Question

Q3) Consider a four-month European call option on the British pound. Suppose that the current spot exchange rate is 1.60 USD per 1 GBP

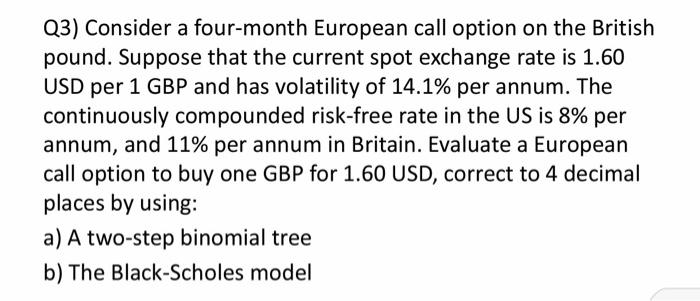

Q3) Consider a four-month European call option on the British pound. Suppose that the current spot exchange rate is 1.60 USD per 1 GBP and has volatility of 14.1% per annum. The continuously compounded risk-free rate in the US is 8% per annum, and 11% per annum in Britain. Evaluate a European call option to buy one GBP for 1.60 USD, correct to 4 decimal places by using: a) A two-step binomial tree b) The Black-Scholes model

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

u 10238 d 09768 R 09950 p 03880 Suu Cuu 1 p 06120 1677...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Finance Putting Theory Into Practice

Authors: Piet Sercu

1st edition

069113667X, 978-0691136677

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App