Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q4 South acquired 400,000 ordinary shares of West Ltd on 1 January 2023 (there has been no change in share capital since). The retained earnings

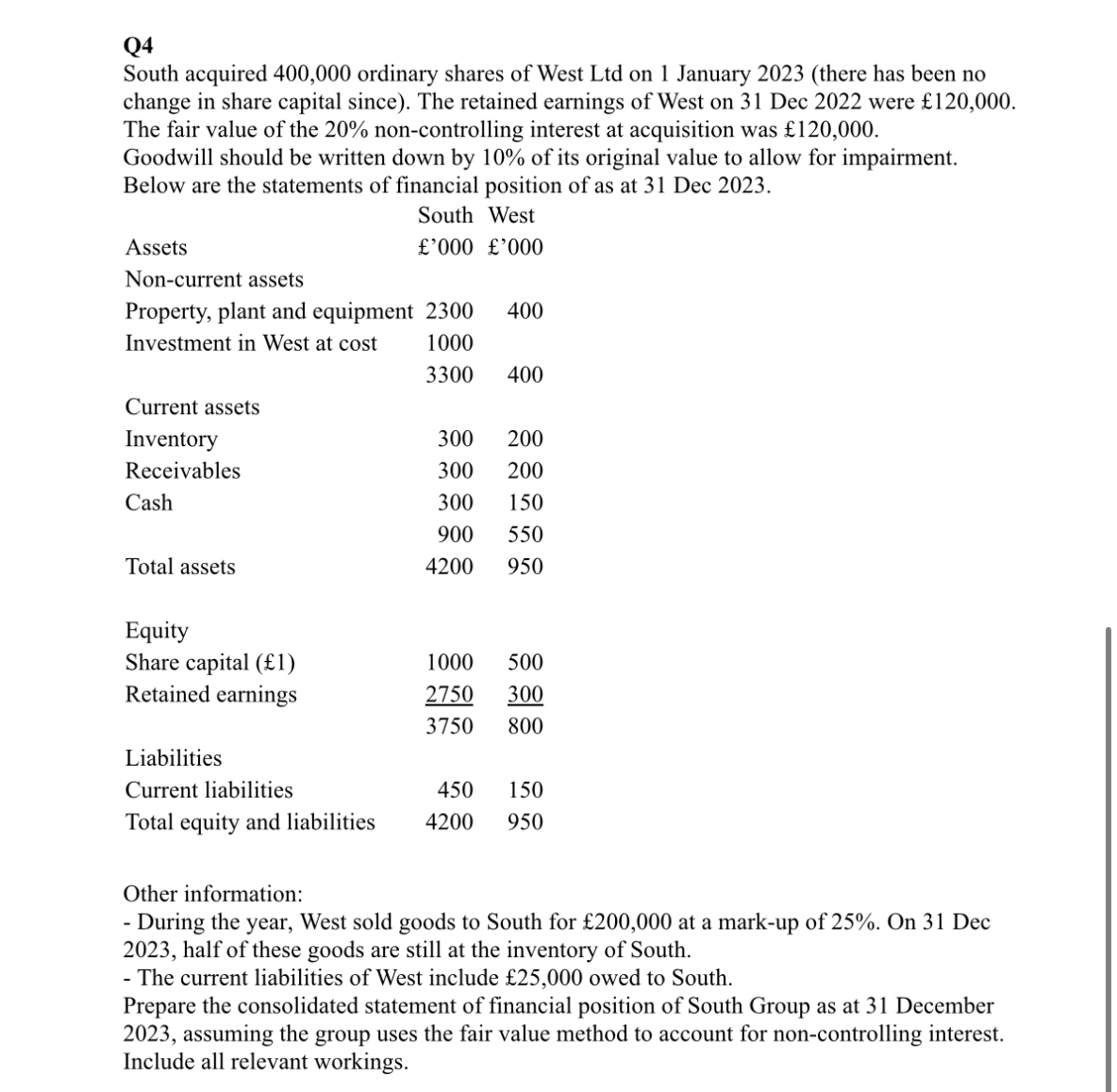

Q4 South acquired 400,000 ordinary shares of West Ltd on 1 January 2023 (there has been no change in share capital since). The retained earnings of West on 31 Dec 2022 were 120,000. The fair value of the 20% non-controlling interest at acquisition was 120,000. Goodwill should be written down by 10% of its original value to allow for impairment. as at 31Dec2023. Other information: - During the year, West sold goods to South for 200,000 at a mark-up of 25%. On 31Dec 2023 , half of these goods are still at the inventory of South. - The current liabilities of West include 25,000 owed to South. Prepare the consolidated statement of financial position of South Group as at 31 December 2023 , assuming the group uses the fair value method to account for non-controlling interest. Include all relevant workings. Q4 South acquired 400,000 ordinary shares of West Ltd on 1 January 2023 (there has been no change in share capital since). The retained earnings of West on 31 Dec 2022 were 120,000. The fair value of the 20% non-controlling interest at acquisition was 120,000. Goodwill should be written down by 10% of its original value to allow for impairment. as at 31Dec2023. Other information: - During the year, West sold goods to South for 200,000 at a mark-up of 25%. On 31Dec 2023 , half of these goods are still at the inventory of South. - The current liabilities of West include 25,000 owed to South. Prepare the consolidated statement of financial position of South Group as at 31 December 2023 , assuming the group uses the fair value method to account for non-controlling interest. Include all relevant workings

Q4 South acquired 400,000 ordinary shares of West Ltd on 1 January 2023 (there has been no change in share capital since). The retained earnings of West on 31 Dec 2022 were 120,000. The fair value of the 20% non-controlling interest at acquisition was 120,000. Goodwill should be written down by 10% of its original value to allow for impairment. as at 31Dec2023. Other information: - During the year, West sold goods to South for 200,000 at a mark-up of 25%. On 31Dec 2023 , half of these goods are still at the inventory of South. - The current liabilities of West include 25,000 owed to South. Prepare the consolidated statement of financial position of South Group as at 31 December 2023 , assuming the group uses the fair value method to account for non-controlling interest. Include all relevant workings. Q4 South acquired 400,000 ordinary shares of West Ltd on 1 January 2023 (there has been no change in share capital since). The retained earnings of West on 31 Dec 2022 were 120,000. The fair value of the 20% non-controlling interest at acquisition was 120,000. Goodwill should be written down by 10% of its original value to allow for impairment. as at 31Dec2023. Other information: - During the year, West sold goods to South for 200,000 at a mark-up of 25%. On 31Dec 2023 , half of these goods are still at the inventory of South. - The current liabilities of West include 25,000 owed to South. Prepare the consolidated statement of financial position of South Group as at 31 December 2023 , assuming the group uses the fair value method to account for non-controlling interest. Include all relevant workings Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started