Answered step by step

Verified Expert Solution

Question

1 Approved Answer

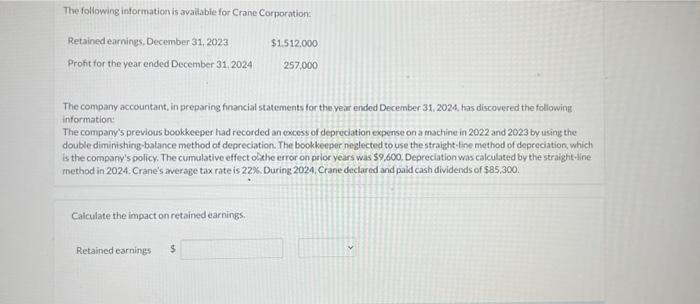

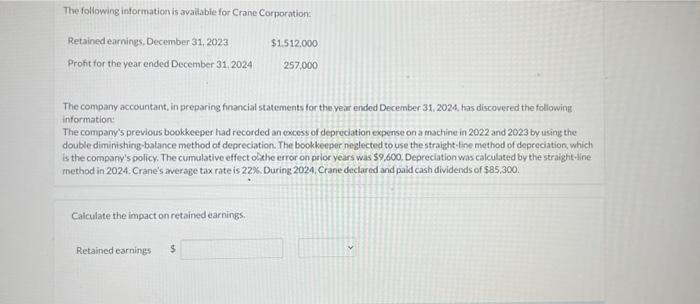

q4 (f) The following information is avakable for Crane Corporation: The company accountant, in preparing financial statements for the year ended December 31, 2024, has

q4 (f)

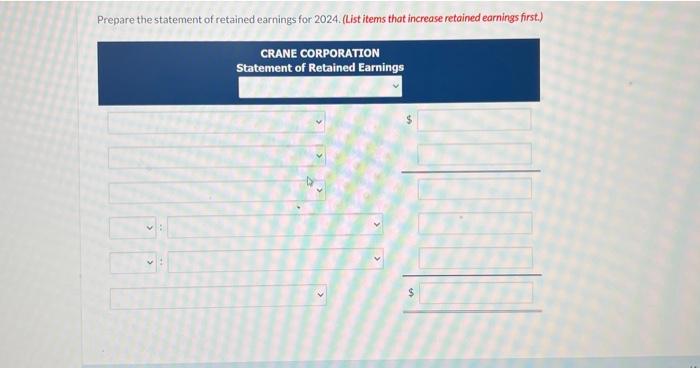

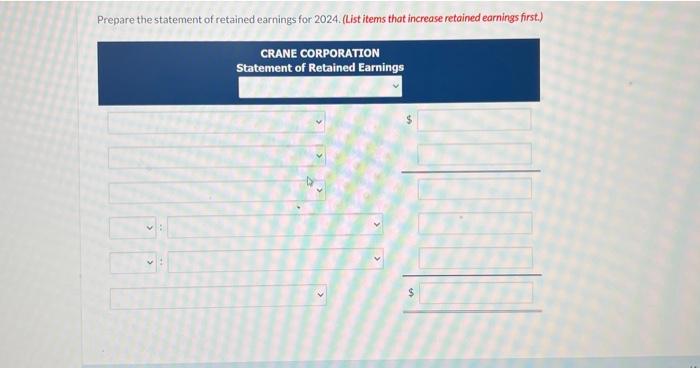

The following information is avakable for Crane Corporation: The company accountant, in preparing financial statements for the year ended December 31, 2024, has discovered the following informatione The company's previous bookkeeper had recorded an excess of depreciation expense on a machine in 2022 and 2023 by using the double diminishing-balance method of depreciation. The bookkeeper neglected to use the straight-line method of depreciation, which is the company's policy. The cumalative effect oxthe error on prior years was $9,600. Depreciation was calculated by the straight-dine. method in 2024. Crane's average tax rate is 22\%. During 2024, Crane declared and pald cash dividends of \$85,300. Calculate the impact on retained earnings. Retained earnings Dronara tho etatamont nf ratainoul oarninae for 2004 . n ict itome that increace retained earnines first.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started