Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Outpatient clinic of eastside Hospital acquired X-ray equipment for 550,000 with an expected useful life of 5 year and a 50,000 expected residual

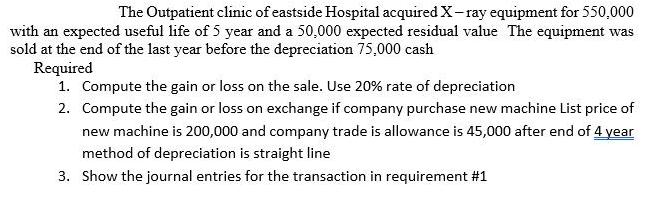

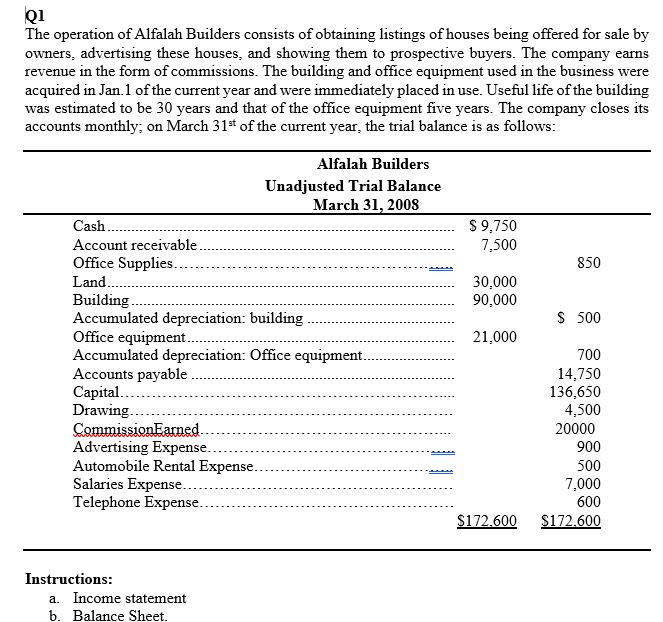

The Outpatient clinic of eastside Hospital acquired X-ray equipment for 550,000 with an expected useful life of 5 year and a 50,000 expected residual value The equipment was sold at the end of the last year before the depreciation 75,000 cash Required 1. Compute the gain or loss on the sale. Use 20% rate of depreciation 2. Compute the gain or loss on exchange if company purchase new machine List price of new machine is 200,000 and company trade is allowance is 45,000 after end of 4 year method of depreciation is straight line 3. Show the journal entries for the transaction in requirement #1 Q1 The operation of Alfalah Builders consists of obtaining listings of houses being offered for sale by owners, advertising these houses, and showing them to prospective buyers. The company earns revenue in the form of commissions. The building and office equipment used in the business were acquired in Jan. 1 of the current year and were immediately placed in use. Useful life of the building was estimated to be 30 years and that of the office equipment five years. The company closes its accounts monthly; on March 31t of the current year, the trial balance is as follows: Alfalah Builders Unadjusted Trial Balance March 31, 2008 Cash. $ 9,750 7,500 Account receivable. Office Supplies. 850 Land.. 30,000 90,000 Building. Accumulated depreciation: building Office equipment. Accumulated depreciation: Office equipment.. Accounts payable Capital.. Drawing. CommissionEarned. Advertising Expense. Automobile Rental Expense.. Salaries Expense.. Telephone Expense.. $ 500 21,000 700 14,750 136,650 4,500 20000 900 500 7,000 600 $172.600 $172.600 Instructions: a. Income statement b. Balance Sheet.

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer Requirement 1 Depreciation as per straight line method 550000500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started