Question

Q3. Consider the CEO of Zeus Engineering who knows very well how to use the Bloomberg Terminals and download the most contemporary data in the

Q3.

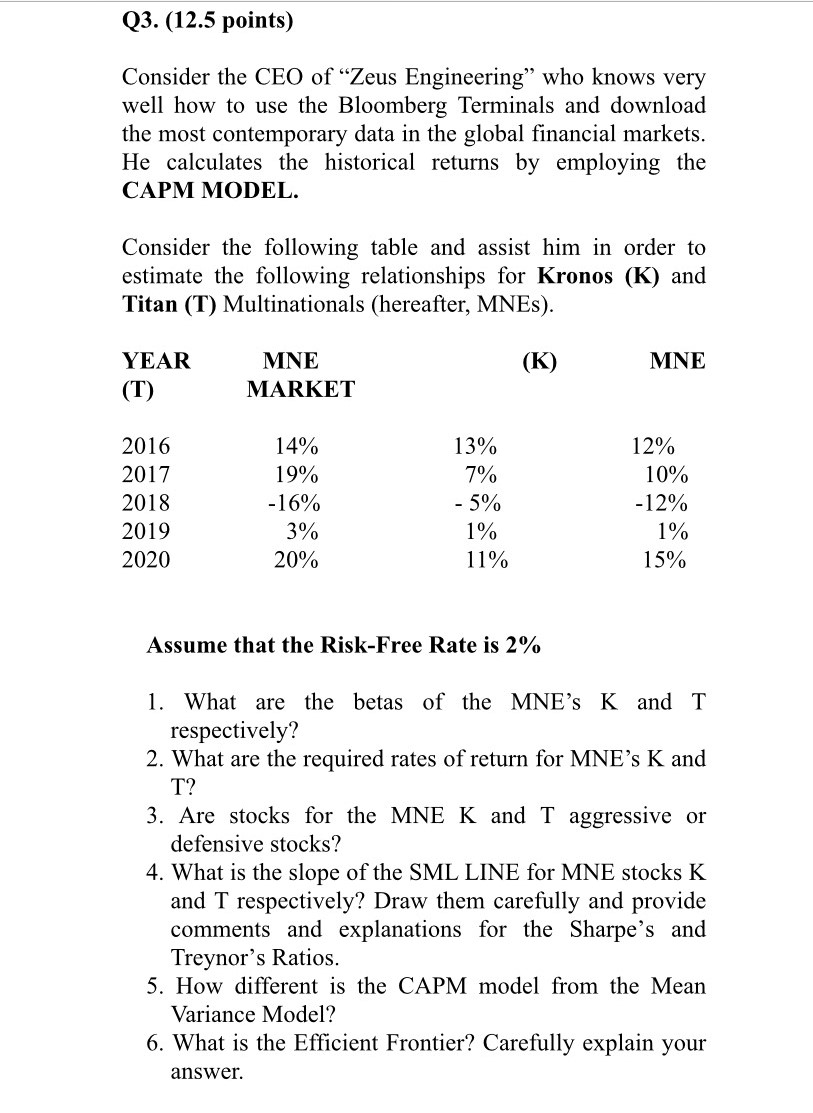

Consider the CEO of Zeus Engineering who knows very well how to use the Bloomberg Terminals and download the most contemporary data in the global financial markets. He calculates the historical returns by employing the CAPM MODEL.

Consider the following table and assist him in order to estimate the following relationships for Kronos (K) and Titan (T) Multinationals (hereafter, MNEs).

YEARMNE (K)MNE (T)MARKET

2016 14%13% 12%

2017 19% 7% 10%

2018-16%- 5%-12%

2019 3% 1% 1%

2020 20%11% 15%

Assume that the Risk-Free Rate is 2%

1. What are the betas of the MNEs K and T respectively?

2. What are the required rates of return for MNEs K and T?

3. Are stocks for the MNE K and T aggressi ve or defensive stocks?

ve or defensive stocks?

4. What is the slope of the SML LINE for MNE stocks K and T respectively? Draw them carefully and provide comments and explanations for the Sharpes and Treynors Ratios.

5. How different is the CAPM model from the Mean Variance Model?

6. What is the Efficient Frontier? Carefully explain your answer.

please answer this Q thank you so much

Q3. (12.5 points) Consider the CEO of Zeus Engineering" who knows very well how to use the Bloomberg Terminals and download the most contemporary data in the global financial markets. He calculates the historical returns by employing the CAPM MODEL. Consider the following table and assist him in order to estimate the following relationships for Kronos (K) and Titan (T) Multinationals (hereafter, MNEs). (K) MNE YEAR (T) MNE MARKET 2016 2017 2018 2019 2020 14% 19% -16% 3% 20% 13% 7% - 5% 1% 11% 12% 10% -12% 1% 15% Assume that the Risk-Free Rate is 2% 1. What are the betas of the MNE's K and T respectively? 2. What are the required rates of return for MNE's K and T? 3. Are stocks for the MNE K and T aggressive or defensive stocks? 4. What is the slope of the SML LINE for MNE stocks K and T respectively? Draw them carefully and provide comments and explanations for the Sharpe's and Treynor's Ratios. 5. How different is the CAPM model from the Mean Variance Model? 6. What is the Efficient Frontier? Carefully explain yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started