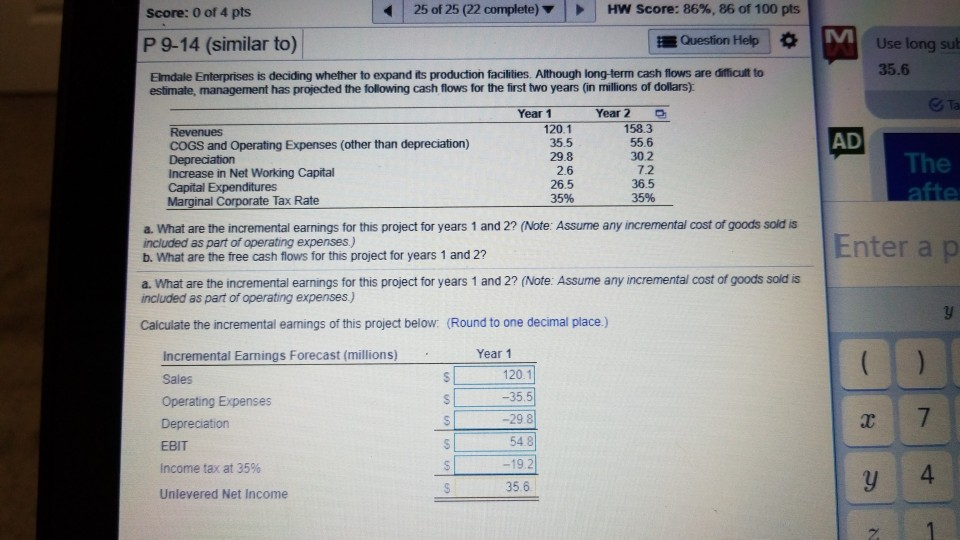

Q25. please fix this and solve for both a. and b. 25 of 25 (22 complete) HW Score: 86%, 86 of 100 pts Score: 0

Q25.

please fix this and solve for both a. and b.

25 of 25 (22 complete) HW Score: 86%, 86 of 100 pts Score: 0 of 4 pts P 9-14 (similar to) Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to Question Help * Use long sub 35.6 estimate, management has projected the following cash flows for the first two years (in millions of dollars) Ta Year 1 Year 2 120.1 35.5 29.8 2.6 26.5 35% 158.3 55.6 30.2 7.2 36.5 35% AD COGS and Operating Expenses (other than depreciation) Increase in Net Working Capital Capital Expenditures The afte Marginal Corporate Tax Rate a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses) b. What are the free cash flows for this project for years 1 and 2? Enter a p a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses) Calculate the incremental eamings of this project below (Round to one decimal place) Year 1 Incremental Earnings Forecast (millions) Sales Operating Expenses Depreciation EBIT Income tax at 35% Unlevered Net Income 120.1 -35.5 -29.8 54.8 -19.2 35.6 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started