Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q3 Best Flat TVs Plc manufactures three types of televisions models: LCD which sells for 200; Plasma which sells for 320; and LED which sells

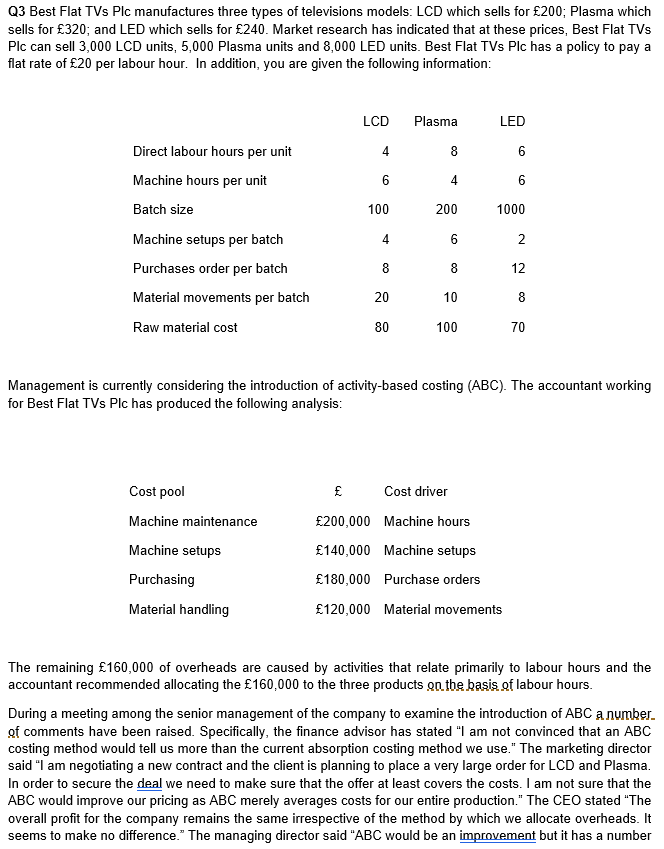

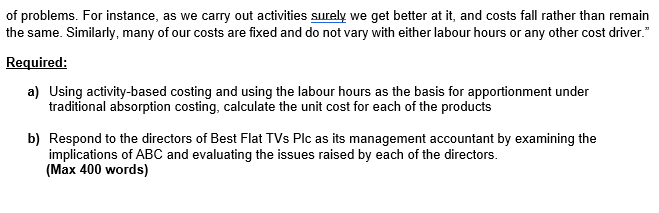

Q3 Best Flat TVs Plc manufactures three types of televisions models: LCD which sells for 200; Plasma which sells for 320; and LED which sells for 240. Market research has indicated that at these prices, Best Flat TVs Plc can sell 3,000 LCD units, 5,000 Plasma units and 8,000 LED units. Best Flat TVs Plc has a policy to pay a flat rate of 20 per labour hour. In addition, you are given the following information: LCD Plasma LED 4 8 6 Direct labour hours per unit Machine hours per unit Batch size 6 4 6 100 200 1000 4 6 2 8 8 12 Machine setups per batch Purchases order per batch Material movements per batch Raw material cost 20 10 8 80 100 70 Management is currently considering the introduction of activity-based costing (ABC). The accountant working for Best Flat TVs Plc has produced the following analysis: Cost driver 200,000 Machine hours Cost pool Machine maintenance Machine setups Purchasing Material handling 140,000 Machine setups 180,000 Purchase orders 120,000 Material movements The remaining 160,000 of overheads are caused by activities that relate primarily to labour hours and the accountant recommended allocating the 160,000 to the three products on the basis of labour hours. During a meeting among the senior management of the company to examine the introduction of ABC a number. of comments have been raised. Specifically, the finance advisor has stated "I am not convinced that an ABC costing method would tell us more than the current absorption costing method we use." The marketing director said "I am negotiating a new contract and the client is planning to place a very large order for LCD and Plasma. In order to secure the deal we need to make sure that the offer at least covers the costs. I am not sure that the ABC would improve our pricing as ABC merely averages costs for our entire production." The CEO stated "The overall profit for the company remains the same irrespective of the method by which we allocate overheads. It seems to make no difference." The managing director said "ABC would be an improvement but it has a number of problems. For instance, as we carry out activities surely we get better at it, and costs fall rather than remain the same. Similarly, many of our costs are fixed and do not vary with either labour hours or any other cost driver." Required: a) Using activity-based costing and using the labour hours as the basis for apportionment under traditional absorption costing, calculate the unit cost for each of the products b) Respond to the directors of Best Flat TVs Plc as its management accountant by examining the implications of ABC and evaluating the issues raised by each of the directors. (Max 400 words) Q3 Best Flat TVs Plc manufactures three types of televisions models: LCD which sells for 200; Plasma which sells for 320; and LED which sells for 240. Market research has indicated that at these prices, Best Flat TVs Plc can sell 3,000 LCD units, 5,000 Plasma units and 8,000 LED units. Best Flat TVs Plc has a policy to pay a flat rate of 20 per labour hour. In addition, you are given the following information: LCD Plasma LED 4 8 6 Direct labour hours per unit Machine hours per unit Batch size 6 4 6 100 200 1000 4 6 2 8 8 12 Machine setups per batch Purchases order per batch Material movements per batch Raw material cost 20 10 8 80 100 70 Management is currently considering the introduction of activity-based costing (ABC). The accountant working for Best Flat TVs Plc has produced the following analysis: Cost driver 200,000 Machine hours Cost pool Machine maintenance Machine setups Purchasing Material handling 140,000 Machine setups 180,000 Purchase orders 120,000 Material movements The remaining 160,000 of overheads are caused by activities that relate primarily to labour hours and the accountant recommended allocating the 160,000 to the three products on the basis of labour hours. During a meeting among the senior management of the company to examine the introduction of ABC a number. of comments have been raised. Specifically, the finance advisor has stated "I am not convinced that an ABC costing method would tell us more than the current absorption costing method we use." The marketing director said "I am negotiating a new contract and the client is planning to place a very large order for LCD and Plasma. In order to secure the deal we need to make sure that the offer at least covers the costs. I am not sure that the ABC would improve our pricing as ABC merely averages costs for our entire production." The CEO stated "The overall profit for the company remains the same irrespective of the method by which we allocate overheads. It seems to make no difference." The managing director said "ABC would be an improvement but it has a number of problems. For instance, as we carry out activities surely we get better at it, and costs fall rather than remain the same. Similarly, many of our costs are fixed and do not vary with either labour hours or any other cost driver." Required: a) Using activity-based costing and using the labour hours as the basis for apportionment under traditional absorption costing, calculate the unit cost for each of the products b) Respond to the directors of Best Flat TVs Plc as its management accountant by examining the implications of ABC and evaluating the issues raised by each of the directors. (Max 400 words)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started