Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q3. Valuation of Coca Cola Company Case You have recently joined Coca Cola company as a manager in finance department. You have been asked

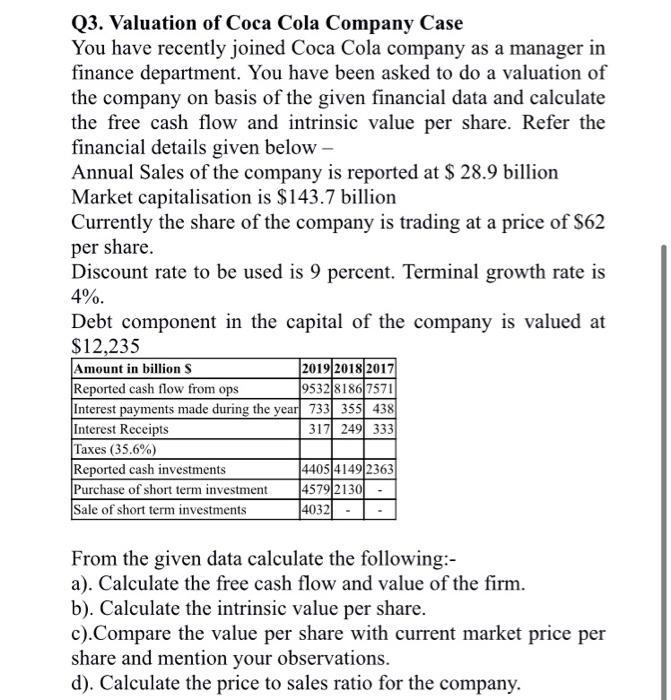

Q3. Valuation of Coca Cola Company Case You have recently joined Coca Cola company as a manager in finance department. You have been asked to do a valuation of the company on basis of the given financial data and calculate the free cash flow and intrinsic value per share. Refer the financial details given below- Annual Sales of the company is reported at $28.9 billion Market capitalisation is $143.7 billion Currently the share of the company is trading at a price of $62 per share. Discount rate to be used is 9 percent. Terminal growth rate is 4%. Debt component in the capital of the company is valued at $12,235 Amount in billion S 2019 2018 2017 Reported cash flow from ops 9532 8186 7571 Interest payments made during the year 733 355 438 Interest Receipts 317 249 333 Taxes (35.6%) Reported cash investments 4405 4149 2363 Purchase of short term investment 4579 2130 Sale of short term investments 4032 From the given data calculate the following:- a). Calculate the free cash flow and value of the firm. b). Calculate the intrinsic value per share. c). Compare the value per share with current market price per share and mention your observations. d). Calculate the price to sales ratio for the company.

Step by Step Solution

★★★★★

3.38 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started