Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q4 (forward pricing, continuous dividend, currencies) Suppose the current exchange rate between Euros and Japanese yen is 0.02/(0.02 euro =1 yen). The euro-denominated annual continuously

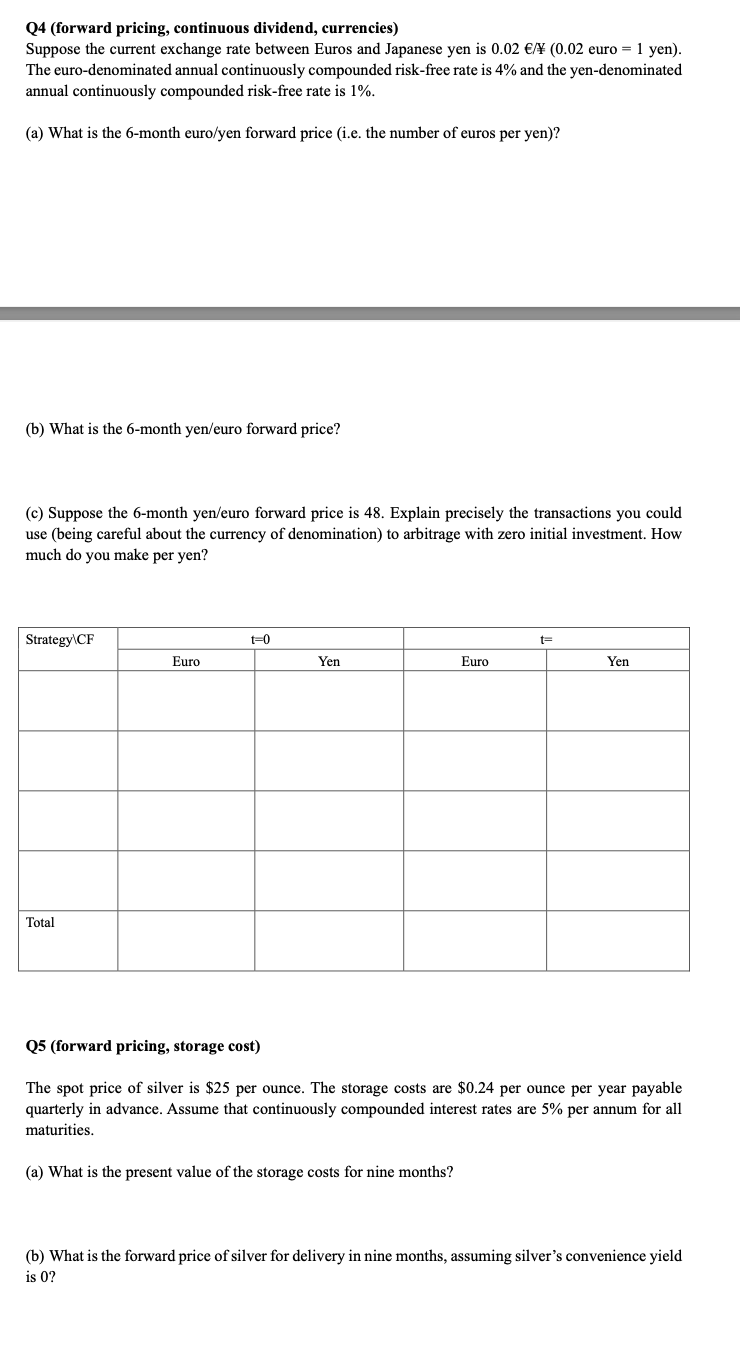

Q4 (forward pricing, continuous dividend, currencies) Suppose the current exchange rate between Euros and Japanese yen is 0.02/(0.02 euro =1 yen). The euro-denominated annual continuously compounded risk-free rate is 4% and the yen-denominated annual continuously compounded risk-free rate is 1%. (a) What is the 6-month euro/yen forward price (i.e. the number of euros per yen)? (b) What is the 6-month yen/euro forward price? (c) Suppose the 6-month yen/euro forward price is 48. Explain precisely the transactions you could use (being careful about the currency of denomination) to arbitrage with zero initial investment. How much do you make per yen? Q5 (forward pricing, storage cost) The spot price of silver is $25 per ounce. The storage costs are $0.24 per ounce per year payable quarterly in advance. Assume that continuously compounded interest rates are 5% per annum for all maturities. (a) What is the present value of the storage costs for nine months? (b) What is the forward price of silver for delivery in nine months, assuming silver's convenience yield is 0

Q4 (forward pricing, continuous dividend, currencies) Suppose the current exchange rate between Euros and Japanese yen is 0.02/(0.02 euro =1 yen). The euro-denominated annual continuously compounded risk-free rate is 4% and the yen-denominated annual continuously compounded risk-free rate is 1%. (a) What is the 6-month euro/yen forward price (i.e. the number of euros per yen)? (b) What is the 6-month yen/euro forward price? (c) Suppose the 6-month yen/euro forward price is 48. Explain precisely the transactions you could use (being careful about the currency of denomination) to arbitrage with zero initial investment. How much do you make per yen? Q5 (forward pricing, storage cost) The spot price of silver is $25 per ounce. The storage costs are $0.24 per ounce per year payable quarterly in advance. Assume that continuously compounded interest rates are 5% per annum for all maturities. (a) What is the present value of the storage costs for nine months? (b) What is the forward price of silver for delivery in nine months, assuming silver's convenience yield is 0 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started