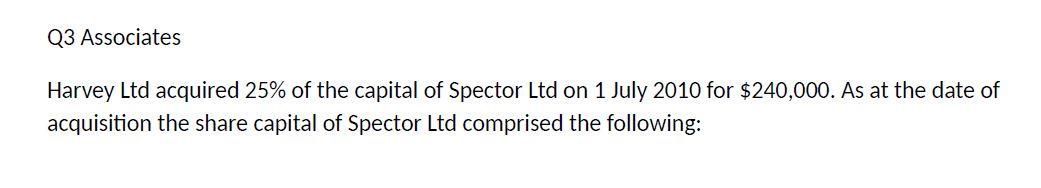

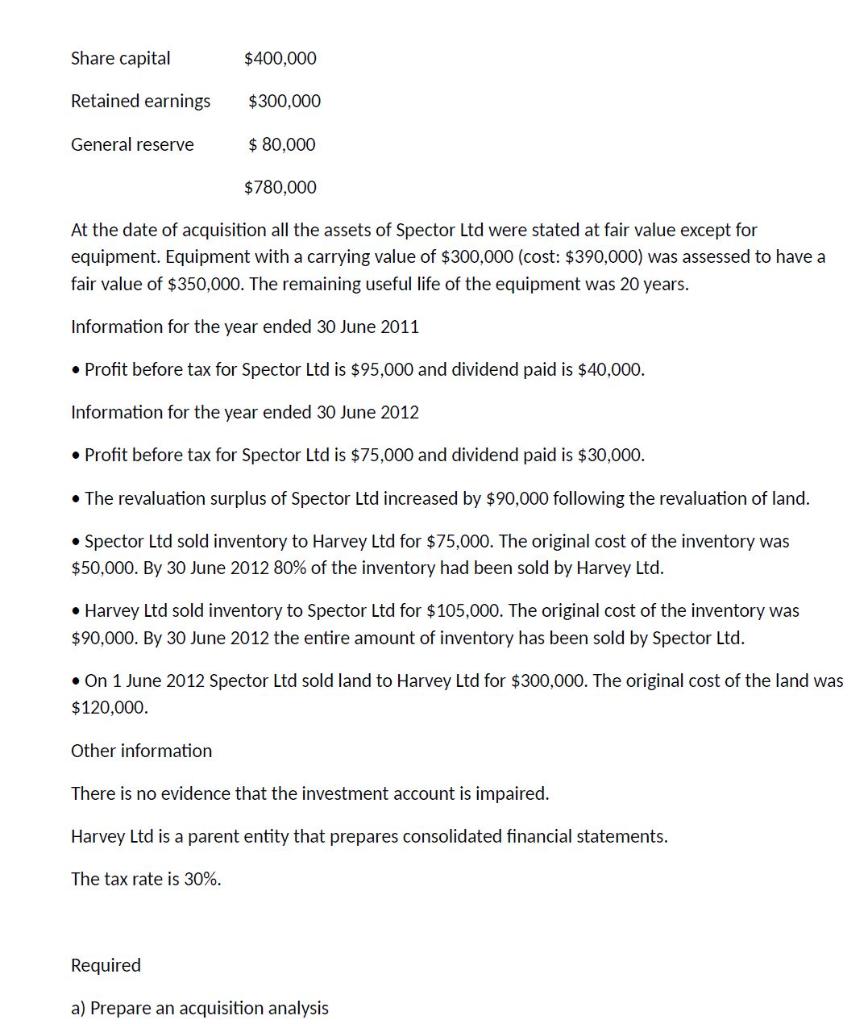

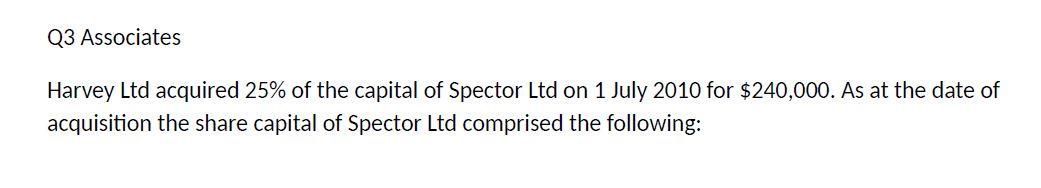

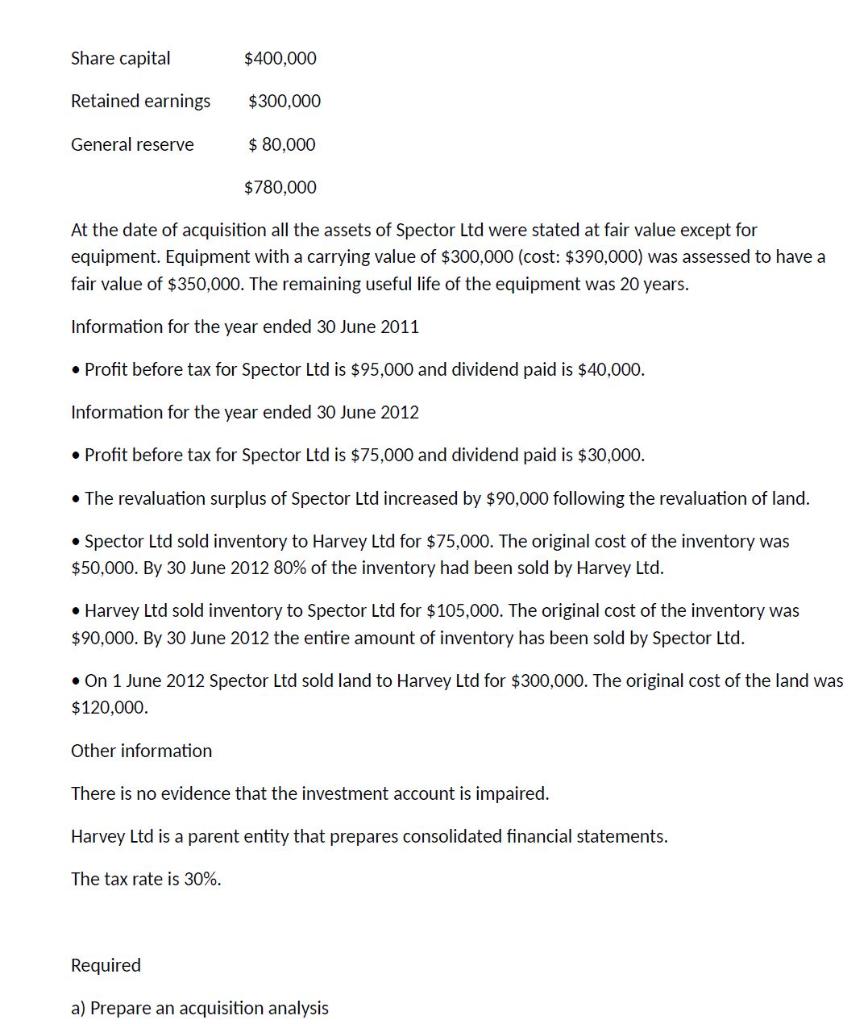

Q3 Associates Harvey Ltd acquired 25\% of the capital of Spector Ltd on 1 July 2010 for $240,000. As at the date of acquisition the share capital of Spector Ltd comprised the following: At the date of acquisition all the assets of Spector Ltd were stated at fair value except for equipment. Equipment with a carrying value of $300,000 (cost: $390,000 ) was assessed to have a fair value of $350,000. The remaining useful life of the equipment was 20 years. Information for the year ended 30 June 2011 - Profit before tax for Spector Ltd is $95,000 and dividend paid is $40,000. Information for the year ended 30 June 2012 - Profit before tax for Spector Ltd is $75,000 and dividend paid is $30,000. - The revaluation surplus of Spector Ltd increased by $90,000 following the revaluation of land. - Spector Ltd sold inventory to Harvey Ltd for $75,000. The original cost of the inventory was $50,000. By 30 June 201280% of the inventory had been sold by Harvey Ltd. - Harvey Ltd sold inventory to Spector Ltd for $105,000. The original cost of the inventory was $90,000. By 30 June 2012 the entire amount of inventory has been sold by Spector Ltd. - On 1 June 2012 Spector Ltd sold land to Harvey Ltd for $300,000. The original cost of the land was $120,000. Other information There is no evidence that the investment account is impaired. Harvey Ltd is a parent entity that prepares consolidated financial statements. The tax rate is 30%. Required b) Provide the equity accounting entries recorded by Harvey Ltd on consolidation for the investment in Spector Ltd for the 2011 and 2012 financial years. Q3 Associates Harvey Ltd acquired 25\% of the capital of Spector Ltd on 1 July 2010 for $240,000. As at the date of acquisition the share capital of Spector Ltd comprised the following: At the date of acquisition all the assets of Spector Ltd were stated at fair value except for equipment. Equipment with a carrying value of $300,000 (cost: $390,000 ) was assessed to have a fair value of $350,000. The remaining useful life of the equipment was 20 years. Information for the year ended 30 June 2011 - Profit before tax for Spector Ltd is $95,000 and dividend paid is $40,000. Information for the year ended 30 June 2012 - Profit before tax for Spector Ltd is $75,000 and dividend paid is $30,000. - The revaluation surplus of Spector Ltd increased by $90,000 following the revaluation of land. - Spector Ltd sold inventory to Harvey Ltd for $75,000. The original cost of the inventory was $50,000. By 30 June 201280% of the inventory had been sold by Harvey Ltd. - Harvey Ltd sold inventory to Spector Ltd for $105,000. The original cost of the inventory was $90,000. By 30 June 2012 the entire amount of inventory has been sold by Spector Ltd. - On 1 June 2012 Spector Ltd sold land to Harvey Ltd for $300,000. The original cost of the land was $120,000. Other information There is no evidence that the investment account is impaired. Harvey Ltd is a parent entity that prepares consolidated financial statements. The tax rate is 30%. Required b) Provide the equity accounting entries recorded by Harvey Ltd on consolidation for the investment in Spector Ltd for the 2011 and 2012 financial years