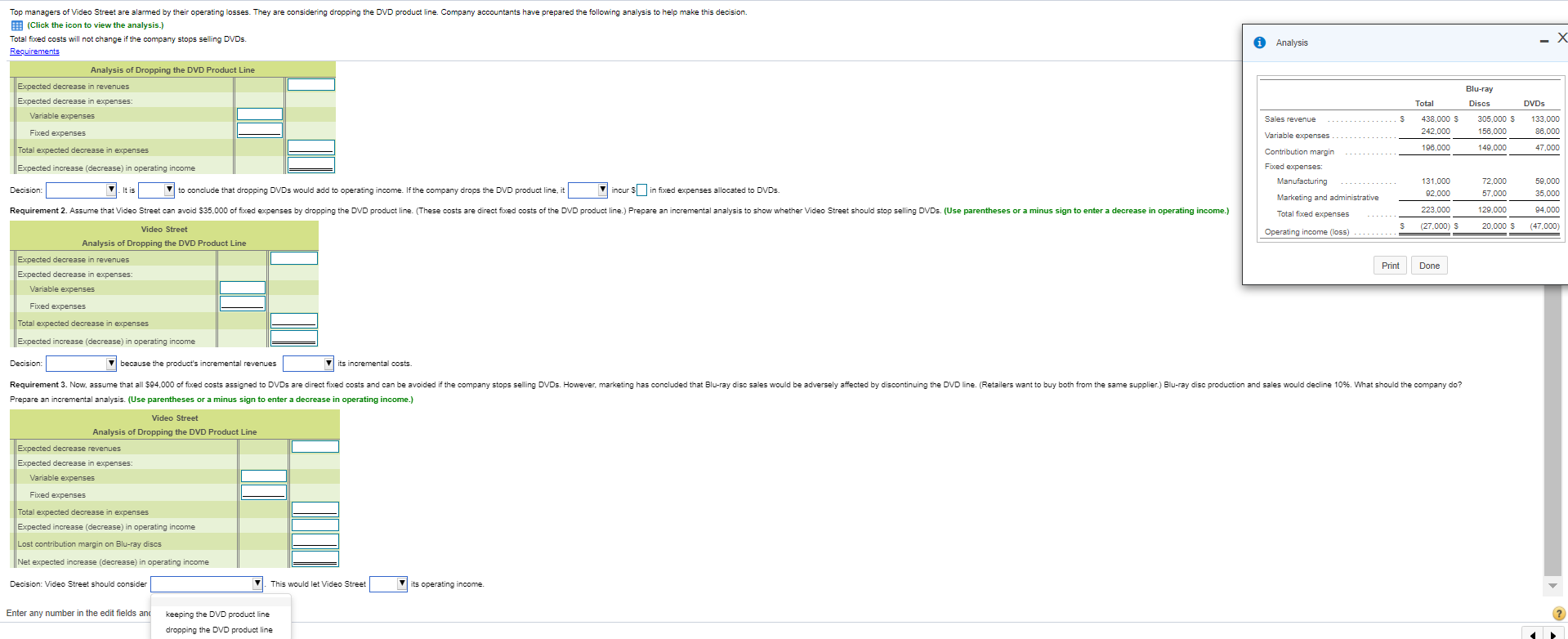

Q49-Top managers of VideoStreet are alarmed by their operating losses. They are considering dropping the DVD product line. Company accountants have prepared the following analysis to help make this decision.

-Please find down the attached picture for the full question

- Just answer If you're 100% about the answer and the question is complete, many thanks in advance!

???

Top managers of Video Street are alarmed by their operating losses. They are considering dropping the DVD product line. Co ving analysis to help make this decision. (Click the icon to view the analysis.) Total fixed costs will not change if the company stops selling DVDs. 1 Analysis Requirements Analysis of Dropping the DVD Product Line Expected decrease in revenues Blu-ray Expected decrease in expenses: Total Discs DVDS Variable expenses Sales revenue . . . . . . . . .. . .. .. . $ 438,000 S 305,000 S 133,000 Fixed expenses Variable expenses 242,000 156,000 36,000 Total expected decrease in expenses Contribution margin 196,000 149,000 47,000 Expected increase (decrease) in operating income Fixed expenses: Manufacturing 131,000 72,000 69,000 Decision: . It is to conclude that dropping DVDs would add to operating income. If the company drops the DVD product line. it incur $] in fixed expenses allocated to DVDs. Marketing and administrative 92,000 57,000 5,00 Requirement 2. Assume that Video Street can avoid $35,000 of fixed expenses by dropping the DVD product line. (These costs are direct fixed costs of the DVD product line.) Prepare an incremental analysis to show whether Video Street should stop selling DVDs. (Use parentheses or a minus sign to enter a decrease in operating income.) Total fixed expenses 23,000 Video Street 27.000) S 20,000 S 47.000 Operating income (loss) . . Analysis of Dropping the DVD Product Line Expected decrease in revenues Print Done Expected decrease in expenses Variable expenses Fixed expenses otal expected se in expenses Expected increase (decrease) in operating income Decision: because the product's incremental revenues its incremental costs. Requirement 3. Now, assume that all $94,000 of fixed costs assigned to DVDs are direct fixed costs and can be avoided if the company stops selling DVDs. However, marketing has concluded that Blu-ray disc sales would be adversely affected by discontinuing the DVD line. (Retailers want to buy both from the same supplier.) Blu-ray disc production and sales would decline 10%. What should the company do? Prepare an incremental analysis. (Use parentheses or a minus sign to enter a decrease in operating income.) Video Street Analysis of Dropping the DVD Product Line Expected decrease revenues Expected decrease in expenses: Variable expenses Fixed expenses Total expected decrease in expenses Expected increase (decrease) in operating income ost contribution margin on Blu-ray discs Net expected increase (decrease) in operating income Decision: Video Street should consider . This would let Video Street|V its operating income. Enter any number in the edit fields and keeping the DVD product line dropping the DVD product line