Answered step by step

Verified Expert Solution

Question

1 Approved Answer

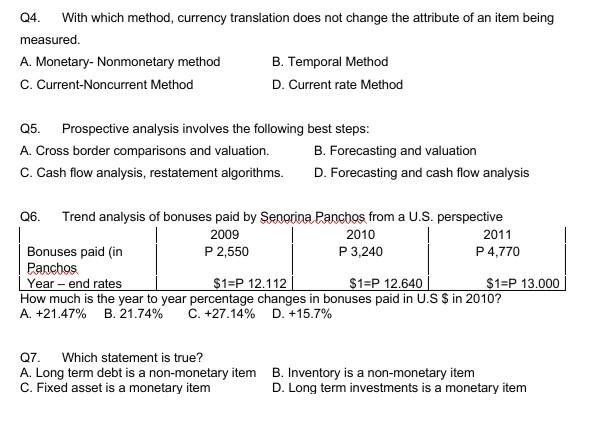

Q4. With which method, currency translation does not change the attribute of an item being measured. A. Monetary-Nonmonetary method B. Temporal Method C. Current-Noncurrent Method

Q4. With which method, currency translation does not change the attribute of an item being measured. A. Monetary-Nonmonetary method B. Temporal Method C. Current-Noncurrent Method D. Current rate Method 05. Prospective analysis involves the following best steps: A. Cross border comparisons and valuation. B. Forecasting and valuation C. Cash flow analysis, restatement algorithms. D. Forecasting and cash flow analysis Q6. Trend analysis of bonuses paid by Senorina Panchos from a U.S. perspective 2009 2010 2011 Bonuses paid in P 2,550 P 3,240 P 4.770 Panchos Year-end rates $1=P 12.112 $1=P 12.640 $1=P 13.000 How much is the year to year percentage changes in bonuses paid in U.S S in 2010? A. +21.47% B. 21.74% C. +27.14% D. +15.7% Q7. Which statement is true? A. Long term debt is a non-monetary item C. Fixed asset is a monetary item B. Inventory is a non-monetary item D. Long term investments is a monetary item

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started