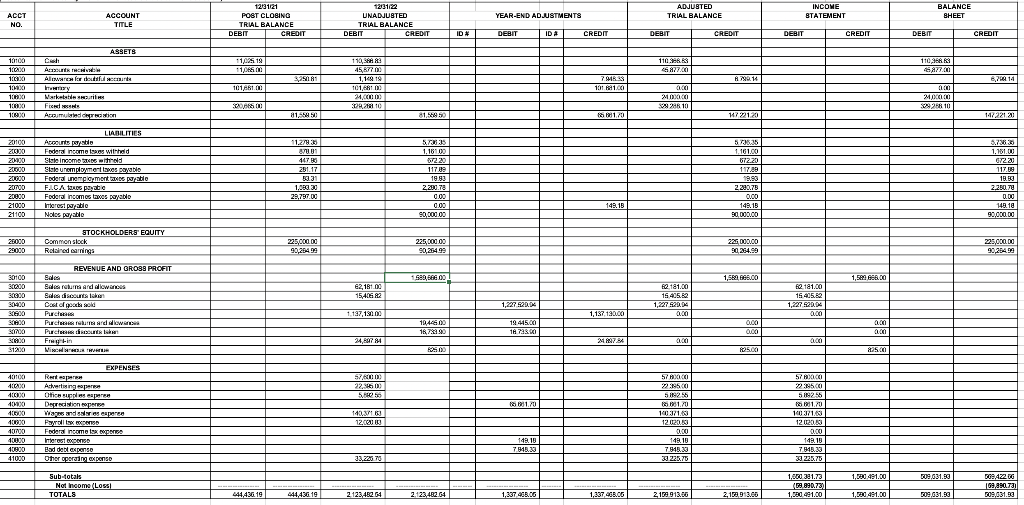

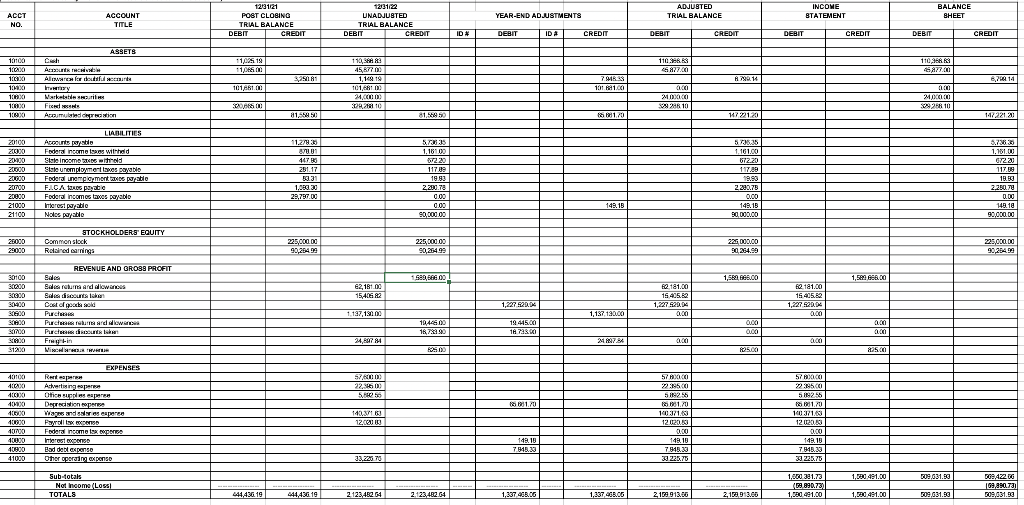

Q4. What is the pre-tax net income? I need it to work out federal income tax expense from the income statement column (tax rate 21%) See excel sheet for year end financials

ADJUSTED TRIAL BALANCE INCOME STATEMENT BALANCE BHEET ACCT NO. . ACCOUNT TITLE 123121 12031122 POST CLOBINO UNADJUSTED TRIAL BALANCE TRIAL BALANCE DEBIT CREDIT DEBIT CREDIT D# ID YEAR-END ADJUSTMENTS DEBIT ID CREDITI a DEBIT CREDIT DEBIT 1 CREDIT DEBIT 1 CREDIT 11,02519 11 pm 110 S 46 87720 11096 67.00 SSIN ASTIETS 10100 Colt Coach 1.CLO Assurser About 1 Altres for furt 10:30 Wy 10X Marketer 100% Free 180 Azumuted carction 6,7614 110,34* &? 45,85702 114019 1016810 24,000 12210 799.14 101AB1 416 131811.00 aca POLO 98 28 10 ED MERCER MX 292810 20 815540 81,58950 11.20 17221.20 147221 22 LIABILITIES 20100 Accounts pasto 2000 Federal income is withid 20200 State income wird bc 20000 Stale unemployment layos payable 20000 Federal unemployment amb pablo 2000 FALCA Gate F.CARD 20800 Federal income taxes peable 21000 Interesi pale 21100 Nodes to Nolesale 11.2/835 B001 4470 Dr. 201.17 03.31 1,089.30 29,797.00 5735 1.16100 9229 117.89 19.93 2.230.78 0.00 0.00 90,00000 1.161.00 672.20 117.89 19.93 2.290.70 0.00 149.15 90,000.00 8.7333 1.161.00 67220 117.89 19.30 2.250.70 0.00 149.18 90,000.00 149.13 STOCKHOLDERS' EQUITY 26000 Common stock 29000 Readed carrings 225,000.00 90,254.99 225,000.00 90,264.99 221 000.00 90,254.90 225,000.00 9025499 1589,668.00 1,5006.00 1,502666.00 62, 1810 15,406 82 REVENUE AND GROSS PROFIT 30100 des 30000 Eala retire ard dewas 3.000 de doors to 30000 Cast of goods 36.0Purchase 31000 Parcerebrard w Sunda Purch 3080Freytin 31230i HR 62.181.00 15 405.22 1,227 529 2100 62. 181.00 15 405.62 1,227 520.00 200 1,227 529.04 1.197,130.00 1,187 190,00 19,44600 167319. 19.445.00 1A 73800 Ooo Quod 012 2.00 24,7 M 21.7.4 200 ada 225.00 57,00 22.09 5 18201.70 EXPENSES 40100 Repron AEON Actining espere III ACUXO Dicas 4000 Deration represe 10X * . Windos espera 40000 Payroll tax expens 40700 40 Tederal income tax per opene 40000 Interest expenso 40930 Bad del expenso 41000 Oher operating expenso 143371 12.000 57 AX 22385.00 51925 1.70 10:271.5 12.020.00 0.00 148.10 7.945.30 30 325.75 57 AXO 22:2500 519256 101.70 140121.00 12.120.00 0.00 149.18 no 7.945.33 33.225.75 149.18 NO 7843.99 23.220.70 1,580.491.00 309.031.50 Sub-totals Not Income (Lassi TOTALS 1,600 31.73 (69.890.73) 1,580 291.00 569,422 06 109,990. TI 609.631.33 444,436.19 444,436.19 2.123,452.64 2.123.482.64 1,337 468.06 1,337,468.00 2159 913.00 2.193.00 1,580.491.00 509,631.50 ADJUSTED TRIAL BALANCE INCOME STATEMENT BALANCE BHEET ACCT NO. . ACCOUNT TITLE 123121 12031122 POST CLOBINO UNADJUSTED TRIAL BALANCE TRIAL BALANCE DEBIT CREDIT DEBIT CREDIT D# ID YEAR-END ADJUSTMENTS DEBIT ID CREDITI a DEBIT CREDIT DEBIT 1 CREDIT DEBIT 1 CREDIT 11,02519 11 pm 110 S 46 87720 11096 67.00 SSIN ASTIETS 10100 Colt Coach 1.CLO Assurser About 1 Altres for furt 10:30 Wy 10X Marketer 100% Free 180 Azumuted carction 6,7614 110,34* &? 45,85702 114019 1016810 24,000 12210 799.14 101AB1 416 131811.00 aca POLO 98 28 10 ED MERCER MX 292810 20 815540 81,58950 11.20 17221.20 147221 22 LIABILITIES 20100 Accounts pasto 2000 Federal income is withid 20200 State income wird bc 20000 Stale unemployment layos payable 20000 Federal unemployment amb pablo 2000 FALCA Gate F.CARD 20800 Federal income taxes peable 21000 Interesi pale 21100 Nodes to Nolesale 11.2/835 B001 4470 Dr. 201.17 03.31 1,089.30 29,797.00 5735 1.16100 9229 117.89 19.93 2.230.78 0.00 0.00 90,00000 1.161.00 672.20 117.89 19.93 2.290.70 0.00 149.15 90,000.00 8.7333 1.161.00 67220 117.89 19.30 2.250.70 0.00 149.18 90,000.00 149.13 STOCKHOLDERS' EQUITY 26000 Common stock 29000 Readed carrings 225,000.00 90,254.99 225,000.00 90,264.99 221 000.00 90,254.90 225,000.00 9025499 1589,668.00 1,5006.00 1,502666.00 62, 1810 15,406 82 REVENUE AND GROSS PROFIT 30100 des 30000 Eala retire ard dewas 3.000 de doors to 30000 Cast of goods 36.0Purchase 31000 Parcerebrard w Sunda Purch 3080Freytin 31230i HR 62.181.00 15 405.22 1,227 529 2100 62. 181.00 15 405.62 1,227 520.00 200 1,227 529.04 1.197,130.00 1,187 190,00 19,44600 167319. 19.445.00 1A 73800 Ooo Quod 012 2.00 24,7 M 21.7.4 200 ada 225.00 57,00 22.09 5 18201.70 EXPENSES 40100 Repron AEON Actining espere III ACUXO Dicas 4000 Deration represe 10X * . Windos espera 40000 Payroll tax expens 40700 40 Tederal income tax per opene 40000 Interest expenso 40930 Bad del expenso 41000 Oher operating expenso 143371 12.000 57 AX 22385.00 51925 1.70 10:271.5 12.020.00 0.00 148.10 7.945.30 30 325.75 57 AXO 22:2500 519256 101.70 140121.00 12.120.00 0.00 149.18 no 7.945.33 33.225.75 149.18 NO 7843.99 23.220.70 1,580.491.00 309.031.50 Sub-totals Not Income (Lassi TOTALS 1,600 31.73 (69.890.73) 1,580 291.00 569,422 06 109,990. TI 609.631.33 444,436.19 444,436.19 2.123,452.64 2.123.482.64 1,337 468.06 1,337,468.00 2159 913.00 2.193.00 1,580.491.00 509,631.50