Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q3. RSPL Group is more than 5500 crore diversified conglomerate, which is committed to value for money propositions and credited with several innovations over

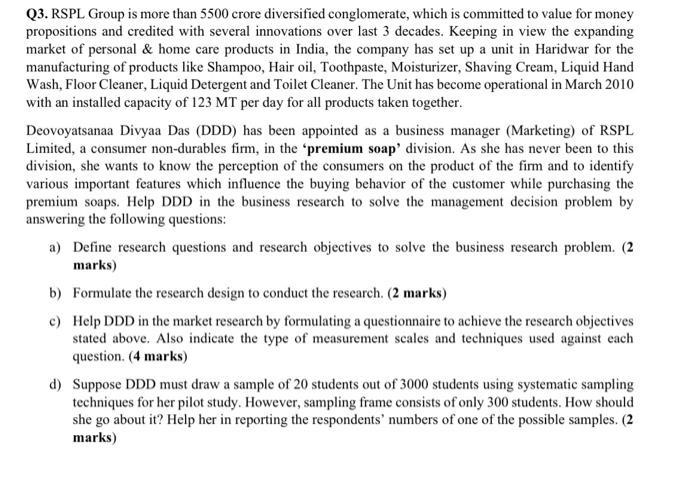

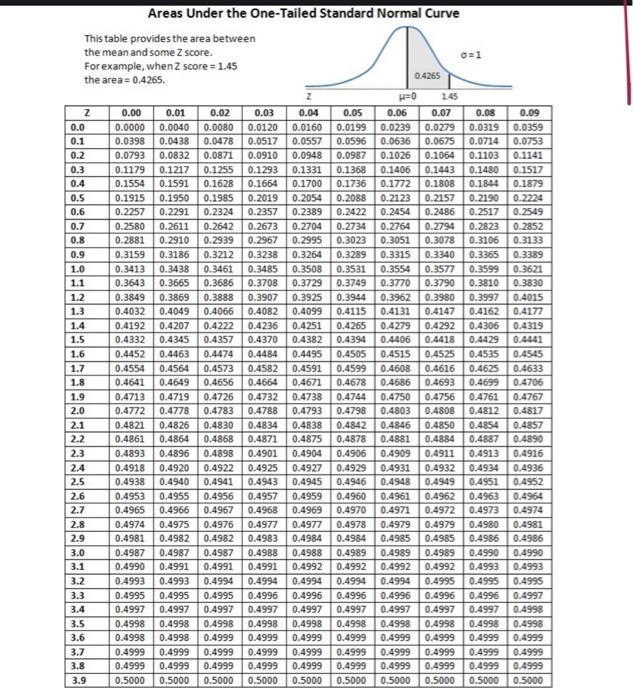

Q3. RSPL Group is more than 5500 crore diversified conglomerate, which is committed to value for money propositions and credited with several innovations over last 3 decades. Keeping in view the expanding market of personal & home care products in India, the company has set up a unit in Haridwar for the manufacturing of products like Shampoo, Hair oil, Toothpaste, Moisturizer, Shaving Cream, Liquid Hand Wash, Floor Cleaner, Liquid Detergent and Toilet Cleaner. The Unit has become operational in March 2010 with an installed capacity of 123 MT per day for all products taken together. Deovoyatsanaa Divyaa Das (DDD) has been appointed as a business manager (Marketing) of RSPL Limited, a consumer non-durables firm, in the premium soap' division. As she has never been to this division, she wants to know the perception of the consumers on the product of the firm and to identify various important features which influence the buying behavior of the customer while purchasing the premium soaps. Help DDD in the business research to solve the management decision problem by answering the following questions: a) Define research questions and research objectives to solve the business research problem. (2 marks) b) Formulate the research design to conduct the research. (2 marks) c) Help DDD in the market research by formulating a questionnaire to achieve the research objectives stated above. Also indicate the type of measurement scales and techniques used against each question. (4 marks) d) Suppose DDD must draw a sample of 20 students out of 3000 students using systematic sampling techniques for her pilot study. However, sampling frame consists of only 300 students. How should she go about it? Help her in reporting the respondents' numbers of one of the possible samples. (2 marks) This table provides the area between the mean and some Z score. For example, when Z score=1.45 the area= 0.4265. Z 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 1.9 2.0 2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 2.9 3.0 3.1 3.2 Areas Under the One-Tailed Standard Normal Curve 3.3 3.4 3.5 3.6 3.7 3.8 3.9 0.00 0.01 0.0000 0.0040 0.0398 0.0438 0.0793 0.0832 0.1179 0.1217 0.1255 0.1554 0.1591 0.1628 0.1915 0.2257 0.2580 0.2881 0.02 0.03 0.04 0.0080 0.0120 0.0478 0.0517 0.0557 0.0871 0.0910 0.0948 0.1293 0.1331 0.1664 0.1700 0.1950 0.1985 0.2019 0.2054 0.2291 0.2324 0.2357 0.2389 0.2611 0.2642 0.2673 0.2704 0.2910 0.2939 0.2967 0.2995 0.3186 0.3212 0.3238 0.3264 0.3438 0.3461 0.3485 0.3508 0.3665 0.3686 0.3708 0.3729 0.3869 0.3888 0.3907 0.3925 0.4049 0.4066 0.4082 0.4099 == THE ===== == 0.3159 0.3413 0.3643 0.3849 0.4032 0.4192 0.4207 0.4222 0.4236 0.4251 0.4332 0.4345 0.4357 0.4370 0.4382 0.4452 0.4463 0.4474 0.4484 0.4495 0.4554 0.4564 0.4573 0.4582 0.4641 0.4649 0.4656 0.4664 0.4713 0.4719 0.4726 0.4778 0.4783 0.4772 0.4821 0.4826 0.4830 0.4861 0.4864 0.4893 0.4896 == 0.05 0.0160 0.0199 HE T + 0.4999 0.4999 =+=+=+ 0.3531 0.3749 0.3944 0.4115 ++ H BEE 0.0596 0.0636 0.0675 0.1026 0.1064 0.0987 0.1368 0.1406 0.1443 0.1736 0.1772 0.4998 0.4998 0.4998 0.4998 0.4998 0.4999 0.4999 0.4999 0.4999 0.4999 0.4999 0.4999 0.5000 0.5000 0.5000 0.5000 0.5000 0.5000 0.4265 =0 0.2088 0.2123 0.2157 0.2190 0.2224 0.2549 0.2422 0.2454 0.2486 0.2517 0.2734 0.2764 0.2794 0.2823 0.2852 0.3023 0.3051 0.3078 0.3106 0.3133 0.3289 0.3315 0.3340 0.3365 0.3389 0.3554 0.3577 0.3599 0.3621 0.3770 0.3790 0.3810 0.3830 0.3962 0.3980 0.3997 0.4015 0.4131 0.4147 0.4162 0.4177 dades 1.45 0.06 0.07 0.08 0.0239 0.0279 0.0319 0.4265 0.4394 0.4406 0.4505 0.4515 0.4599 0.4608 0.4678 0.4744 0.4798 0.4803 0.4279 0.4292 0.4306 0.4418 0.4429 0.4525 0.4535 0.4545 0.4591 0.4616 0.4625 0.4633 0.4671 0.4686 0.4693 0.4699 0.4706 0.4732 0.4738 0.4767 0.4750 0.4756 0.4761 0.4808 0.4812 0.4817 0.4788 0.4793 0.4834 0.4838 0.4842 0.4857 0.4846 0.4850 0.4854 0.4881 0.4884 0.4887 0.4890 0.4909 0.4911 0.4913 0.4916 0.4936 0.4918 0.4920 0.4922 0.4925 0.4931 0.4932 0.4934 0.4868 0.4871 0.4875 0.4878 0.4898 0.4901 0.4904 0.4906 0.4927 0.4929 0.4943 0.4945 0.4946 0.4960 0.4969 0.4970 0.4952 0.4964 0.4974 0.4938 0.4940 0.4941 0.4948 0.4949 0.4951 0.4953 0.4955 0.4956 0.4957 0.4959 0.4961 0.4962 0.4963 0.4965 0.4966 0.4967 0.4968 0.4971 0.4972 0.4973 0.4974 0.4975 0.4976 0.4977 0.4977 0.4978 0.4979 0.4979 0.4980 0.4981 0.4981 0.4982 0.4982 0.4983 0.4984 0.4984 0.4985 0.4985 0.4986 0.4986 0.4987 0.4987 0.4987 0.4988 0.4988 0.4989 0.4989 0.4989 0.4990 0.4990 0.4990 0.4991 0.4991 0.4991 0.4992 0.4992 0.4992 0.4992 0.4993 0.4993 0.4993 0.4993 0.4994 0.4994 0.4994 0.4994 0.4994 0.4995 0.4995 0.4995 0.4995 0.4995 0.4995 0.4996 0.4996 0.4996 0.4996 0.4996 0.4996 0.4997 0.4997 0.4997 0.4997 0.4997 0.4997 0.4997 0.4998 0.4998 0.4998 0.4998 0.4998 0.4998 0.4998 0.4998 0.4997 0.4997 0.4997 0.4999 0.4999 0.4999 0.4999 0.4999 0.4999 0.4999 0.4999 0.4999 0.4999 0.4999 0.4999 0.4999 0.4999 0.4999 0.4999 0.5000 0.5000 0.5000 0.4999 0.4999 0.4999 0.5000 0=1 0.09 0.0359 0.0714 0.0753 0.1103 0.1141 0.1480 0.1517 0.1808 0.1844 0.1879 0.4319 0.4441

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started