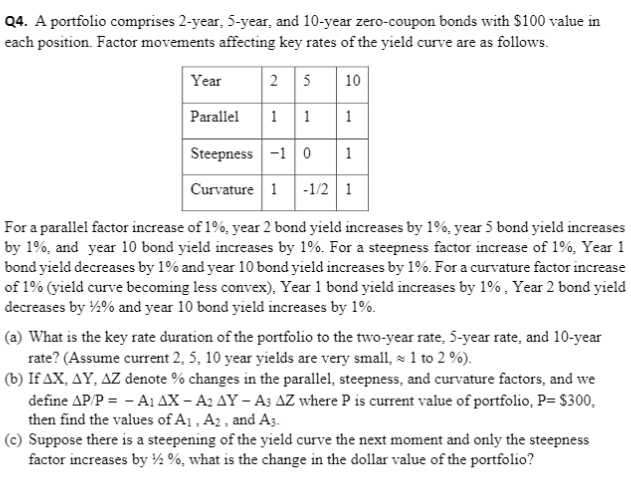

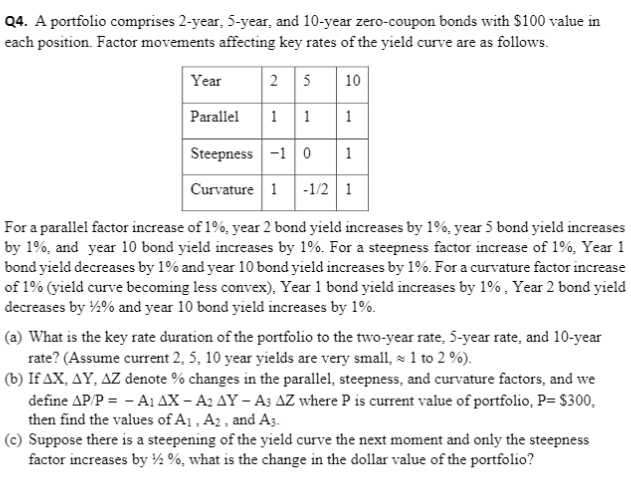

Q4. A portfolio comprises 2-year, 5-year, and 10-year zero-coupon bonds with $100 value in each position. Factor movements affecting key rates of the yield curve are as follows. Year 2 5 10 Parallel 1 1 1 Steepness -1 0 1 Curvature 1 -1/2 1 For a parallel factor increase of 1%, year 2 bond yield increases by 1%, year 5 bond yield increases by 1%, and year 10 bond yield increases by 1%. For a steepness factor increase of 1% Year 1 bond yield decreases by 1% and year 10 bond yield increases by 1%. For a curvature factor increase of 1% (yield curve becoming less convex). Year 1 bond yield increases by 1%. Year 2 bond yield decreases by % and year 10 bond yield increases by 1%. (a) What is the key rate duration of the portfolio to the two-year rate, 5-year rate, and 10-year rate? (Assume current 2, 5, 10 year yields are very small, = 1 to 2%). (b) If AX, AY, AZ denote % changes in the parallel, steepness, and curvature factors, and we define APP = - A1 AX - A2 AY - Az AZ where P is current value of portfolio, P= $300, then find the values of A1, A2, and A3. (C) Suppose there is a steepening of the yield curve the next moment and only the steepness factor increases by 12%, what is the change in the dollar value of the portfolio? Q4. A portfolio comprises 2-year, 5-year, and 10-year zero-coupon bonds with $100 value in each position. Factor movements affecting key rates of the yield curve are as follows. Year 2 5 10 Parallel 1 1 1 Steepness -1 0 1 Curvature 1 -1/2 1 For a parallel factor increase of 1%, year 2 bond yield increases by 1%, year 5 bond yield increases by 1%, and year 10 bond yield increases by 1%. For a steepness factor increase of 1% Year 1 bond yield decreases by 1% and year 10 bond yield increases by 1%. For a curvature factor increase of 1% (yield curve becoming less convex). Year 1 bond yield increases by 1%. Year 2 bond yield decreases by % and year 10 bond yield increases by 1%. (a) What is the key rate duration of the portfolio to the two-year rate, 5-year rate, and 10-year rate? (Assume current 2, 5, 10 year yields are very small, = 1 to 2%). (b) If AX, AY, AZ denote % changes in the parallel, steepness, and curvature factors, and we define APP = - A1 AX - A2 AY - Az AZ where P is current value of portfolio, P= $300, then find the values of A1, A2, and A3. (C) Suppose there is a steepening of the yield curve the next moment and only the steepness factor increases by 12%, what is the change in the dollar value of the portfolio