Answered step by step

Verified Expert Solution

Question

1 Approved Answer

q3 Question 3 1 pts On January 1, 2019. a company purchased a mining site for P10,000,000 and spent an additional P2,500,000 to prepare the

q3

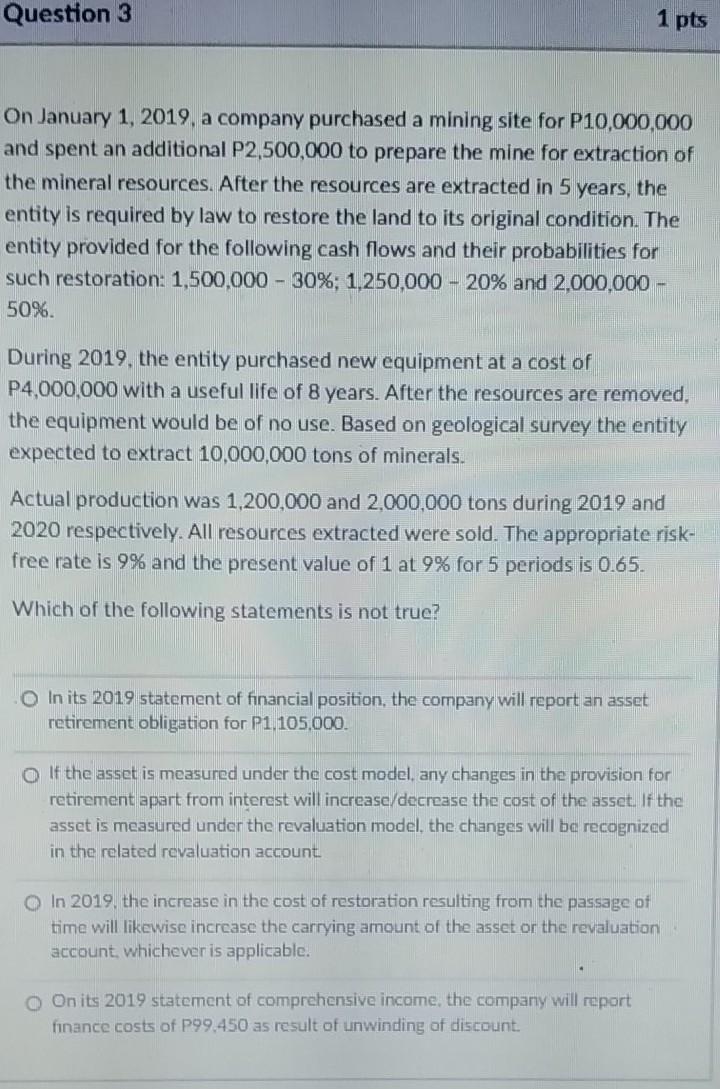

Question 3 1 pts On January 1, 2019. a company purchased a mining site for P10,000,000 and spent an additional P2,500,000 to prepare the mine for extraction of the mineral resources. After the resources are extracted in 5 years, the entity is required by law to restore the land to its original condition. The entity provided for the following cash flows and their probabilities for such restoration: 1,500,000 - 30%; 1,250,000 - 20% and 2,000,000 - 50%. During 2019. the entity purchased new equipment at a cost of P4,000,000 with a useful life of 8 years. After the resources are removed, the equipment would be of no use. Based on geological survey the entity expected to extract 10,000,000 tons of minerals. Actual production was 1,200,000 and 2,000,000 tons during 2019 and 2020 respectively. All resources extracted were sold. The appropriate risk- free rate is 9% and the present value of 1 at 9% for 5 periods is 0.65. Which of the following statements is not true? O In its 2019 statement of financial position, the company will report an asset retirement obligation for P1.105.000. o If the asset is measured under the cost model. any changes in the provision for retirement apart from interest will increase, decrease the cost of the asset. If the asset is measured under the revaluation model, the changes will be recognized in the related revaluation account O In 2019, the increase in the cost of restoration resulting from the passage of time will likewise increase the carrying amount of the asset or the revaluation account, whichever is applicable. o Onits 2019 statement of comprehensive income, the company will report finance costs of 299.450 as result of unwinding of discountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started