Q3. From Manager's perspective 3-1. DuPont Identity DuPont Identity decompose the ROE into three different sources: profitability, management efficiency, and financial leverage. Net profit

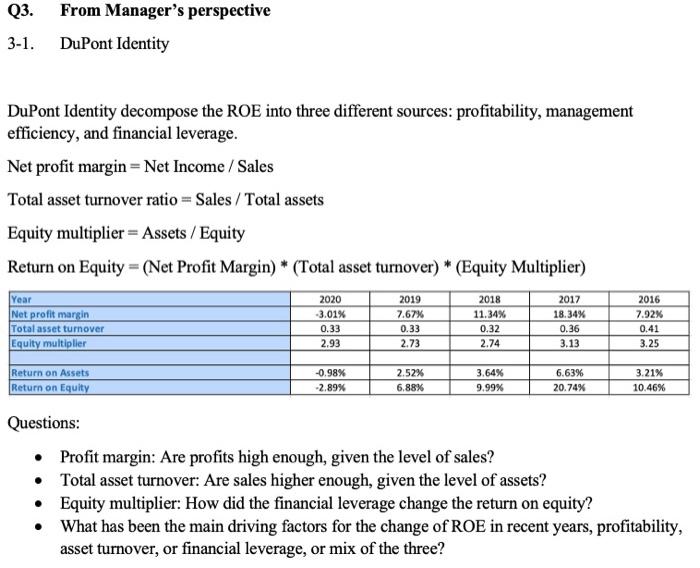

Q3. From Manager's perspective 3-1. DuPont Identity DuPont Identity decompose the ROE into three different sources: profitability, management efficiency, and financial leverage. Net profit margin = Net Income /Sales Total asset turnover ratio = Sales / Total assets Equity multiplier = Assets / Equity Return on Equity (Net Profit Margin) * (Total asset turnover) * (Equity Multiplier) Year Net profit margin Total asset turnover Equity multiplier 2018 2017 18.34% 2020 2019 2016 -3.01% 7.67% 11.34% 7.92% 0.33 0.33 0.32 0.36 0.41 2.93 2.73 2.74 3.13 3.25 Return on Assets Return on Equity -0.98% 2.52% 3.64% 6.63% 3.21% -2.89% 6.88% 9.99% 20.74% 10.46% Questions: Profit margin: Are profits high enough, given the level of sales? Total asset turnover: Are sales higher enough, given the level of assets? Equity multiplier: How did the financial leverage change the return on equity? What has been the main driving factors for the change of ROE in recent years, profitability, asset turnover, or financial leverage, or mix of the three?

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

ANSWERDupont identity model explains that decomposition of ROE permits investors to focus on the key ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started