Answered step by step

Verified Expert Solution

Question

1 Approved Answer

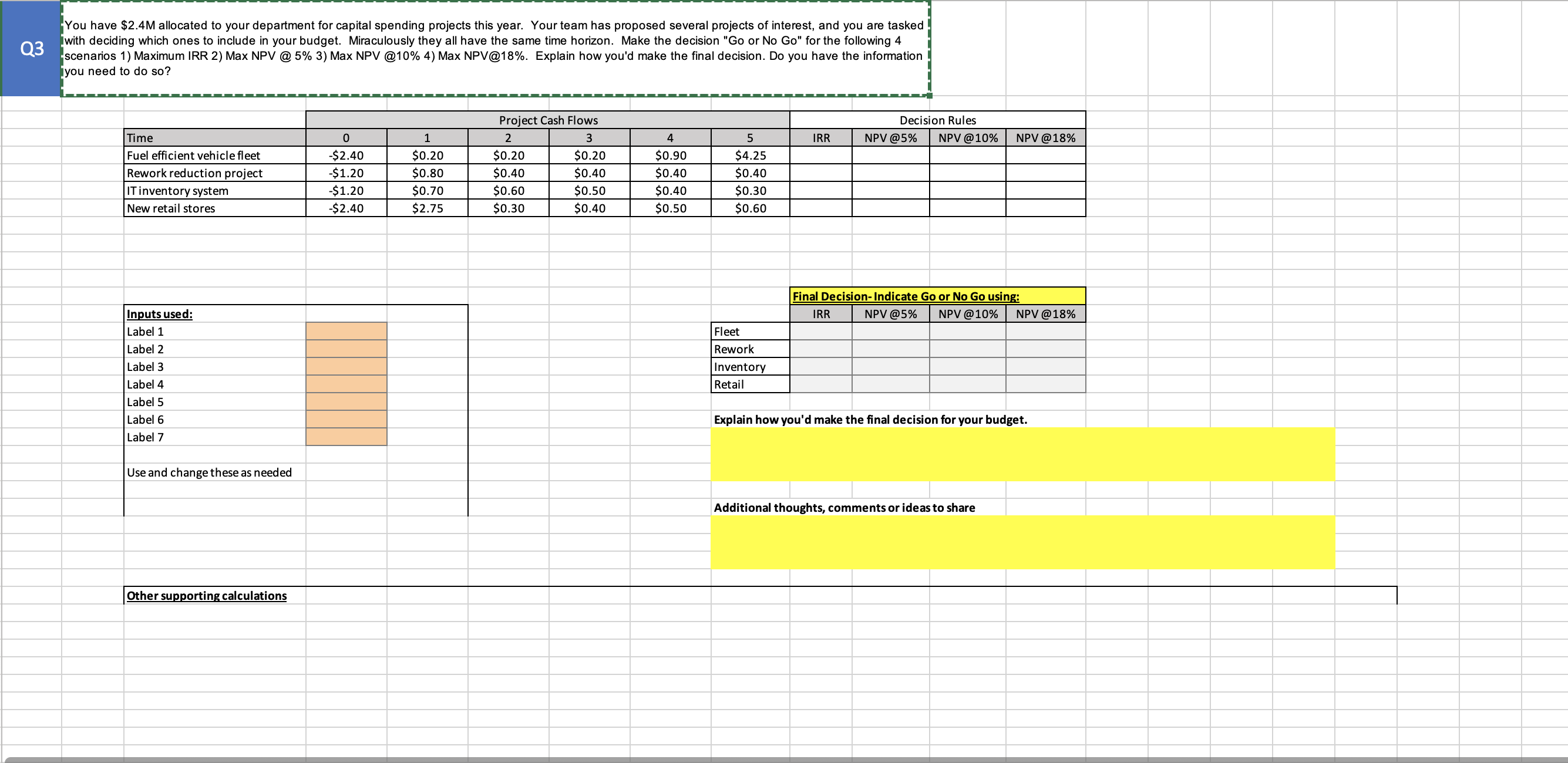

Q3 You have $2.4M allocated to your department for capital spending projects this year. Your team has proposed several projects of interest, and you

Q3 You have $2.4M allocated to your department for capital spending projects this year. Your team has proposed several projects of interest, and you are tasked with deciding which ones to include in your budget. Miraculously they all have the same time horizon. Make the decision "Go or No Go" for the following 4 scenarios 1) Maximum IRR 2) Max NPV @ 5% 3) Max NPV @10% 4) Max NPV@18%. Explain how you'd make the final decision. Do you have the information you need to do so? Time Fuel efficient vehicle fleet Rework reduction project IT inventory system New retail stores Inputs used: Label 1 Label 2 Label 3 Label 4 Label 5 Label 6 Label 7 Use and change these as needed Other supporting calculations 0 -$2.40 -$1.20 -$1.20 -$2.40 1 $0.20 $0.80 $0.70 $2.75 Project Cash Flows 2 3 $0.20 $0.20 $0.40 $0.40 $0.60 $0.50 $0.30 $0.40 4 $0.90 $0.40 $0.40 $0.50 5 $4.25 $0.40 $0.30 $0.60 Fleet Rework Inventory Retail IRR Decision Rules NPV @5% NPV @10% NPV @18% Final Decision-Indicate Go or No Go using: IRR NPV @5% NPV @10% NPV @18% Explain how you'd make the final decision for your budget. Additional thoughts, comments or ideas to share

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To evaluate the four investment scenarios based on different criteria we can use the internal rate o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started