Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q3&Q4 3 Maryanne paid the following interest in 2022: - $3,000 student loan interest - $11,000 investment interest (not related to rental/royalty property) - $13,000

Q3&Q4

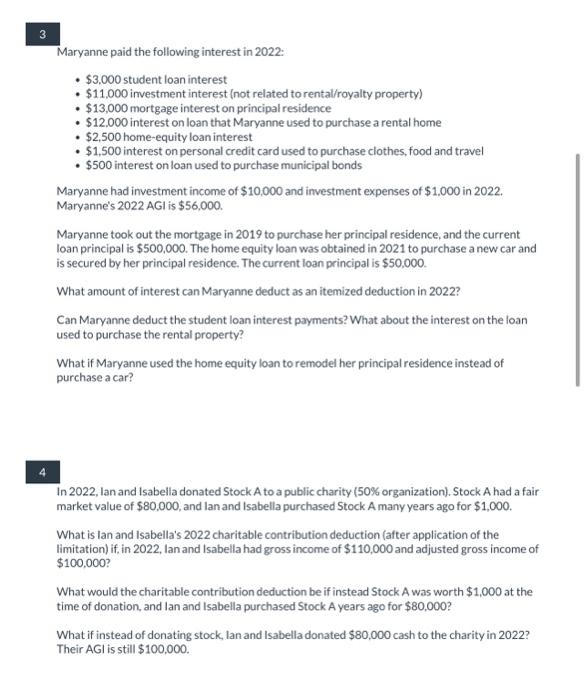

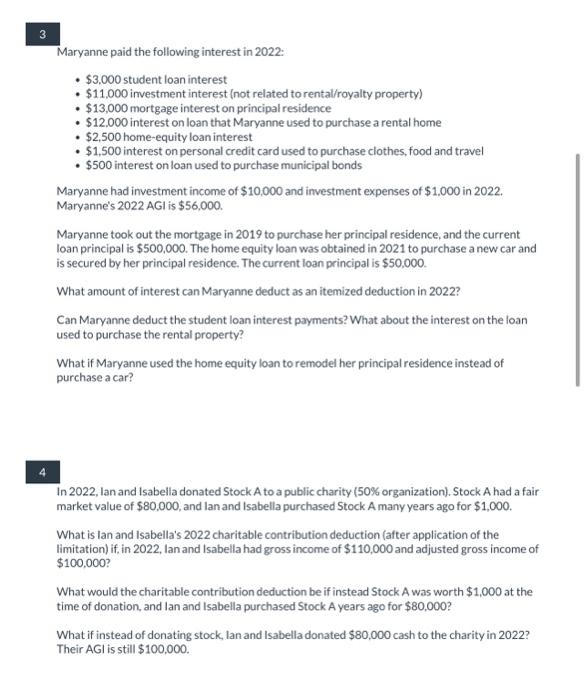

3 Maryanne paid the following interest in 2022: - $3,000 student loan interest - $11,000 investment interest (not related to rental/royalty property) - $13,000 mortgage interest on principal residence - $12,000 interest on loan that Maryanne used to purchase a rental home - $2,500 home-equity loan interest - $1,500 interest on personal credit card used to purchase clothes, food and travel - $500 interest on loan used to purchase municipal bonds Maryanne had investment income of $10,000 and investment expenses of $1,000 in 2022. Maryanne's 2022AGl is $56,000. Maryanne took out the mortgage in 2019 to purchase her principal residence, and the current loan principal is $500,000. The home equity loan was obtained in 2021 to purchase a new car and is secured by her principal residence. The current loan principal is $50,000. What amount of interest can Maryanne deduct as an itemized deduction in 2022? Can Maryanne deduct the student loan interest payments? What about the interest on the loan used to purchase the rental property? What if Maryanne used the home equity loan to remodel her principal residence instead of purchase a car? In 2022, Ian and Isabella donated Stock A to a public charity (50\% organization). Stock A had a fair market value of $80,000, and lan and Isabella purchased Stock A many years ago for $1,000. What is lan and Isabella's 2022 charitable contribution deduction (after application of the limitation) if, in 2022, Ian and Isabella had gross income of $110,000 and adjusted gross income of $100,000 ? What would the charitable contribution deduction be if instead Stock A was worth $1,000 at the time of donation, and Ian and Isabella purchased Stock A years ago for $80,000 ? What if instead of donating stock, lan and Isabella donated $80,000 cash to the charity in 2022 ? Their AGl is still $100,000. 3 Maryanne paid the following interest in 2022: - $3,000 student loan interest - $11,000 investment interest (not related to rental/royalty property) - $13,000 mortgage interest on principal residence - $12,000 interest on loan that Maryanne used to purchase a rental home - $2,500 home-equity loan interest - $1,500 interest on personal credit card used to purchase clothes, food and travel - $500 interest on loan used to purchase municipal bonds Maryanne had investment income of $10,000 and investment expenses of $1,000 in 2022. Maryanne's 2022AGl is $56,000. Maryanne took out the mortgage in 2019 to purchase her principal residence, and the current loan principal is $500,000. The home equity loan was obtained in 2021 to purchase a new car and is secured by her principal residence. The current loan principal is $50,000. What amount of interest can Maryanne deduct as an itemized deduction in 2022? Can Maryanne deduct the student loan interest payments? What about the interest on the loan used to purchase the rental property? What if Maryanne used the home equity loan to remodel her principal residence instead of purchase a car? In 2022, Ian and Isabella donated Stock A to a public charity (50\% organization). Stock A had a fair market value of $80,000, and lan and Isabella purchased Stock A many years ago for $1,000. What is lan and Isabella's 2022 charitable contribution deduction (after application of the limitation) if, in 2022, Ian and Isabella had gross income of $110,000 and adjusted gross income of $100,000 ? What would the charitable contribution deduction be if instead Stock A was worth $1,000 at the time of donation, and Ian and Isabella purchased Stock A years ago for $80,000 ? What if instead of donating stock, lan and Isabella donated $80,000 cash to the charity in 2022 ? Their AGl is still $100,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started