Answered step by step

Verified Expert Solution

Question

1 Approved Answer

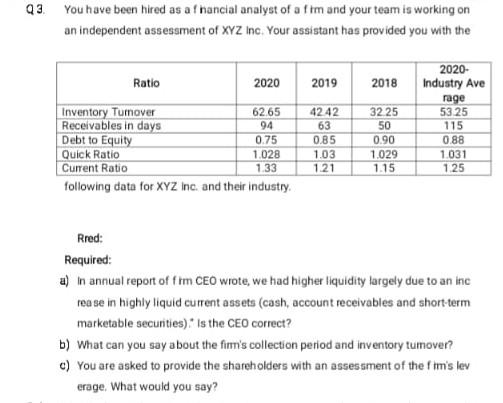

Q3. You have been hired as a fnancial analyst of a fim and your team is working on an independent assessment of XYZ Inc. Your

Q3. You have been hired as a fnancial analyst of a fim and your team is working on an independent assessment of XYZ Inc. Your assistant has provided you with the Ratio 2020 2019 2018 94 0.75 Inventory Tumover 62.65 Receivables in days Debt to Equity Quick Ratio 1.028 Current Ratio 1.33 following data for XYZ Inc. and their industry. 4242 63 0.85 1.03 121 32 25 50 0.90 1.029 1.15 2020- Industry Ave rage 53 25 115 0 88 1.031 1.25 Rred: Required: a) In annual report of fim CEO wrote, we had higher liquidity largely due to an inc rease in highly liquid current assets (cash, account receivables and short-term marketable securities). Is the CEO correct? b) What can you say about the firm's collection period and inventory tumover? c) You are asked to provide the shareholders with an assessment of the fm's lev erage. What would you say? Q3. You have been hired as a fnancial analyst of a fim and your team is working on an independent assessment of XYZ Inc. Your assistant has provided you with the Ratio 2020 2019 2018 94 0.75 Inventory Tumover 62.65 Receivables in days Debt to Equity Quick Ratio 1.028 Current Ratio 1.33 following data for XYZ Inc. and their industry. 4242 63 0.85 1.03 121 32 25 50 0.90 1.029 1.15 2020- Industry Ave rage 53 25 115 0 88 1.031 1.25 Rred: Required: a) In annual report of fim CEO wrote, we had higher liquidity largely due to an inc rease in highly liquid current assets (cash, account receivables and short-term marketable securities). Is the CEO correct? b) What can you say about the firm's collection period and inventory tumover? c) You are asked to provide the shareholders with an assessment of the fm's lev erage. What would you say

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started