Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q3. ABC Ltd is an exporter of mobile phones to Switzerland. The company has contracted to sell 5,000 mechanisms at a unit price of 20

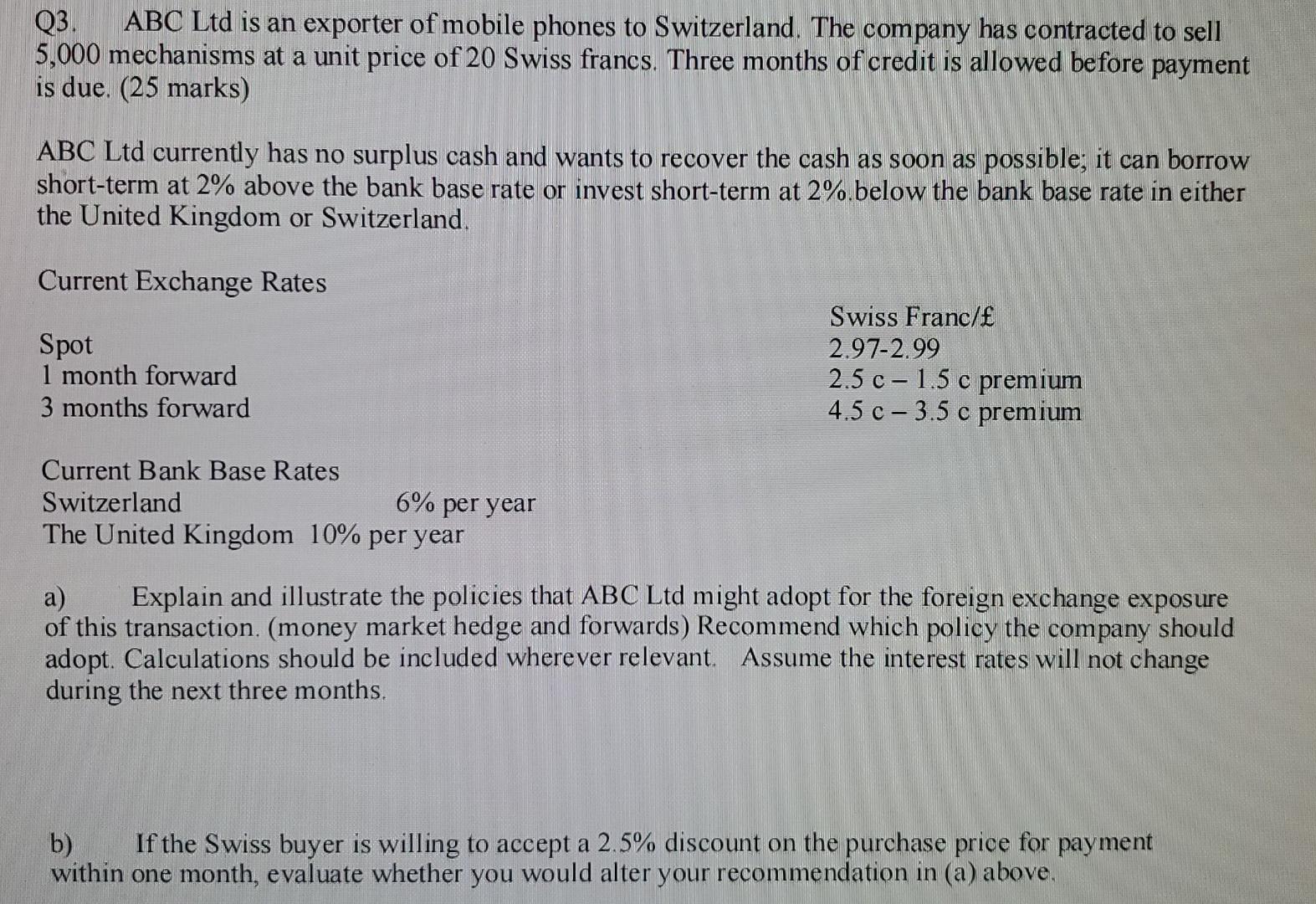

Q3. ABC Ltd is an exporter of mobile phones to Switzerland. The company has contracted to sell 5,000 mechanisms at a unit price of 20 Swiss francs. Three months of credit is allowed before payment is due. (25 marks) ABC Ltd currently has no surplus cash and wants to recover the cash as soon as possible; it can borrow short-term at 2% above the bank base rate or invest short-term at 2%.below the bank base rate in either the United Kingdom or Switzerland. Current Exchange Rates Spot 1 month forward 3 months forward Current Bank Base Rates Switzerland The United Kingdom 10% per year 6% per year Swiss Franc/ 2.97-2.99 2.5 c 1.5 c premium 4.5 c-3.5 c premium a) Explain and illustrate the policies that ABC Ltd might adopt for the foreign exchange exposure of this transaction. (money market hedge and forwards) Recommend which policy the company should adopt. Calculations should be included wherever relevant. Assume the interest rates will not change during the next three months. b) If the Swiss buyer is willing to accept a 2.5% discount on the purchase price for payment within one month, evaluate whether you would alter your recommendation in (a) above. Q3. ABC Ltd is an exporter of mobile phones to Switzerland. The company has contracted to sell 5,000 mechanisms at a unit price of 20 Swiss francs. Three months of credit is allowed before payment is due. (25 marks) ABC Ltd currently has no surplus cash and wants to recover the cash as soon as possible; it can borrow short-term at 2% above the bank base rate or invest short-term at 2%.below the bank base rate in either the United Kingdom or Switzerland. Current Exchange Rates Spot 1 month forward 3 months forward Current Bank Base Rates Switzerland The United Kingdom 10% per year 6% per year Swiss Franc/ 2.97-2.99 2.5 c 1.5 c premium 4.5 c-3.5 c premium a) Explain and illustrate the policies that ABC Ltd might adopt for the foreign exchange exposure of this transaction. (money market hedge and forwards) Recommend which policy the company should adopt. Calculations should be included wherever relevant. Assume the interest rates will not change during the next three months. b) If the Swiss buyer is willing to accept a 2.5% discount on the purchase price for payment within one month, evaluate whether you would alter your recommendation in (a) above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started