Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q4. Business Combination Peter Corp acquired the net identifiable assets of Simon Corp by issuing its own 5,000 ordinary shares with par and fair value

Q4. Business Combination

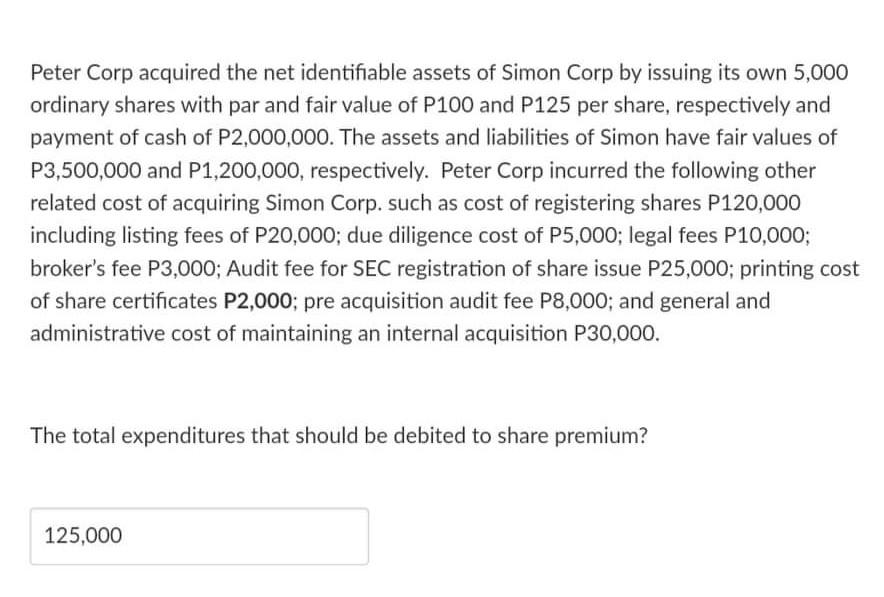

Peter Corp acquired the net identifiable assets of Simon Corp by issuing its own 5,000 ordinary shares with par and fair value of P100 and P125 per share, respectively and payment of cash of P2,000,000. The assets and liabilities of Simon have fair values of P3,500,000 and P1,200,000, respectively. Peter Corp incurred the following other related cost of acquiring Simon Corp. such as cost of registering shares P120,000 including listing fees of P20,000; due diligence cost of P5,000; legal fees P10,000; broker's fee P3,000; Audit fee for SEC registration of share issue P25,000; printing cost of share certificates P2,000; pre acquisition audit fee P8,000; and general and administrative cost of maintaining an internal acquisition P30,000. The total expenditures that should be debited to share premium? 125,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started