Answered step by step

Verified Expert Solution

Question

1 Approved Answer

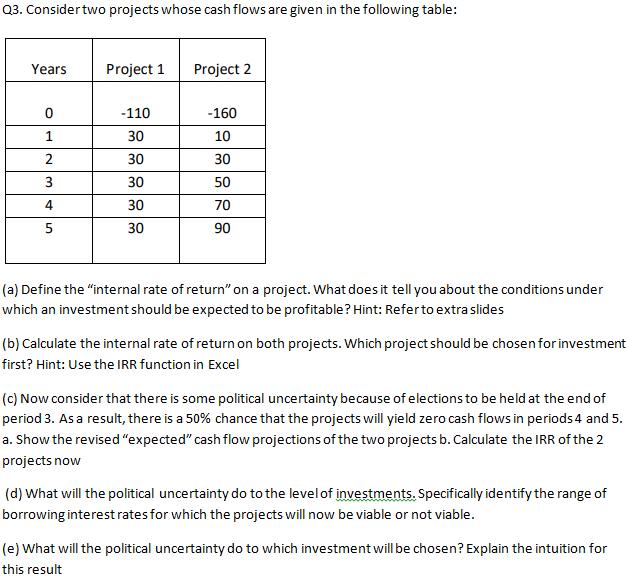

Q3. Consider two projects whose cash flows are given in the following table: Years 0 1 2 3 4 5 Project 1 Project 2

Q3. Consider two projects whose cash flows are given in the following table: Years 0 1 2 3 4 5 Project 1 Project 2 -110 30 30 30 30 30 -160 10 30 50 70 90 (a) Define the "internal rate of return" on a project. What does it tell you about the conditions under which an investment should be expected to be profitable? Hint: Refer to extra slides (b) Calculate the internal rate of return on both projects. Which project should be chosen for investment first? Hint: Use the IRR function in Excel (c) Now consider that there is some political uncertainty because of elections to be held at the end of period 3. As a result, there is a 50% chance that the projects will yield zero cash flows in periods 4 and 5. a. Show the revised "expected" cash flow projections of the two projects b. Calculate the IRR of the 2 projects now (d) What will the political uncertainty do to the level of investments. Specifically identify the range of borrowing interest rates for which the projects will now be viable or not viable. (e) What will the political uncertainty do to which investment will be chosen? Explain the intuition for this result

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The internal rate of return IRR is the discount rate that makes the net present value NPV of all c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started