Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q5 (20 points) - Back testing your VaR calculated from Question 4 We will test whether your 1-day VaR calculated from Question 4 is

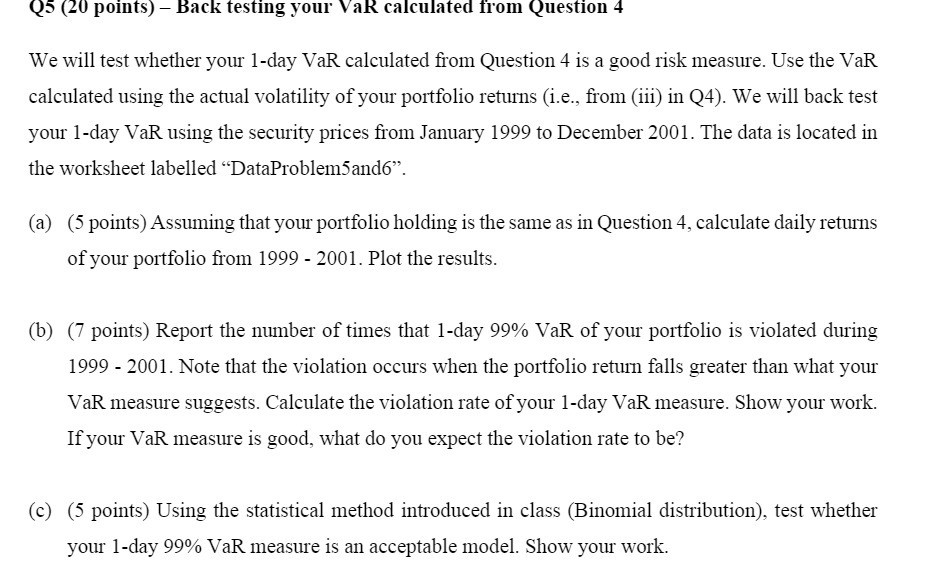

Q5 (20 points) - Back testing your VaR calculated from Question 4 We will test whether your 1-day VaR calculated from Question 4 is a good risk measure. Use the VaR calculated using the actual volatility of your portfolio returns (i.e., from (iii) in Q4). We will back test your 1-day VaR using the security prices from January 1999 to December 2001. The data is located in the worksheet labelled "DataProblem5 and6". (a) (5 points) Assuming that your portfolio holding is the same as in Question 4, calculate daily returns of your portfolio from 1999 - 2001. Plot the results. (b) (7 points) Report the number of times that 1-day 99% VaR of your portfolio is violated during 1999 - 2001. Note that the violation occurs when the portfolio return falls greater than what your VaR measure suggests. Calculate the violation rate of your 1-day VaR measure. Show your work. If your VaR measure is good, what do you expect the violation rate to be? (c) (5 points) Using the statistical method introduced in class (Binomial distribution), test whether your 1-day 99% VaR measure is an acceptable model. Show your work.

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate daily returns of your portfolio from 19992001 you would typically use the formula Daily Return Portfolio Value Today Portfolio Value Ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started