Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q3. ABC steel plant industry plans to manufacture a product. The product needs a special component. The industry has reviewed that the special component

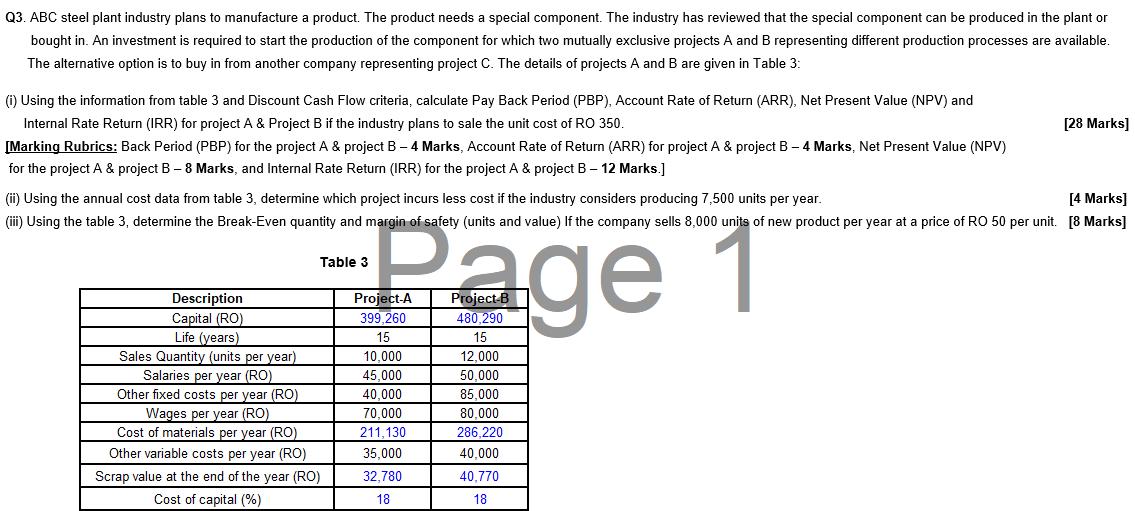

Q3. ABC steel plant industry plans to manufacture a product. The product needs a special component. The industry has reviewed that the special component can be produced in the plant or bought in. An investment is required to start the production of the component for which two mutually exclusive projects A and B representing different production processes are available. The alternative option is to buy in from another company representing project C. The details of projects A and B are given in Table 3: (i) Using the information from table 3 and Discount Cash Flow criteria, calculate Pay Back Period (PBP), Account Rate of Return (ARR), Net Present Value (NPV) and Internal Rate Return (IRR) for project A & Project B if the industry plans to sale the unit cost of RO 350. [Marking Rubrics: Back Period (PBP) for the project A & project B - 4 Marks, Account Rate of Return (ARR) for project A & project B - 4 Marks, Net Present Value (NPV) for the project A & project B - 8 Marks, and Internal Rate Return (IRR) for the project A & project B - 12 Marks.] (ii) Using the annual cost data from table 3, determine which project incurs less cost if the industry considers producing 7,500 units per year. [28 Marks] [4 Marks] (iii) Using the table 3, determine the Break-Even quantity and margin of safety (units and value) If the company sells 8,000 units of new product per year at a price of RO 50 per unit. [8 Marks] Page 1 Table 3 Description Capital (RO) Project-A Project-B 399,260 480,290 Life (years) 15 15 Sales Quantity (units per year) 10,000 12,000 Salaries per year (RO) 45,000 50,000 Other fixed costs per year (RO) Wages per year (RO) 40,000 85,000 70,000 80,000 Cost of materials per year (RO) Other variable costs per year (RO) 211,130 286,220 35,000 40,000 Scrap value at the end of the year (RO) Cost of capital (%) 32,780 40,770 18 18

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started