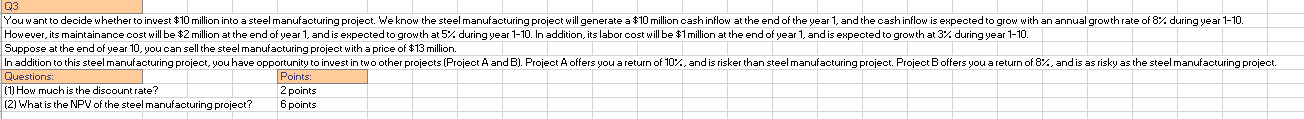

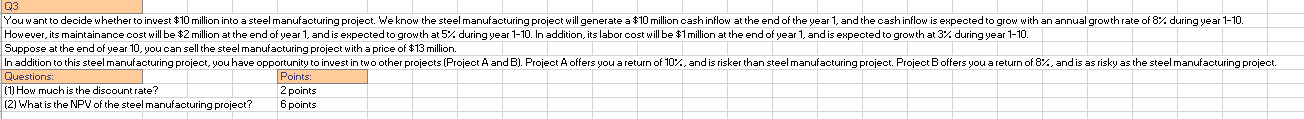

Q3 You want to decide whether to invest $10 million into a steel manufacturing project. We know the steel manufacturing project will generate a $10 million cash inflow at the end of the year 1, and the cash inflow is expected to grow with an annual growth rate of 8% during year 1-10. However, its maintainance cost will be $2 million at the end of year 1, and is expected to growth at 5% during year 1-10. In addition, its labor cost will be $1 million at the end of year 1, and is expected to growth at 3% during year 1-10. Suppose at the end of year 10, you can sell the steel manufacturing project with a price of $13 million. In addition to this steel manufacturing project, you have opportunity to invest in two other projects (Project A and B). Project A offers you a return of 10%, and is risker than steel manufacturing project. Project Boffers you a return of 8%, andis as risky as the steel manufacturing project. Questions Points: (1) How much is the discount rate? 2 points (2) What is the NPV of the steel manufacturing project? 6 points Q3 You want to decide whether to invest $10 million into a steel manufacturing project. We know the steel manufacturing project will generate a $10 million cash inflow at the end of the year 1, and the cash inflow is expected to grow with an annual growth rate of 8% during year 1-10. However, its maintainance cost will be $2 million at the end of year 1, and is expected to growth at 5% during year 1-10. In addition, its labor cost will be $1 million at the end of year 1, and is expected to growth at 3% during year 1-10. Suppose at the end of year 10, you can sell the steel manufacturing project with a price of $13 million. In addition to this steel manufacturing project, you have opportunity to invest in two other projects (Project A and B). Project A offers you a return of 10%, and is risker than steel manufacturing project. Project Boffers you a return of 8%, andis as risky as the steel manufacturing project. Questions Points: (1) How much is the discount rate? 2 points (2) What is the NPV of the steel manufacturing project? 6 points