Answered step by step

Verified Expert Solution

Question

1 Approved Answer

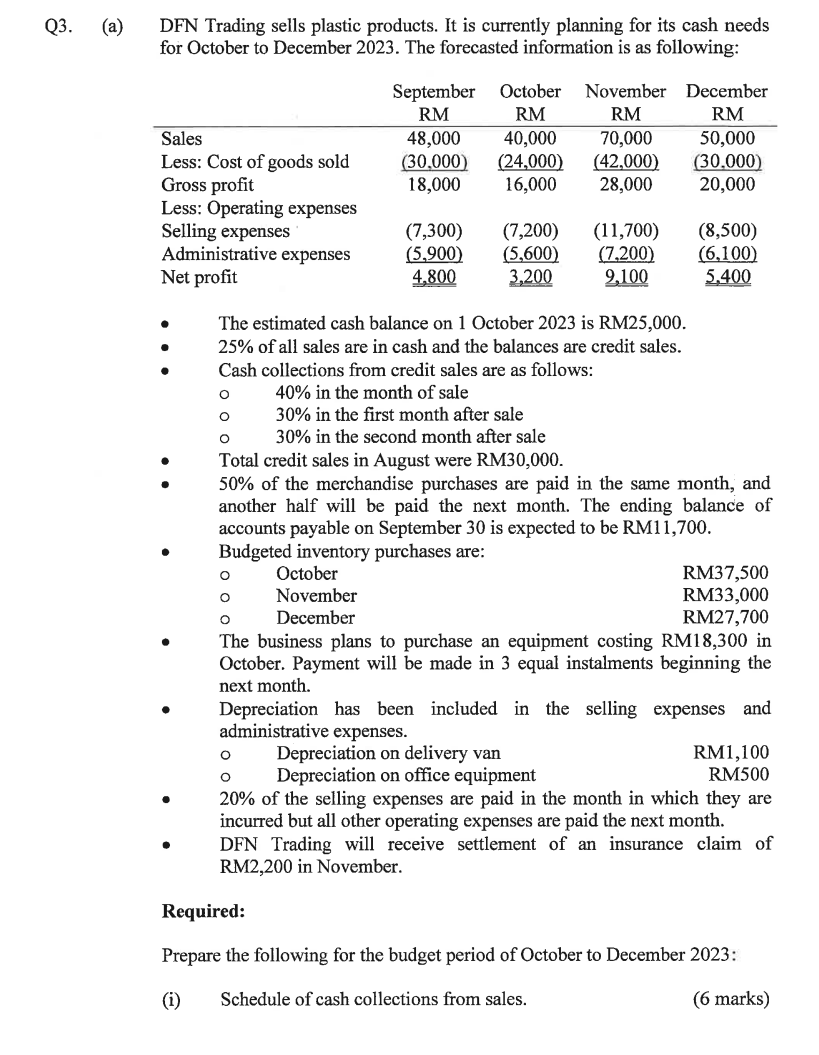

Q3. (a) DFN Trading sells plastic products. It is currently planning for its cash needs for October to December 2023. The forecasted information is

Q3. (a) DFN Trading sells plastic products. It is currently planning for its cash needs for October to December 2023. The forecasted information is as following: September October November December RM RM RM RM Sales 48,000 40,000 70,000 50,000 Less: Cost of goods sold (30,000) (24,000) (42,000) (30.000) Gross profit 18,000 16,000 28,000 20,000 Less: Operating expenses Selling expenses (7,300) (7,200) (11,700) (8,500) Administrative expenses (5,900) (5,600) (7,200) (6,100) Net profit 4,800 3,200 2,100 5.400 : . The estimated cash balance on 1 October 2023 is RM25,000. 25% of all sales are in cash and the balances are credit sales. Cash collections from credit sales are as follows: 40% in the month of sale 30% in the first month after sale 30% in the second month after sale Total credit sales in August were RM30,000. 50% of the merchandise purchases are paid in the same month, and another half will be paid the next month. The ending balance of accounts payable on September 30 is expected to be RM11,700. Budgeted inventory purchases are: October November December RM37,500 RM33,000 RM27,700 The business plans to purchase an equipment costing RM18,300 in October. Payment will be made in 3 equal instalments beginning the next month. Depreciation has been included in the selling expenses and administrative expenses. Depreciation on delivery van Depreciation on office equipment RM1,100 RM500 20% of the selling expenses are paid in the month in which they are incurred but all other operating expenses are paid the next month. DFN Trading will receive settlement of an insurance claim of RM2,200 in November. Required: Prepare the following for the budget period of October to December 2023: (i) Schedule of cash collections from sales. (6 marks) (ii) Schedule of cash payments for purchases. (3 marks) (iii) Schedule of cash payments for selling expenses. (3 marks) (iv) Cash budget. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started